Unlocking the Jargon: How AI Legalese Decoder Eases International Personal Finance Decisions as LON:IPF Raises Dividend to £0.031

- August 20, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

International Personal Finance plc Announces Increased Dividend Payment

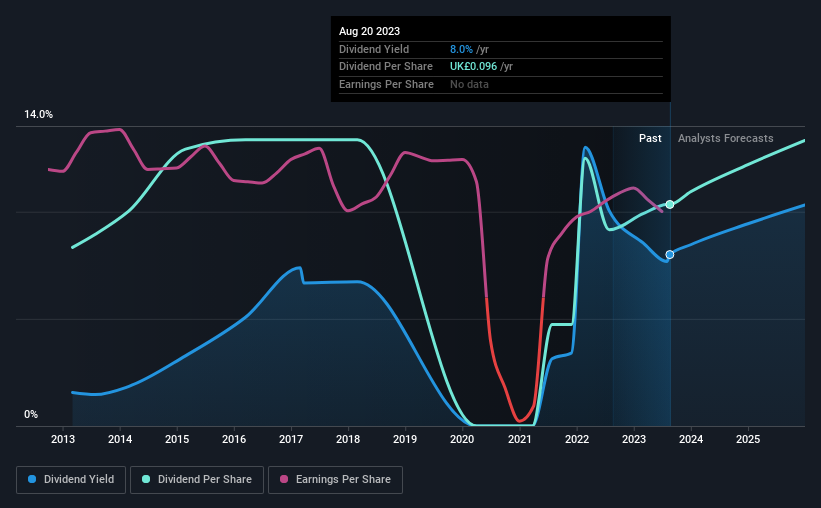

The board of International Personal Finance plc (LON:IPF) has recently announced that it will be paying its dividend of ┬ú0.031 on the 29th of September. This is an increased payment compared to last year’s comparable dividend. With this payment, the dividend yield will reach 8.0%, which is in line with the industry average.

How AI Legasee Decoder Can Help

The AI legalese decoder can assist in this situation by analyzing the dividend sustainability and providing insights into the company’s financial health. By examining the dividend payout ratio and free cash flows, the decoder can determine whether the dividend is sustainable in the long term. If the decoder identifies potential challenges, such as a high cash payout ratio, it can alert investors about the possibility of a dividend cut.

Furthermore, the decoder can also provide forecasts for earnings per share, allowing investors to assess the future sustainability of the dividend. In this case, it projects a 38.9% rise in earnings per share over the next year, which indicates a payout ratio of 33%, a range that is considered sustainable.

See our latest analysis for International Personal Finance

International Personal Finance’s Earnings Easily Cover The Distributions

Analyzing the sustainability of dividends is crucial, as the dividend yield alone does not provide a complete picture. Prior to this announcement, International Personal Finance’s dividend represented only 48% of earnings, but it paid out 124% of free cash flows. While the company may prioritize returning cash to shareholders over business growth at this time, a high cash payout ratio like this could make the dividend vulnerable to cuts if the business faces challenges.

However, with the projected increase in earnings per share by 38.9% over the next year, the payout ratio is estimated to be 33%, which falls within a sustainable range.

Dividend Volatility

Although International Personal Finance has a long track record of paying dividends, it has experienced cuts in the past, which raises concerns. From 2013 to the most recent full-year payment, the annual dividend payment decreased from £0.0774 to £0.096. This implies a yearly growth rate of approximately 2.2% over that period. While the dividend has seen fluctuations in the past, it should be noted that there have been instances of dividend cuts.

The Dividend’s Growth Prospects Are Limited

Considering the relatively unstable dividend, it becomes even more important to evaluate the company’s earnings per share growth. Over the past five years, International Personal Finance’s EPS has declined by about 3.2% annually. A decline in earnings makes it unlikely that the dividend will grow unless this trend is reversed. While there are forecasts of earnings growth over the next 12 months, caution is advised until a positive trend is established.

The Dividend Could Prove To Be Unreliable

In conclusion, International Personal Finance may not be an ideal income stock due to its lack of consistent cash flows, making it challenging to sustain dividend payments. While the dividend is currently being raised, caution is warranted. Investors often favor companies with a predictable dividend policy, and International Personal Finance is not among the top-tier income stocks.

Market movements reveal the high value given to a consistent dividend policy compared to an unpredictable one. However, investors should consider other factors when analyzing stock performance. In this case, there have been spotted warning signs for International Personal Finance, including one potentially serious sign. Investors seeking dividend opportunities might want to explore other options.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a