Unlocking Investment Potential: How AI Legalese Decoder Can Guide You in Exploring High Growth Tech Stocks This January 2025

- January 5, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

# The State of Global Markets in January 2025

As we transition into January 2025, the landscape of global markets presents a combination of optimism and caution. In the United States, stocks have concluded the previous year on a favorable note, showcasing their resilience despite experiencing intermittent volatility. However, key economic indicators, such as the Chicago Purchasing Managers Index (PMI) and GDP forecasts, underscore persistent challenges that could impact future growth. Within this multifaceted environment, investors aiming to pinpoint high-growth technology stocks must engage in a meticulous evaluation process, weighing factors such as innovation potential, adaptability to changing market dynamics, and overall economic resilience. These considerations render tech stocks particularly attractive even in the midst of economic fluctuations, providing opportunities for savvy investors.

## Top 10 High Growth Tech Companies

The following tables offer a glimpse into some of the top-performing high-growth tech companies, illustrating their significant revenue and earnings growth rates, along with their growth ratings.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|————————–|—————-|——————|—————|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

For a more in-depth exploration, click here to view the complete list of 1,267 stocks from our High Growth Tech and AI Stocks screener.

Here’s a closer look at a selection of highlighted companies from the screener:

### Example Company Analysis: Integrity Technology Group Inc.

**Simply Wall St Growth Rating:** ★★★★★☆

**Overview:** Integrity Technology Group Inc. operates within the network security sector, specifically in providing robust security solutions in China and holds a market capitalization of CN¥2.45 billion.

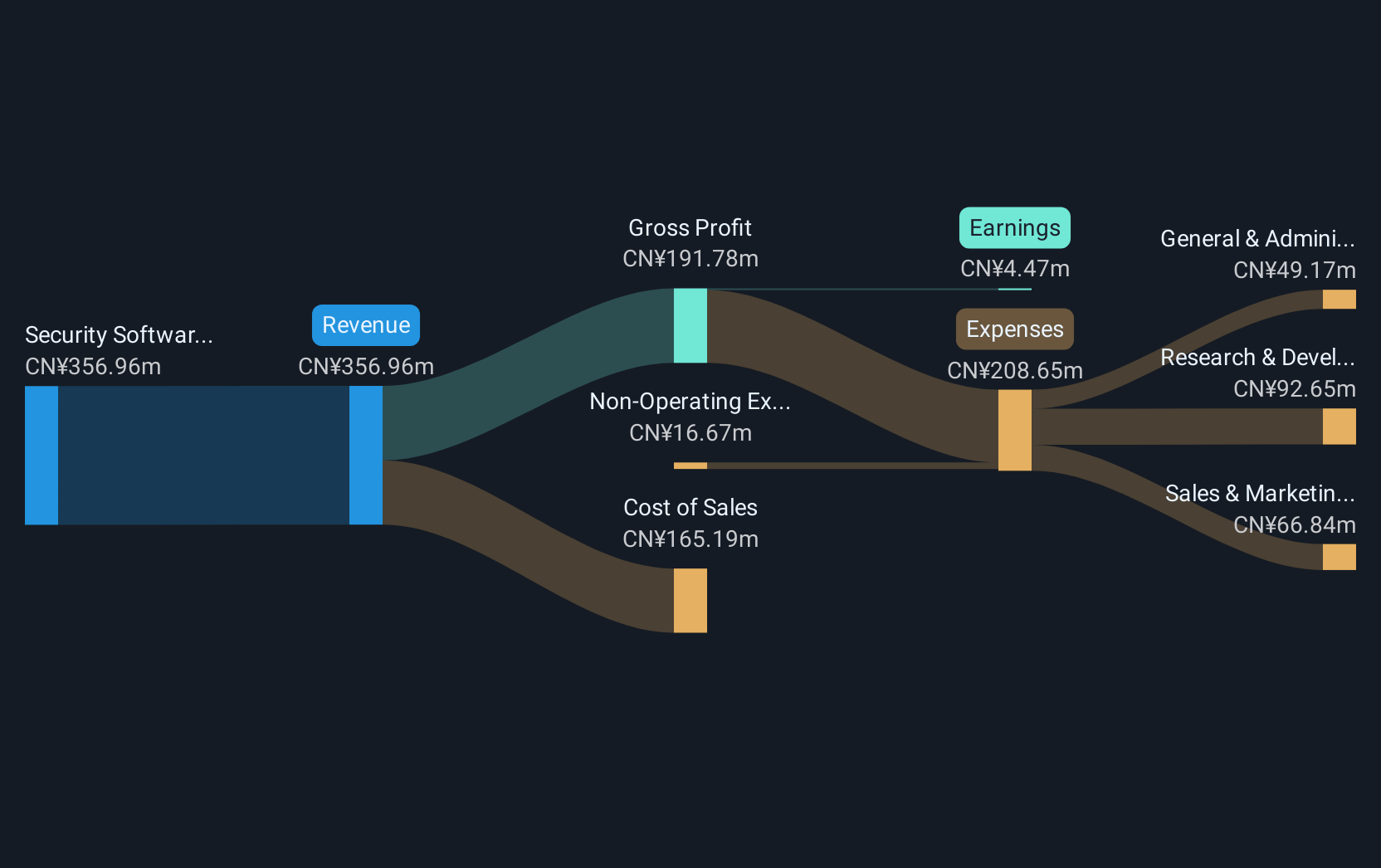

**Operations:** The company generates revenue primarily through its Security Software & Services segment, which accounted for CN¥398.07 million. Despite facing a challenging fiscal period illustrated by a net loss of CNY 31.58 million—an increase from CNY 30.49 million the prior year—Integrity Technology Group is forecasting a promising annual revenue growth rate of 28.6%. This projection substantially exceeds the Chinese market average of 13.5%, placing the company in a favorable position within its sector. Furthermore, a potential earnings growth rate of 51.9% annually hints at possible recovery and improved operational efficiency in the future.

*SHSE:688244 Revenue and Expenses Breakdown as at Jan 2025*

### Example Company Analysis: Hangzhou Raycloud Technology Co., Ltd.

**Simply Wall St Growth Rating:** ★★★★☆☆

**Overview:** This company specializes in e-commerce software and service technologies, both in China and internationally, and has a market capitalization of CN¥4.82 billion.

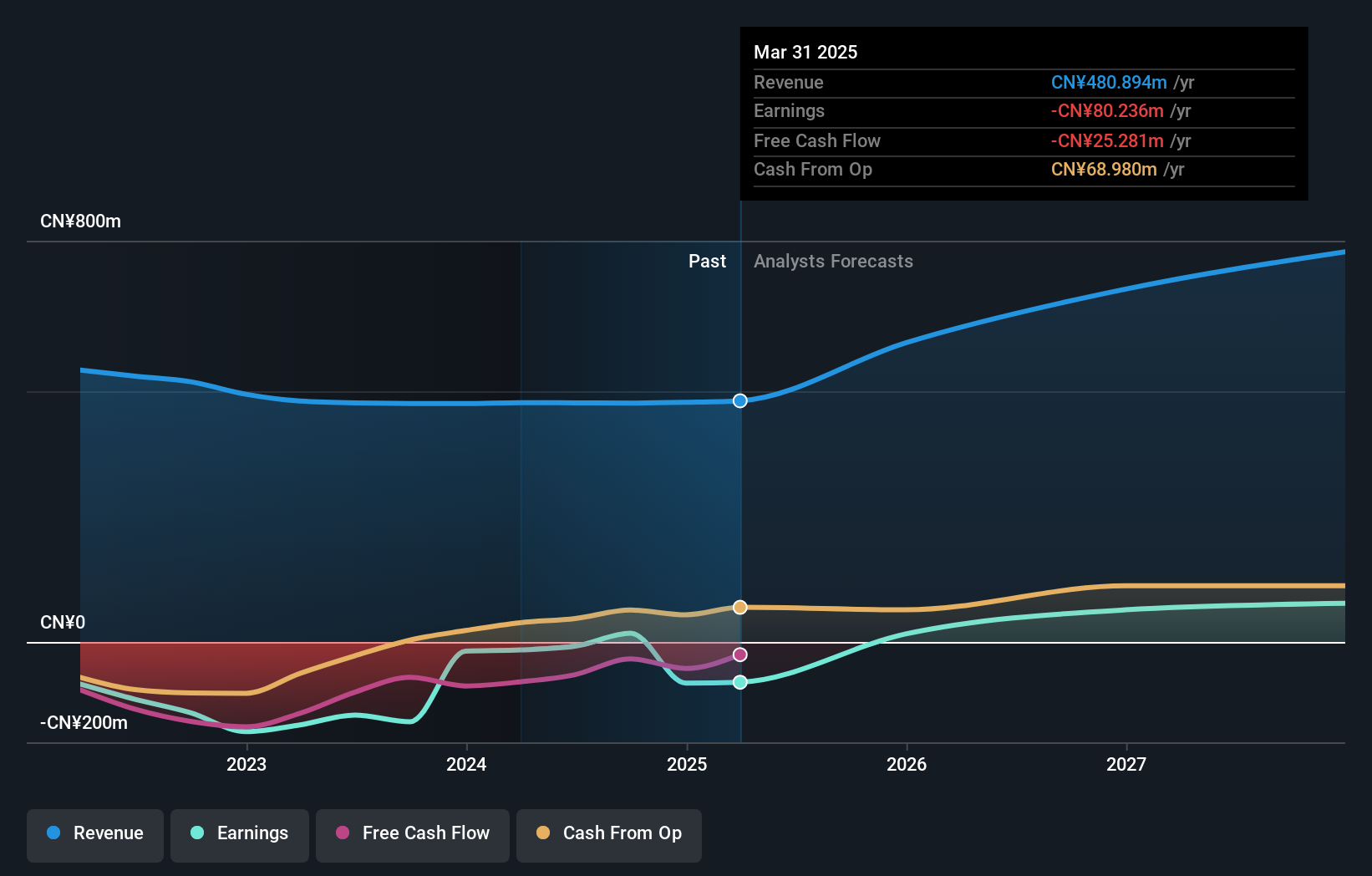

**Operations:** Raycloud’s revenues mainly stem from its internet software and services segment, totaling around CN¥476.40 million. It has recently shown resilience through a reduction in net losses, down to CNY 55.74 million from CNY 91.87 million year-over-year. The company’s stability in sales figures, around CNY 352.63 million, combined with a projected earnings growth rate of 71.3% annually, positions it for strong growth when compared to the broader market’s forecast of 25%. The firm’s dedication to innovation is reflected in its substantial R&D investments that are essential for maintaining competitiveness in the ever-evolving tech sector.

*SHSE:688365 Earnings and Revenue Growth as at Jan 2025*

### Example Company Analysis: Hefei Kewell Power System Co., Ltd.

**Simply Wall St Growth Rating:** ★★★★★☆

**Overview:** This firm is engaged in the manufacturing and sale of test power supplies and systems within China, boasting a market capitalization of approximately CN¥2.23 billion.

**Operations:** Hefei Kewell focuses on the production and distribution of its products within the competitive landscape of China’s tech market. The company has taken proactive measures to enhance shareholder value, as evidenced by share repurchases totaling CNY 20.3 million, showing a commitment to investor confidence. While there was a decline in net income from CNY 75.33 million in the previous year to CNY 51.64 million, the firm achieved a remarkable revenue growth rate of 35.5% annually, significantly above the broader market’s rate.

*SHSE:688551 Revenue and Expenses Breakdown as at Jan 2025*

## The Path Forward

As investors seek to navigate these ever-evolving market dynamics, understanding the complexities of valuation becomes paramount. However, with so many moving parts, simplification of this complex analysis is essential.

### Ready for a Different Approach?

This article, provided by Simply Wall St, is intended to offer a general perspective based on historical data and analyst forecasts, employing an unbiased methodology. Importantly, it should not be misconstrued as financial advice or an endorsement of specific companies or stocks. The analysis does not factor in each individual’s specific financial goals or situations, nor does it capture real-time developments or price-sensitive announcements.

**Valuation made simple:** To make your investment decisions easier, discover whether Hefei Kewell Power System Ltd might be undervalued or overvalued by accessing our comprehensive assessments, which include **fair value estimates, potential risks, dividends, insider trades, and detailed evaluations of its financial condition.**

[Access Free Analysis Here](#)

We value your feedback! If you have thoughts on this article or questions regarding the content, please reach out to us directly.

Alternatively, you can email our editorial team at [email protected].

## Leveraging AI legalese decoder

In an increasingly intricate investment landscape, utilizing tools like the AI legalese decoder can provide significant advantages. As regulations and technology intertwine, understanding complex legal documents, investment terms, and corporate compliance becomes crucial. The AI legalese decoder simplifies deciphering and interpreting legal jargon, ensuring stakeholders can make informed decisions without misinterpretations that could lead to missed opportunities or legal pitfalls. This tool equips investors and businesses alike to confidently navigate and manage their legal obligations, enhancing the overall decision-making process in the volatile world of high-growth tech stocks.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a