Unlocking the Future: How AI Legalese Decoder Can Simplify Crypto Chart Analysis for Bitcoin, Solana, and XRP in 2025

- January 3, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin has regained its strength, trading above $96,000 after touching a support level of $92,000 on December 31. The cryptocurrency markets are experiencing a recovery phase from recent corrections, and both major and minor altcoins are also showing signs of rebounds. This resurgence comes amid growing anticipation for pro-crypto regulations and policies expected to emerge in the U.S. in 2025, igniting optimism among crypto investors.

As President-elect Donald Trump prepares for his inauguration in under three weeks, the impact on the cryptocurrency ecosystem could be significant. Analysts speculate that this political change may sway crypto market dynamics, potentially affecting altcoin prices. The tokens that are most likely to experience notable price fluctuations include Bitcoin (BTC), Solana (SOL), and Ripple (XRP), as market sentiments shift with regulatory prospects.

On-chain Metrics Indicate Potential Gains for Bitcoin, XRP, and Solana

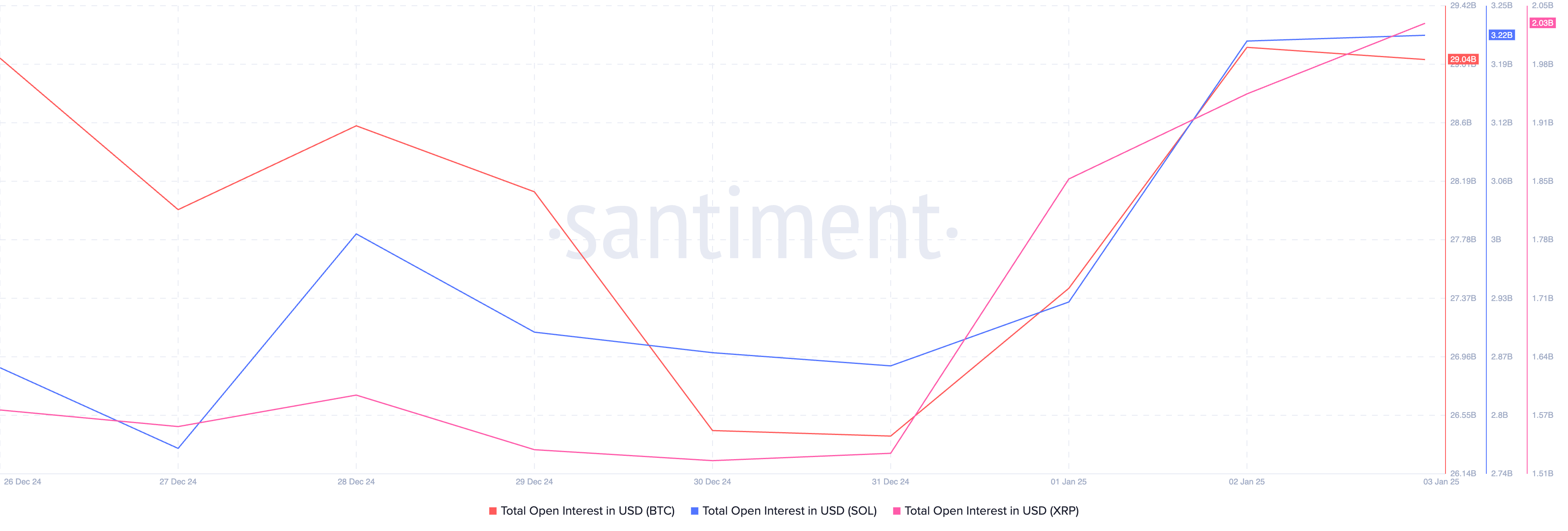

Open interest (OI), which reflects the demand and interest for cryptocurrencies among traders, has shown a significant uptrend in Bitcoin, XRP, and Solana since the dip on December 31. According to data provided by Santiment, OI for these three tokens has surged, indicating that traders’ appetite is revitalized following the preceding downturn.

The increased interest from derivatives traders during the first few days of January strengthens a bullish outlook for these cryptocurrencies. The renewed optimism suggests that investors are preparing for potential price increases in these leading tokens.

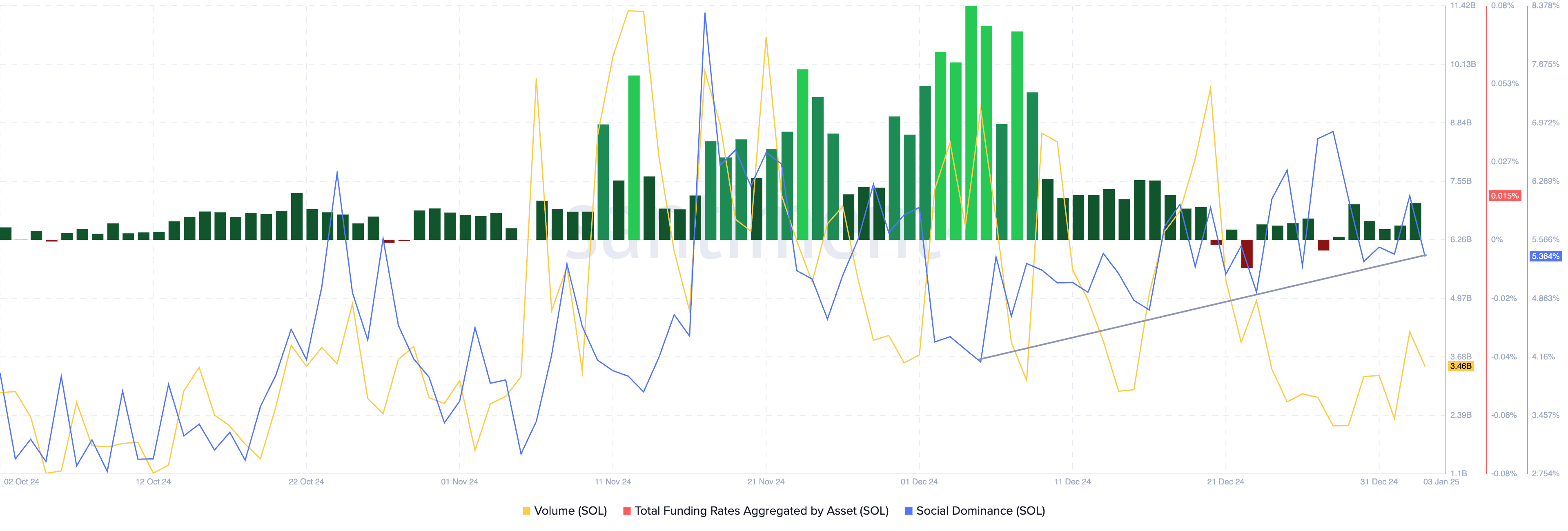

Particularly, Solana has seen a rise in its social dominance, with more mentions across social media platforms like X and an uptick in the volume of SOL being traded on various exchanges. Santiment’s data shows that the funding rate, aggregated from derivatives exchanges, has been positive for the last five days, indicating a sense of optimism among traders regarding Solana’s prospects.

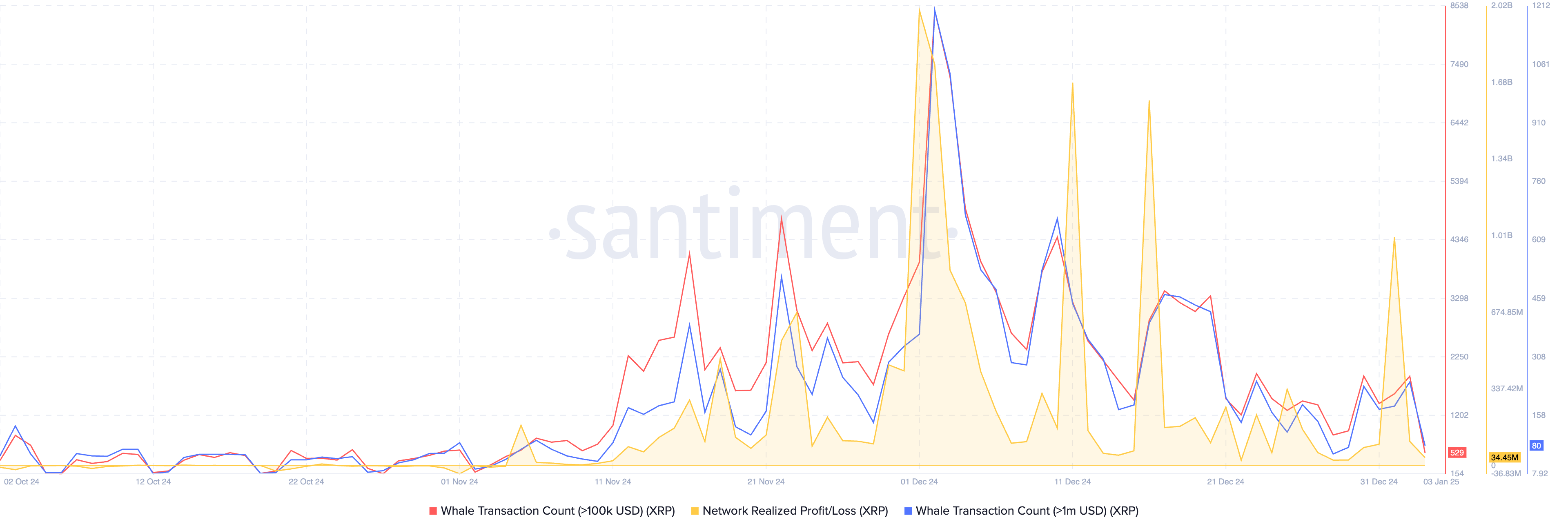

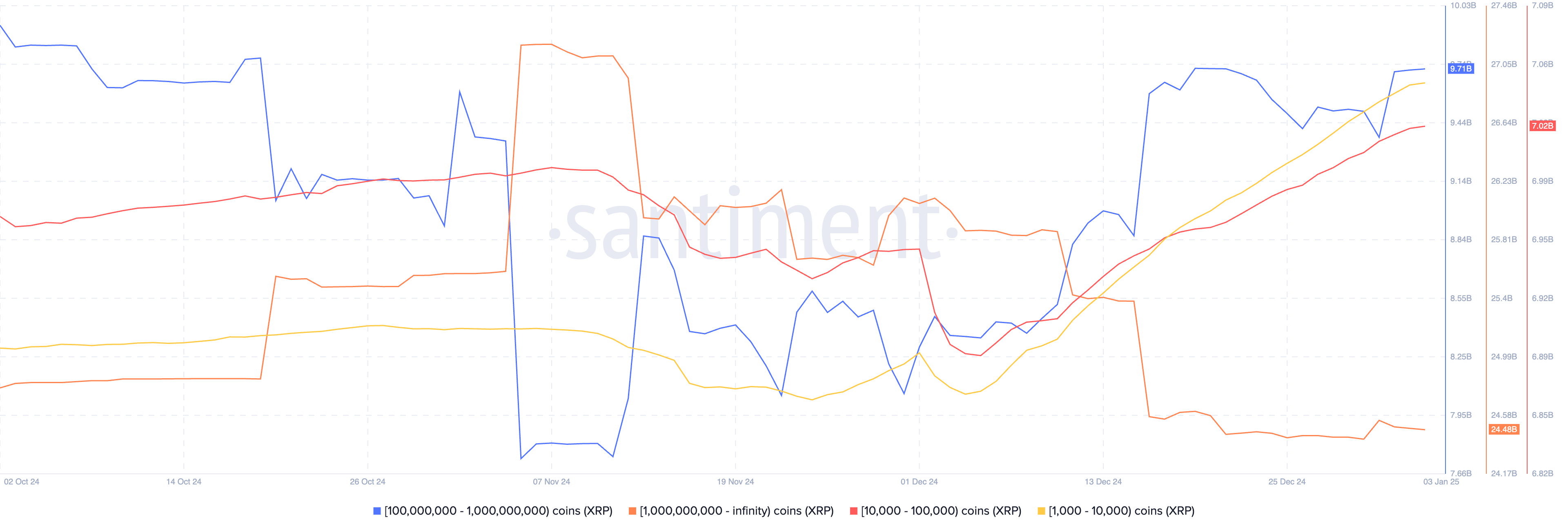

On the other hand, XRP has witnessed a decrease in large-volume transactions—those valued between $100,000 and $1,000,000—since December 31. While this may appear as a bearish signal, it could signal a reduction in profit-taking activities among whale investors, giving rise to the possibility of a stabilization in XRP prices.

The Network Realized Profit/Loss (NPL) metric, which assesses the net profit or loss realized by traders purchasing or selling tokens on a given day, has shown persistent profit-taking since November’s first week. This nearly two-month streak could see a slowdown as whale activities diminish amid the recent market shifts. This transition indicates that XRP may witness a corrective phase leading to stabilized trading behavior.

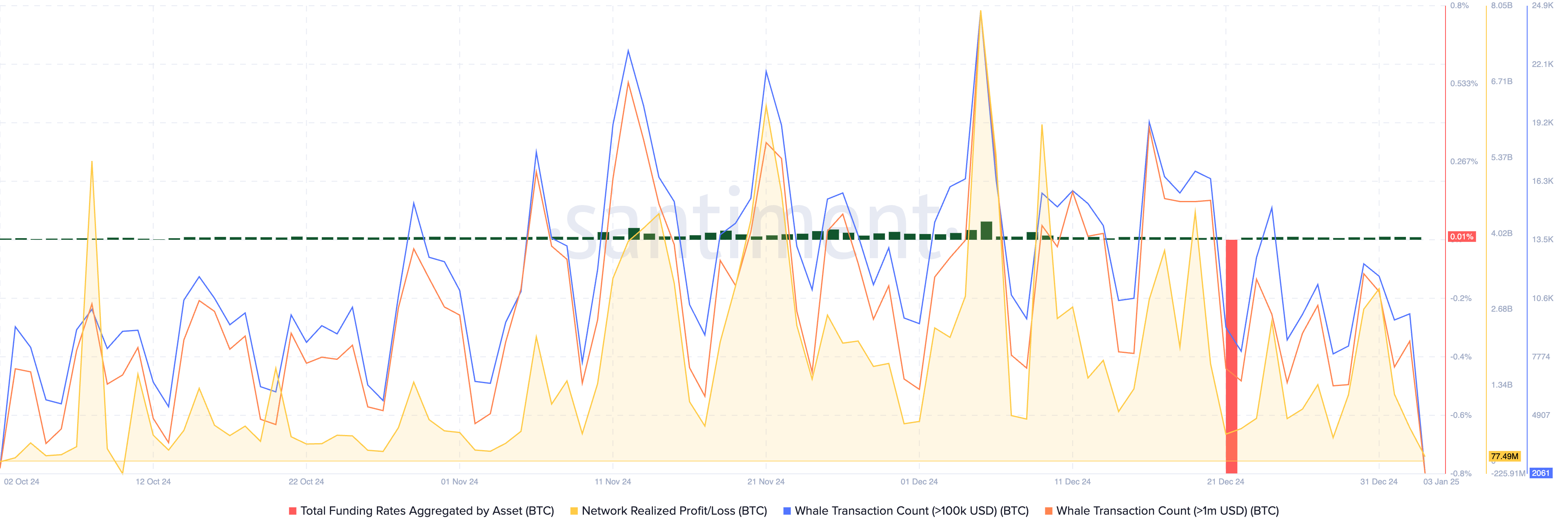

Bitcoin itself has enjoyed a positive funding rate for the past ten days extending from December into early January 2025. With the prevailing optimism from derivatives traders, it’s suggested that profit-taking may decline, echoing patterns seen in XRP’s trading behavior.

MicroStrategy’s Declining NAV Poses Additional Challenges for Bitcoin

Despite the encouraging signs from individual tokens, institutional capital inflows to Bitcoin appear to be waning. Data sourced from Farside investors reveals that net flows to U.S.-based spot Bitcoin ETFs have taken a hit since the last week of December 2024. The figures are compelling; as noted on January 2, these ETFs recorded a staggering net outflow of $247.80 million.

As institutional investments served as significant catalysts for Bitcoin’s surge in 2024, the decline in inflows raises questions regarding its impact on the cryptocurrency’s price trajectory moving into 2025. It remains to be seen how the current macroeconomic conditions might further influence institutional interest and investment patterns in Bitcoin.

MicroStrategy, widely known as one of the largest publicly traded holders of Bitcoin, is grappling with a significant 44% decline in its shares from their historic peak. This decline reveals a broader trend among corporations, many of which had initially adopted Bitcoin as a treasury asset. However, the excitement surrounding Bitcoin’s utility as a corporate treasury asset appears to be dissipating.

The slowdown in trading volumes, stablecoin issuance, combined with recent holiday factors in the U.S. macroeconomic environment, are contributing to the challenges faced by Bitcoin’s price stability. Despite the price holding steady above $96,000, the market is keenly waiting to see if Bitcoin can once again challenge the $100,000 threshold, seeking a new all-time high above $108,000.

Solana and XRP Encounter Obstacles Despite Hopes for ETF Approvals

Turning attention to Solana, the altcoin is facing challenges that impede its momentum. The once-thriving meme coin narrative that previously contributed to SOL’s gains is showing signs of fatigue. A decline in airdrops and reduced network activity suggests a slowdown in Solana’s growth, leading to diminished on-chain activity, a concerning sign for its investors.

Further complicating matters is Solana’s stablecoin market capitalization, which continues to lag behind Ethereum, despite outperforming Ether with respect to decentralized exchange metrics like volume and protocol revenue. This dichotomy may raise further concerns among traders regarding Solana’s positioning within the broader market landscape.

Moreover, the ongoing appeal by the Securities and Exchange Commission (SEC) concerning the Ripple lawsuit is another hurdle for XRP. Currently, traders are hopeful that a potential shift in the regulatory landscape under a new SEC Chair could positively impact XRP, potentially bringing an end to the protracted legal challenges that have hindered the coin since 2020.

This anticipation has led to a notable accumulation of XRP tokens by large wallet investors, specifically entities holding between 100 million to 1 billion XRP tokens. In the first three days of January alone, these wallets added over 350 million XRP to their reserves, which Santiment data associates with a bullish outlook on XRP’s future.

Technical Analysis and Price Targets for Key Tokens

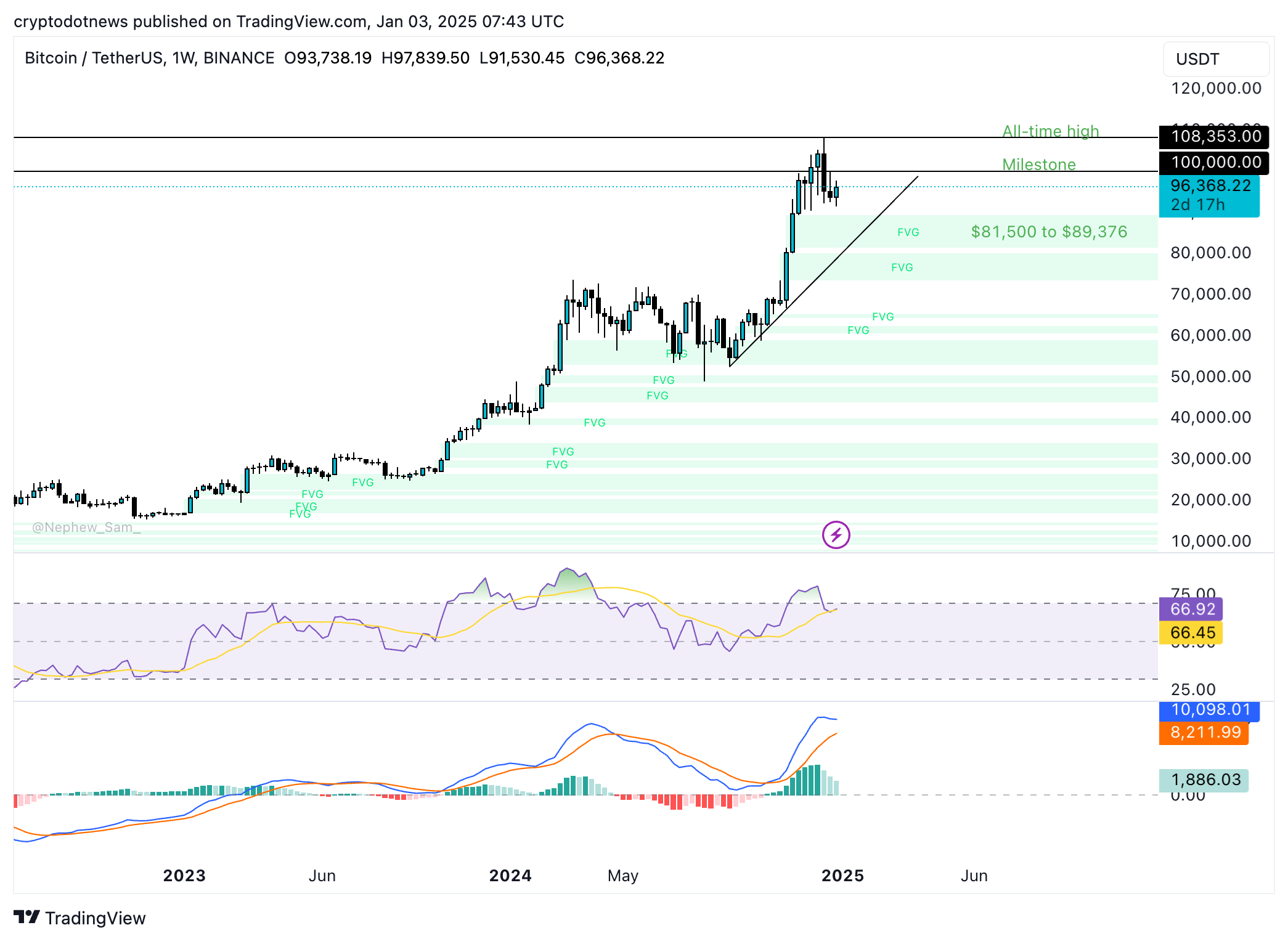

A technical analysis of Bitcoin’s weekly price chart suggests that BTC is currently in an upward trend. Positive indicators point toward potential gains ahead, with the Moving Average Convergence Divergence (MACD) flashing green histogram bars above the neutral line. This signals that underlying momentum remains bullish as the Relative Strength Index (RSI) currently sits at 66 and is continuing to slope upwards.

If Bitcoin undergoes a correction, it could find support within the Fair Value Gap ranging between $81,500 and $89,376. Current analyses propose that if the upward trend continues, BTC might challenge the $100,000 milestone once more, and even set its sights on reaching a new all-time high beyond $108,000.

As for XRP, it remains about 20% shy of its high of $2.9092 reached in 2024. The altcoin is currently contending with resistance at the December 9 high of $2.6076, indicating a crucial moment that could dictate the next phase for XRP. If a correction occurs, key support could be found in the imbalance zone between $1.63 and $2.17.

Although the RSI currently suggests XRP is overvalued, the MACD indicates that there is an underlying positive momentum present in the price trend, pointing to a potential for upward movement in the near future.

Solana’s weekly chart reveals an upward trend, nearing the resistance level of $231.62, which corresponds to the 78.6% Fibonacci retracement level calculated from its movement between the $110 low and the peak of $264.59. Notably, the $200 mark stands out as a significant milestone for Solana to achieve.

Currently, SOL trades approximately 12% below its nearest resistance level, with the high from October 28 at $183.38 acting as crucial support. While the RSI is trending upward at a reading of 56, MACD indicates that Solana’s underlying momentum could be shifting toward a negative outlook, arms traders with valuable insights into its price direction.

Pump.fun Continues to Offload SOL Tokens and Impact Market Sentiment

New analysis from Lookonchain indicates that Pump.fun, the launchpad on Solana, persists in its strategy of liquidating SOL token holdings. On January 3, the associated wallet deposited 292,437 SOL, valued at over $55 million, into Kraken and subsequently sold nearly $42 million worth of SOL tokens. This trend raises significant concerns regarding the impact on SOL’s price stability.

In a subsequent transaction on Friday, the launchpad’s wallet deposited another 63,171 SOL, carrying a value exceeding $13 million into Kraken. The persistent offloading of SOL tokens could lead to increased selling pressure, which may adversely affect the altcoin’s value unless corrective measures from the launchpad are implemented soon. Traders are advised to closely monitor whale activities and the supply levels of Solana on exchanges to better predict potential price corrections of SOL.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a