Unlocking Legal Clarity: How AI Legalese Decoder Enhances Home and Small Business Security in Europe and North America

- February 4, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Comprehensive Insights into the Home and Small Business Security System Market

Dublin, Feb. 04, 2026 (GLOBE NEWSWIRE) — The report titled "The Home and Small Business Security System Market – 15th Edition" has been newly included in the offerings of ResearchAndMarkets.com.

Overview of the Home and Small Business Security System Market

This report represents the fifteenth consecutive edition in the series, shedding light on the evolving landscape of the small alarm market in Europe and North America. It serves as a vital business intelligence resource, offering unique insights and information. The report includes five-year industry forecasts and expert commentary, acting as a robust foundation for making informed business decisions.

Types of Security Systems: Self-Monitored vs. Professionally Monitored

In the realm of security solutions for residential properties and small businesses, systems are broadly categorized into two types: self-monitored and professionally monitored systems.

Self-Monitored Systems

Self-monitored systems employ cloud-based technologies to deliver real-time alerts directly to property owners. These notifications can arrive via various means such as push notifications, SMS, or email, allowing users to conduct immediate remote assessments through dedicated smartphone applications.

Professionally Monitored Systems

Conversely, professionally monitored security systems are linked to a 24/7 Alarm Receiving Centre (ARC). These systems, when triggered, prompt the ARC to verify the alert and initiate rapid responses, which can include dispatching security patrols and alerting emergency services. Traditional home security frameworks generally include professional alarm monitoring as a standard feature, while DIY systems primarily depend on self-monitoring—though optional professional services are frequently available.

Market Size and Projections

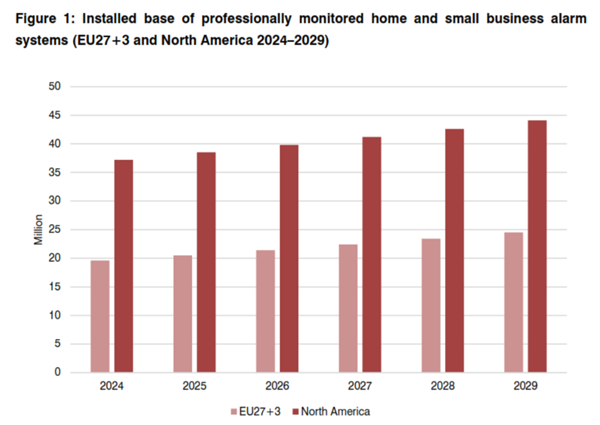

The North American market for home and small business security systems nearly doubles that of Europe. As of the end of 2024, approximately 37.2 million active monitored alarm systems were documented across the U.S. and Canada. This signifies a penetration rate of 23.9% across the approximately 156 million households and small businesses in North America. The sector is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 3.5%, with projections estimating around 44.1 million monitored alarms by 2029.

European Market Dynamics

In the EU27+3 region, there were about 19.6 million active monitored alarm systems as of 2024, corresponding to a penetration rate of 7.9% among the roughly 250 million households and small businesses in Europe. Importantly, the market data suggests significant growth potential, particularly in the residential segment where current penetration stands at a mere 6.5%. Variability in growth rates is anticipated among European countries, with markets like Spain, France, and Sweden expected to grow faster than the regional average due to established home security industries.

Nonetheless, growth in other European markets may be hampered by high fragmentation and the scarcity of specialized alarm service providers actively marketing solutions. The projected CAGR for alarm systems in Europe is 4.6%, likely reaching 24.5 million systems by 2029. Both North America and Europe will see interactive security services and smart home products emerge as pivotal growth drivers in the security market.

Key Players in the Industry

The traditional home and small business security systems sector is characterized by a mix of specialist companies and larger security service providers. Industry leaders like ADT, Verisure, Brinks Home (Monitronics), and Sector Alarm are prominent alongside telecommunications and cable giants such as Comcast and Telus, as well as banking and insurance firms like Credit Mutuel and Groupe IMA.

For DIY home security systems, companies such as SimpliSafe, Ring (Amazon), and Arlo Technologies are key players that have gained market traction over the years.

The Future of Market Research and legal Considerations

The Home and Small Business Security System Market report stands as the primary source of information regarding professionally monitored security systems across Europe and North America. Its tailored insights are essential for vendors, telecom operators, investors, consultants, application developers, and government agencies, aiding them in making well-informed strategic decisions that align with market trends.

How AI legalese decoder Can Assist

Given the intricate nature of contracts and agreements prevalent in the security systems market, leveraging tools like AI legalese decoder can significantly streamline the process. This AI-driven platform translates complex legal terms into understandable language, enabling companies to decode contracts related to service agreements, partnerships, and regulatory compliance. By demystifying legal jargon, businesses can focus more on strategy and execution while ensuring they are safeguarding their interests effectively.

Report Highlights

- Insights from 30 executive interviews with leading market companies.

- Fresh data showcasing alarm system adoption across various countries and segments.

- A thorough overview of the alarm system value chain in both residential and small business sectors.

- Detailed profiles of key market players in Europe and North America.

- Comprehensive analysis of market trends and key developments.

- Region-specific market forecasts extending until 2029.

Critical Questions Addressed in the Report

- Who are the prominent providers of monitored home and small business alarm systems?

- Why are alarm service providers investing in smart home technology?

- Are DIY home alarm system providers posing a threat to traditional market players?

- What is the potential market size for cellular Internet of Things (IoT) in the alarm systems industry?

- How is AI integrated into alarm system services, and what are the primary drivers for adopting such technologies?

- What is the current market value of the alarm system industry in Europe and North America?

- What are the notable recent trends and developments shaping this market?

Key Topics Covered

1. The Security Industry

1.1 Market overview

1.1.1 Security Services

1.1.2 Enterprise Security Systems

1.1.3 Home and Small Business Security Systems

1.1.4 Cash Handling

1.2 Key Industry Players

2. Home and Small Business Security Systems

2.1 Technology Overview

2.2 European Standards for Intruder Alarm Systems

2.3 Alarm System Value Chain

2.3.1 Traditional Security Providers

2.3.2 DIY Home Security Providers

2.3.3 System Manufacturers and Platform Providers

3. Market Forecasts and Trends

3.1 Regional Insights: Europe

3.2 Regional Insights: North America

3.3 Vendor Market Shares

3.4 Market Drivers and Trends

4. Company Profiles and Strategies

4.1 Traditional Security Providers

4.2 DIY Security System Providers

4.3 System Manufacturers and Platform Providers

For more information about this report, visit ResearchAndMarkets.com.

Conclusion

ResearchAndMarkets.com remains a leading global source for market research reports and data. They provide essential insights into international and regional markets, encompassing key industries, top companies, novel products, and the latest trends. The information in the latest report will undoubtedly serve as an indispensable tool for businesses within the home and small business security system sector as they navigate a rapidly evolving environment.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a