Unlocking Legal Clarity: How AI Legalese Decoder Can Navigate Bitcoin’s Surge to $70,000 Amid ZEC, STX, and BNB Losses

- February 4, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Market Update: Zcash, Stacks, and BNB Struggle as Bitcoin Teeters Near $72,000

The cryptocurrency market is currently experiencing significant turmoil, particularly affecting cryptocurrencies such as Zcash (ZEC), Stacks (STX), and BNB (formerly known as Binance Coin). Over the past 24 hours, these digital assets have recorded substantial losses as Bitcoin (BTC) hovers near the $72,000 mark. This recent correction can be attributed to a confluence of factors, including large-scale, steady outflows from institutional investors and major wallet holders, a prevailing risk-off sentiment across the broader market, and delays in the implementation of the Digital Asset Clarity Act. Given the current technical analysis, Zcash, Stacks, and BNB are under intense bearish pressure, suggesting risks remain tilted to the downside.

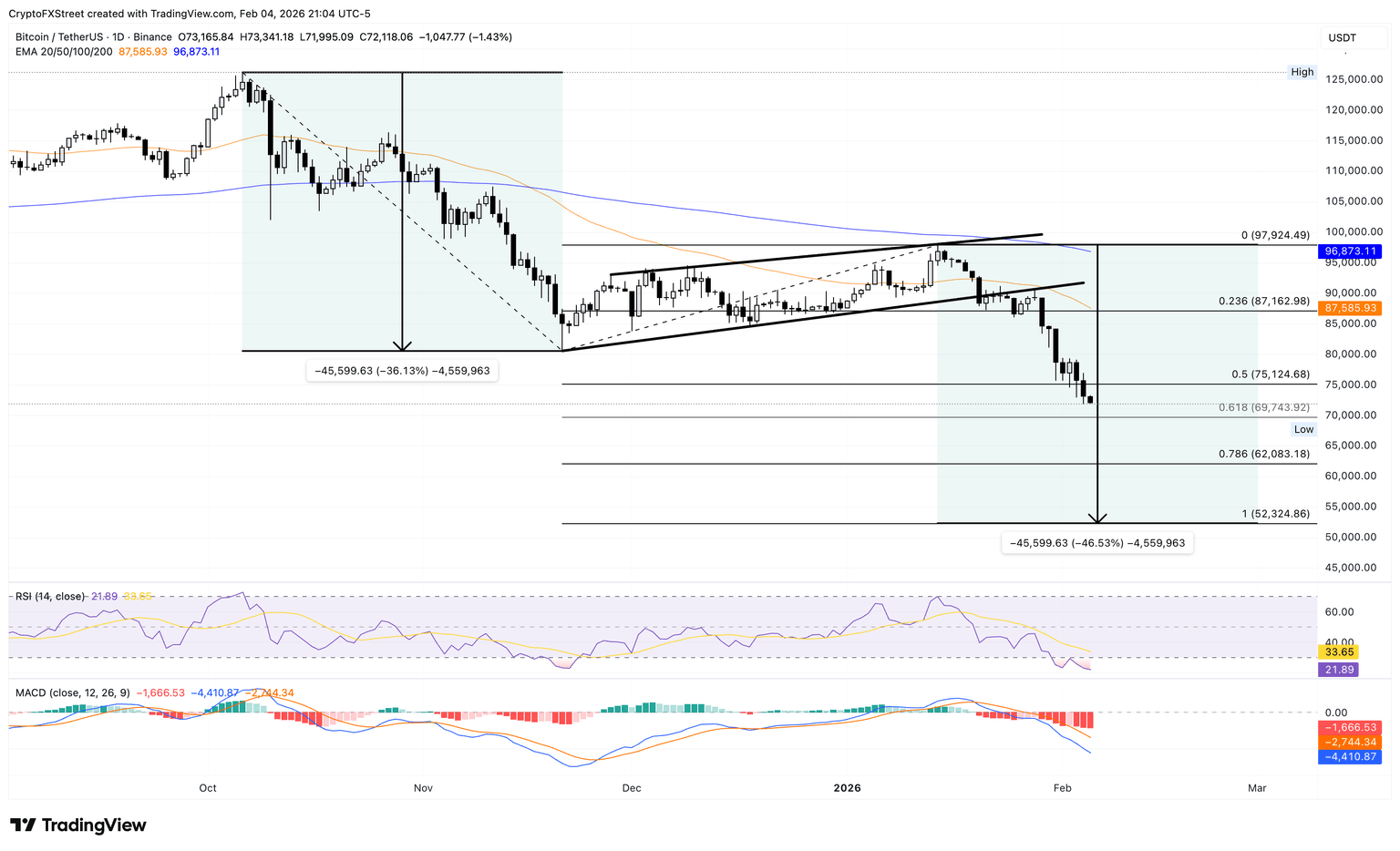

Bitcoin Faces Increased Downside Risk Toward $70,000

As of Thursday, Bitcoin is trading close to $72,000, reflecting an observed decline of over 1%. This marks the third consecutive day of losses for the leading cryptocurrency. Current trading levels are significantly below both the 50-and 200-day Exponential Moving Averages (EMAs), which are exhibiting a downward slope indicative of a bearish trend.

The prevailing downtrend of Bitcoin illustrates an extension of a bearish flag pattern breakout, positioning Bitcoin close to the critical 61.8% Fibonacci extension level at $69,743. This measure is taken from the peak observed on October 6 at $126,199 to the low recorded on November 21 at $80,600, with an interim height marked at the January 15 high of $97,924.

The Moving Average Convergence Divergence (MACD) and its corresponding signal line remain firmly entrenched in negative territory, and as the MACD histogram widens, it indicates increasing downward momentum. Meanwhile, the Relative Strength Index (RSI) has dipped to 22, suggesting oversold conditions that could lead to a possible rebound; however, any recovery would likely encounter considerable overhead supply.

On the upside, the 50% retracement level located at $75,124 may act as immediate resistance, should Bitcoin attempt any recovery moves.

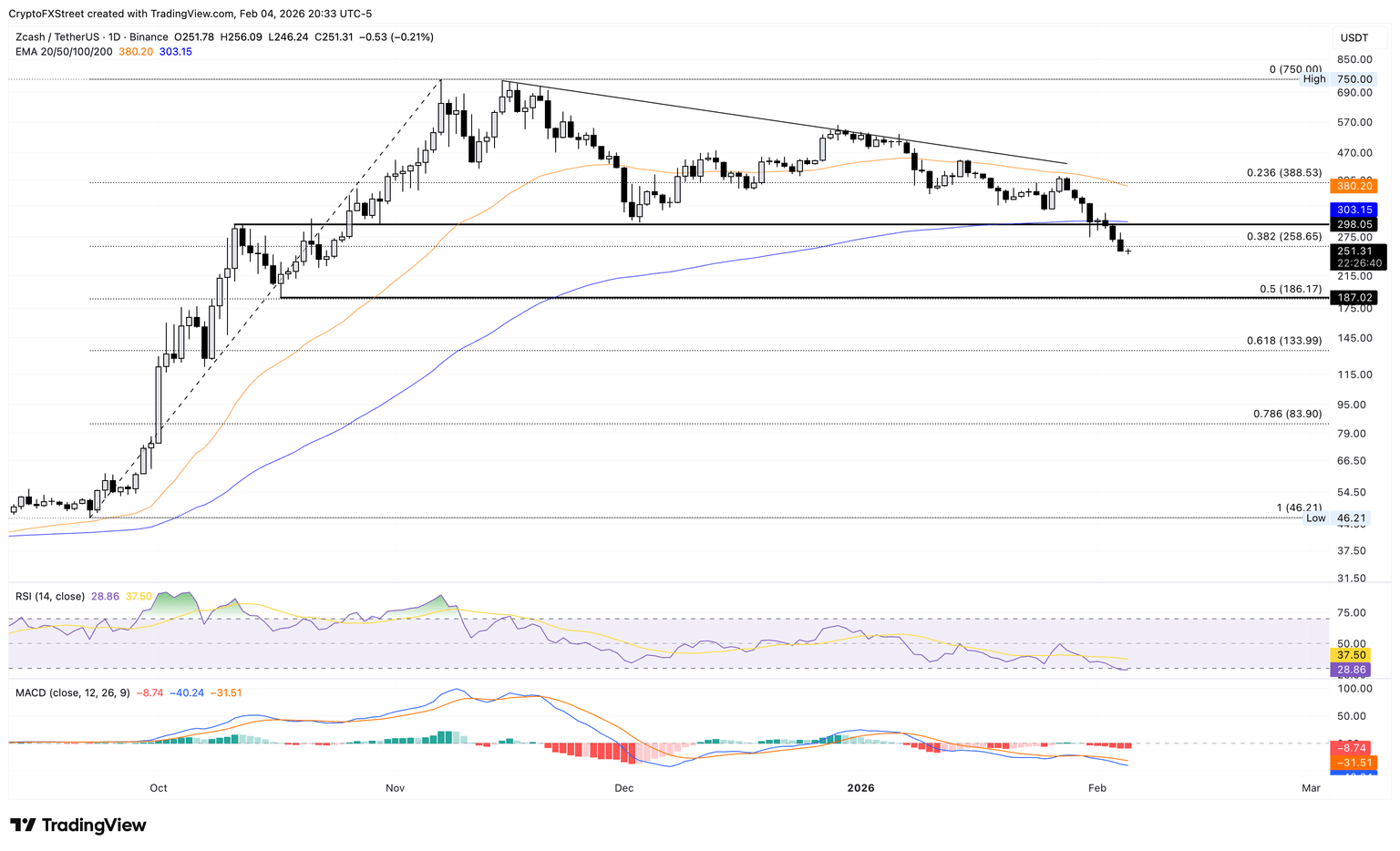

Zcash Plummets to $250 amid Ongoing Corrective Moves

At present, Zcash is trading around the $250 level and is currently situated below both the 50-day and 200-day EMAs, which are showing a downward trajectory and nearing a potential Death Cross pattern. This correction was triggered after Zcash faced significant selling pressure at the $300 mark, coinciding with the 200-day EMA and crossing the 38.2% Fibonacci retracement level at $258. This measure is derived from the low of $46 on September 22 to the high of $750 on November 7.

Thus far in the week, Zcash has experienced a sharp decline of approximately 20%, with the $186 level representing the next target aligned with the 50% retracement level.

An examination of the MACD reveals a steady decline in both lines within the negative territory, indicated by a broadening red histogram. This confirms the presence of considerable bearish momentum. Parallelly, the RSI, now at 28, indicates oversold conditions that may warn of extended price pressure.

Looking ahead, if Zcash can break above the resistance of $258, the $300 level will be a significant hurdle to overcome in future trading sessions.

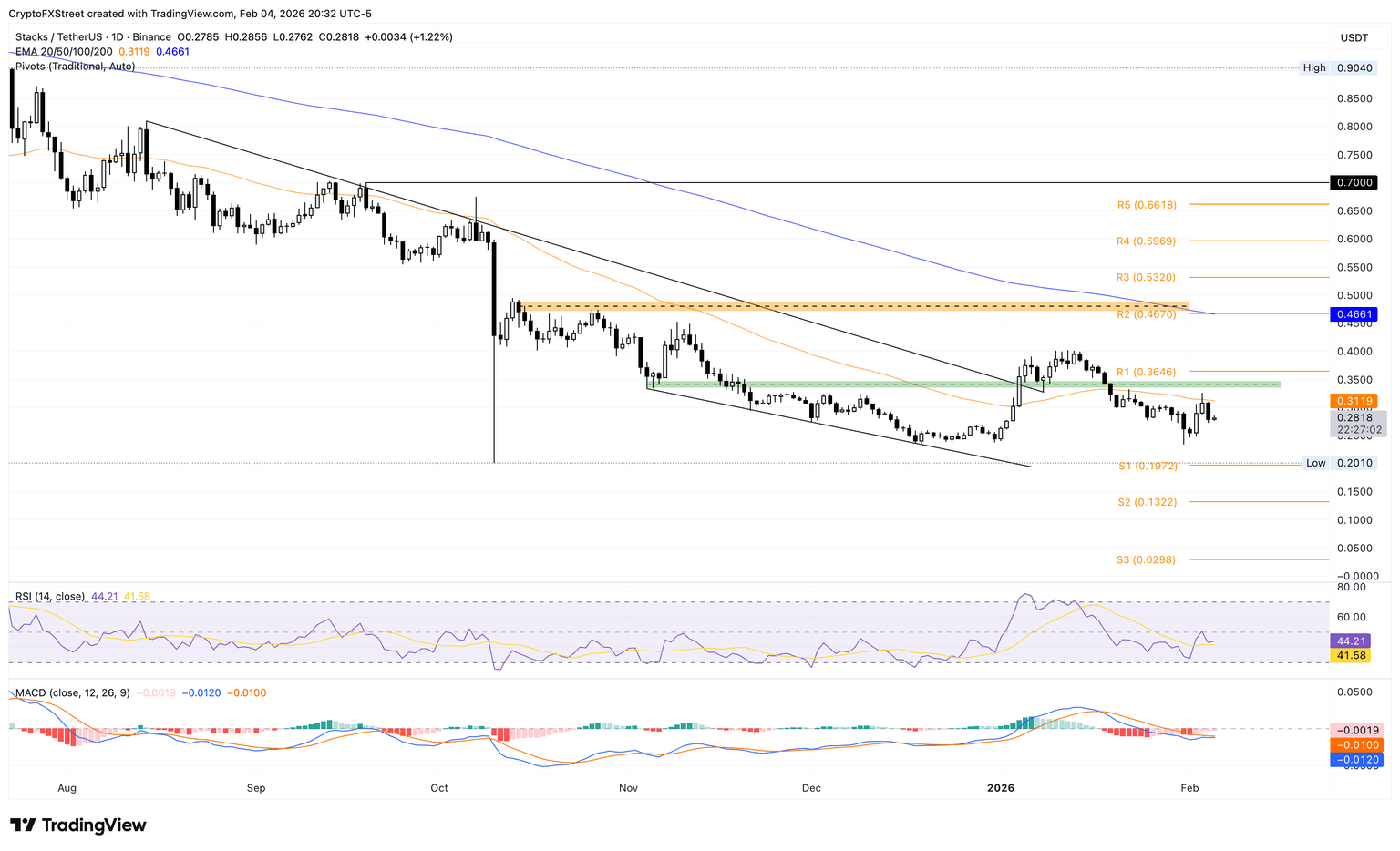

Stacks Faces Resistance at 50-day EMA

Stacks is currently displaying a slight upward movement, following a steep drop of 10% the day before. However, gains remain constrained by the falling 50-day EMA situated at $0.3119, which has established a continuing bearish outlook.

The MACD line remains closely aligned with the signal line, reflecting a contracting negative histogram that implies diminishing selling pressure. Additionally, the RSI level, currently at 44, remains below the critical 50 midline, suggesting that sellers maintain a degree of control in the market dynamics.

For Stacks to regain bullish momentum, a close above the 50-day EMA at $0.3119 is crucial. Such a move would open the door for further upside potential, allowing traders to test the resistance around the supply zone between $0.3500 and the R1 Pivot Point at $0.3646.

On the downside, the crucial support level for Stacks remains pinned to the October 10 low at $0.2010. A failure to maintain this support could lead to increased bearish pressure.

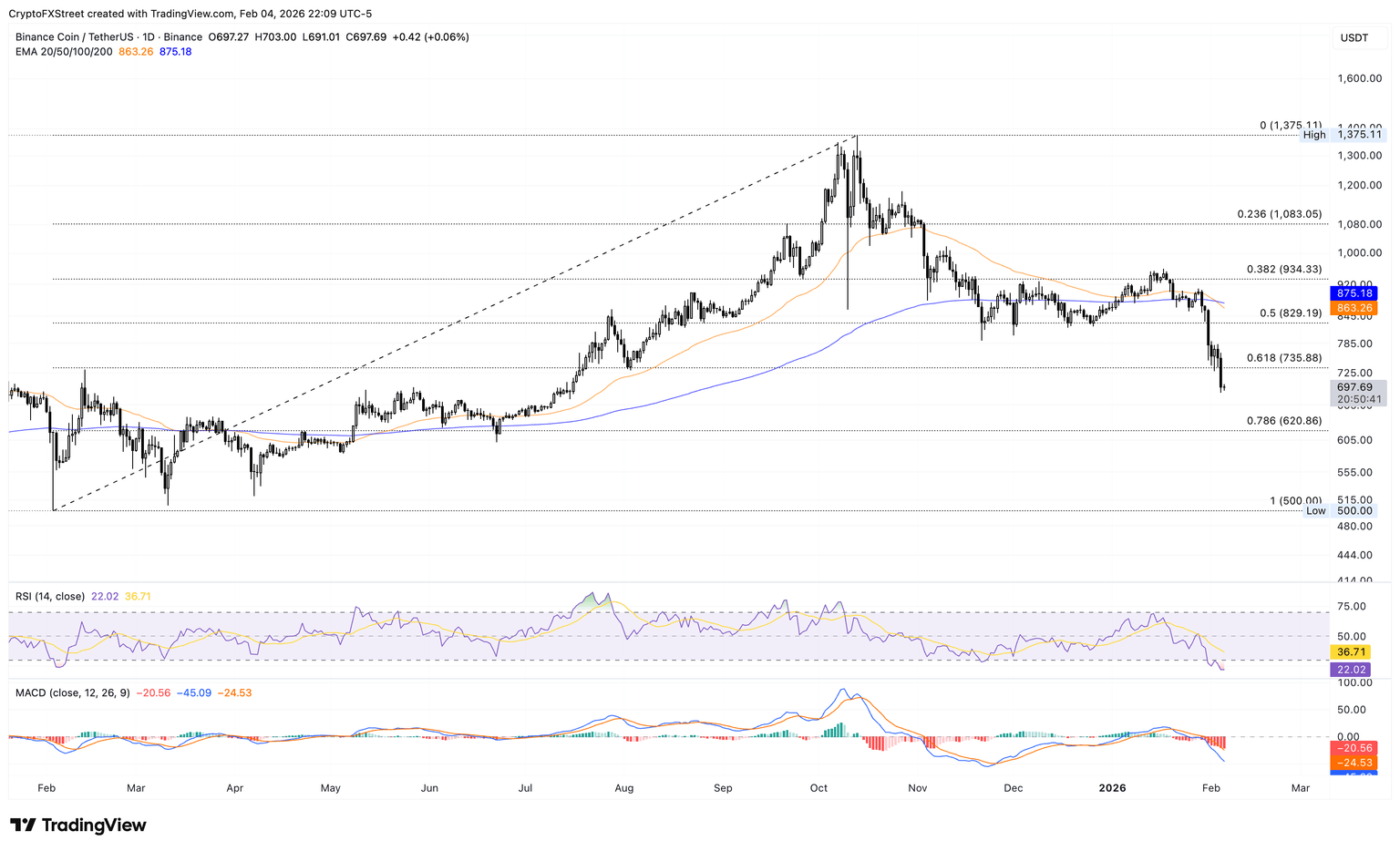

BNB’s Freefall: Dipping Below $700

Currently, BNB has fallen below the $700 mark today, marking its third consecutive week of bearish performance. The exchange token finds itself significantly below both the 50-day EMA at $863 and the 200-day EMA at $875, with the shorter average confirming its downward trajectory beneath the longer one, indicative of a established Death Cross pattern observed just this past Monday.

Both the MACD and its signal lines are trapped in a freefall below zero, while the widening negative histogram underscores a climate characterized by intensifying bearish momentum. Furthermore, the RSI is now at 21, indicating that the broader market sentiment remains under considerable pressure unless stabilization efforts yield results.

The immediate support level for BNB is registered at the 78.6% Fibonacci retracement point at $620, calculated from the low observed in February 2025 at $500 to its high of $1,375 recorded in October 2025. A significant breach below this level could unlock more extensive weaknesses for BNB.

To ease the negative sentiment, a daily close above the 61.8% retracement level at $735 would be crucial in reducing bearish pressure and potentially initiating a recovery phase for BNB.

How AI legalese decoder Can Assist Traders Amid Market Turmoil

In an environment marked by uncertainty and rapid changes, the importance of clear and comprehensible legal information cannot be overstated. Traders navigating the complexities of cryptocurrency investments may often encounter convoluted legal documents and compliance requirements that can complicate decision-making. Here is where the AI legalese decoder proves invaluable.

This AI-powered tool excels in translating complex legal jargon into plain language, allowing traders to swiftly grasp essential information without getting bogged down in technicalities. By simplifying intricate legal documents, the AI legalese decoder empowers traders to make informed decisions. Whether dealing with terms of service from an exchange or understanding regulations surrounding their investments, having access to simplified legal insights enhances not only comprehension but also strategic positioning in the market.

Thus, incorporating the AI legalese decoder into daily trading practices can not only mitigate risks associated with legal misunderstandings but also foster an environment of informed trading, where market participants can operate with clarity and confidence in these tumultuous times.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a