Unlocking Legal Insights: How AI Legalese Decoder Helps Navigate BTC’s Return to $100K and Stellar’s XRP Price Surge Post-VanEck ETF Filing

- January 15, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

- Cryptocurrencies aggregate market capitalization reached an impressive $3.5 trillion on Wednesday, reflecting a significant rise of $152 billion within just 24 hours.

- This notable 4.8% increase represents the highest single-day crypto market gains seen in a notable period of 35 days, going back to December 11.

- Bitcoin’s price surged as high as $100,600, marking an increase of 3.3% over the day.

- While Bitcoin (BTC) surged by 3%, it still lagged behind the broader crypto sector gains of 5%, indicating that investors are currently favoring altcoins in their trading strategies.

Bitcoin Market Updates: BTC retakes $100,000, yet downside risks remain active

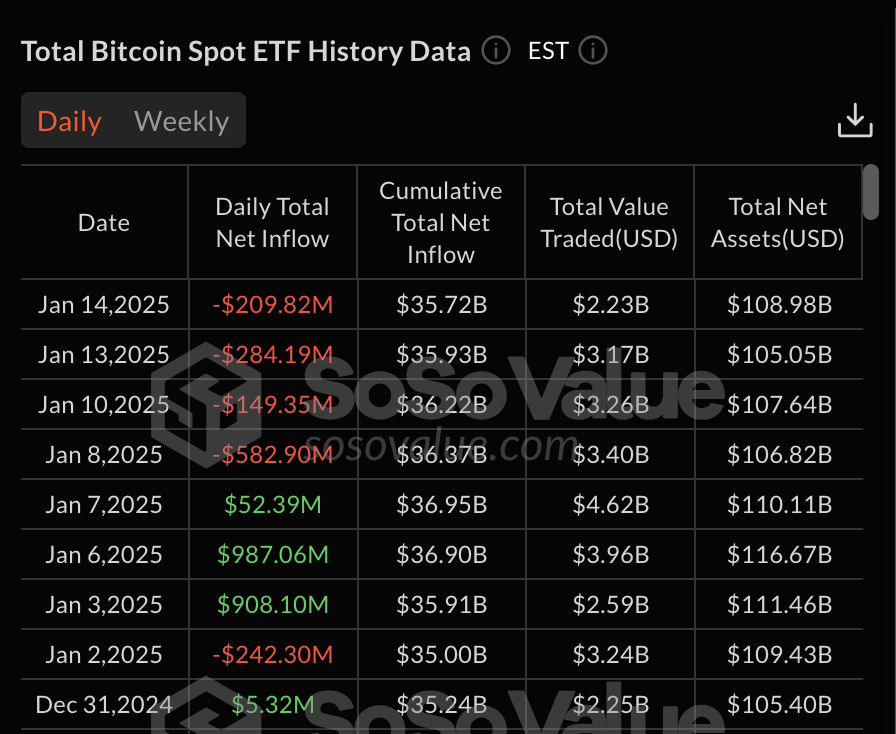

Bitcoin ETFs Performance, January 15 2025 | Source: SosoValue

Bitcoin ETFs Performance, January 15 2025 | Source: SosoValue

- Bitcoin ETFs witnessed outflows exceeding $209 million on Wednesday, a factor that has dampened the prevailing bullish momentum in the market.

Altcoin Market Updates: Stellar (XLM) mirrors XRP rally as traders intensify Trump bets

The global altcoin market experienced an impressive rise of 8.61% on Wednesday, which is more than double Bitcoin’s 3.6% price gains. This surge is particularly remarkable given the relatively subdued interest in Bitcoin on that day due to ETF outflows and lower retail participation.

- Solana’s price surged by 9% as SOL bulls reclaimed momentum in its trading activity.

Solana (SOL) showcased a remarkable increase of 9% on Thursday, pushing its price up to $205. This bullish momentum appears to be fueled by robust on-chain activity and the swift integration of AI-based projects into its growing ecosystem, which is ultimately boosting user adoption significantly.

- Stellar (XLM) mirrors XRP rally amid rising optimism surrounding proposed Trump Crypto policy.

Stellar (XLM) and Ripple (XRP) have shared an upward trajectory lately, with XLM jumping by 14% and XRP increasing by 12% on Wednesday alone. The fortunes of these two tokens are deeply intertwined due to their shared genesis, as both Stellar and XRP were co-founded by Jed McCaleb.

Both XRP and XLM share utility factors aimed at revolutionizing cross-border payments and enhancing financial inclusion through their decentralized networks. The price correlation between XLM and XRP ensures that favorable updates concerning Ripple will likely also uplift Stellar.

The market speculation about potential policy shifts and a renewed interest in blockchain solutions for conventional finance under Trump has motivated both assets to emerge as significantly strong performers within the altcoin market on Wednesday. Should this momentum continue, analysts are optimistic that XLM could target a price of $0.60, while XRP could retest the $3 mark shortly.

- Polygon (POL) jumps by 5% amid a surge in Layer-2 adoption

Polygon (MATIC) saw a 5% gain on Wednesday, trading at $0.48, primarily due to the increasing demand for scalable solutions in the Layer-2 network sector. With strong fundamentals backing this token, MATIC could soon test the $0.50 price level before encountering significant selling pressure.

Chart of the Day: Layer-2s emerge as the standout sector as market activity heightens

As Donald Trump’s inauguration approaches, just under a week away, trading activity across the crypto market has intensified, leading to congestion on Ethereum and other Layer-1 blockchains. This surge in activity particularly stems from heightened transaction fees associated with core Layer 1 networks like Ethereum, prompting traders to pivot toward Layer-2 protocols that offer scalable and cost-effective solutions. This unique market dynamic has emerged over the past week.

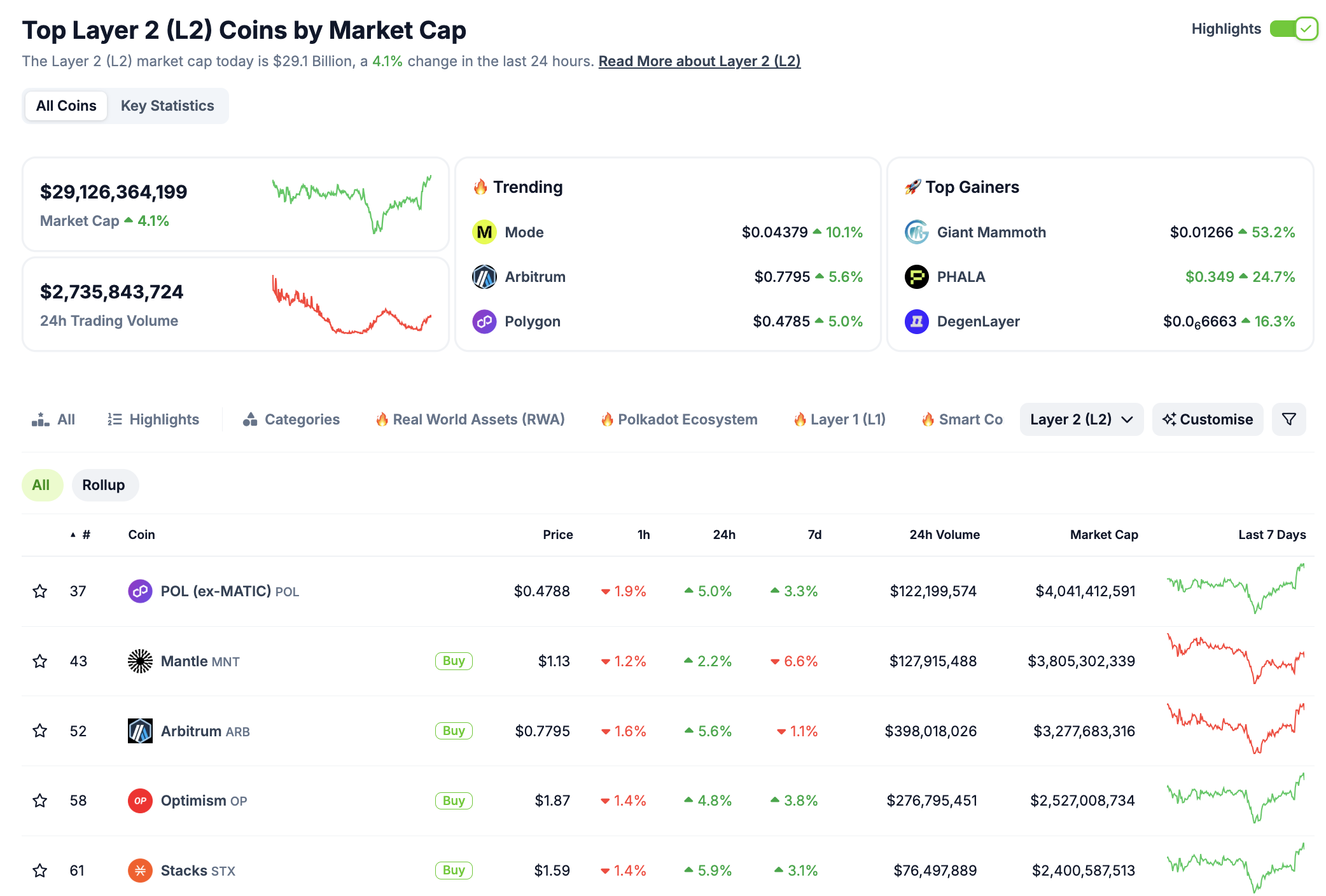

Layer-2 Sector Performance, January 15 2025 | Source: Coingecko

Layer-2 Sector Performance, January 15 2025 | Source: Coingecko

According to data from CoinGecko, the Layer-2 sector saw its total market capitalization rise by 4.1% on Wednesday, hitting $29.1 billion. Additionally, trading volumes remained robust, with around $2.7 billion traded within the past 24 hours, demonstrating a sustained demand for projects within the Layer-2 scaling solutions.

Among the notable performers were Mode, which surged 10.1% as developer adoption bolstered its standing within the ecosystem. Meanwhile, Arbitrum saw a 5.6% gain, strengthened by the advancing integration of DeFi, and Optimism posted an increase of 4.8%.

On the other hand, some tokens like Mantle noted modest growth at 2.2% within the day, despite facing a 6.6% downturn on a weekly basis, signaling mixed sentiments in the market. POL (formerly known as MATIC) remained resilient with a 5% daily increase, exhibiting investor confidence in its recent rebranding initiatives.

The robust performance of the Layer-2 ecosystem highlights its significant role in easing blockchain congestion during periods of market volatility. As Ethereum gas fees continue to rise, these protocols are well-positioned for ongoing growth, providing both traders and institutions with dependable solutions for conducting high-frequency transactions, thus maximizing potential gains amid the rising market activity.

Crypto News Updates:

- VanEck submits application for Onchain Economy ETF to SEC

Investment management firm VanEck has officially filed an application with the U.S. Securities and Exchange Commission (SEC) to create an Onchain Economy exchange-traded fund (ETF). This proposed fund is designed to invest in companies operating within the cryptocurrency industry. It will encompass a variety of entities, including software developers, mining firms, cryptocurrency exchanges, infrastructure providers, payment companies, and other related businesses.

The filing detailed that the fund aims to focus on what they term “Digital Transformation Companies,” which covers a diverse array of entities contributing to the burgeoning digital asset ecosystem.

- Jamie Dimon criticizes Bitcoin as the currency of choice for criminals

Jamie Dimon, the CEO of JPMorgan Chase, has reiterated his disdain for Bitcoin, openly expressing skepticism regarding its value, and categorizing it as a favored currency among criminals involved in activities such as sex trafficking, money laundering, and ransomware.

Despite his bearish stance on Bitcoin, Dimon acknowledges the pivotal legitimacy of blockchain technology and the role of stablecoins, indicating that JPMorgan is already leveraging blockchain for transferring money and data efficiently.

- Text scammers steal $2 million in cryptocurrency, claims NY Attorney General

The office of the New York Attorney General has disclosed that scammers have siphoned off over $2 million in cryptocurrency by exploiting individuals looking for remote job opportunities. Victims were approached through unsolicited text messages that promised lucrative jobs for reviewing products online.

To commence earning, they were instructed to create cryptocurrency accounts and maintain certain balance thresholds. However, the funds were, unfortunately, redirected into the scammers’ digital wallets. Seven victims from New York, Virginia, and Florida have surfaced in the current lawsuit.

- BitMEX fined $100 million for anti-money laundering violations

Cryptocurrency exchange BitMEX has been ordered to pay a hefty fine of $100 million by a U.S. judge for willfully breaching anti-money laundering laws. The company has pleaded guilty to charges relating to violations of the Bank Secrecy Act that occurred between 2015 and 2020, specifically for failing to implement adequate anti-money laundering measures and a proper customer verification process.

This financial penalty includes two years of probation and adds to previous settlements that collectively amount to approximately $110 million in related legal disputes. The company has stated that it has since intensified its compliance measures to meet regulatory standards, reflecting a commitment to maintaining integrity within the cryptocurrency industry.

Given the complexities and nuances surrounding these crypto regulations and legal issues, utilizing tools like AI legalese decoder can greatly assist individuals and companies navigate through the dense legal terminology involved. AI legalese decoder is designed to simplify legal jargon, making it easier for users to understand their rights, responsibilities, and any potential liabilities they may have in various situations within the cryptocurrency space.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a