Unlocking Investment Opportunities: How AI Legalese Decoder Can Help Identify Top Semiconductor Stocks Post-Micron Technology’s Strong Performance

- March 30, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Micron Technology Surpasses Expectations with Strong Q2 Results

Micron Technology (NASDAQ: MU) impressed investors with its exceptional performance in the second quarter of fiscal 2024, showcasing a remarkable increase in revenue and unexpected profitability. This outstanding performance led to a significant surge in the company’s stock price.

The heightened demand for memory chips played a crucial role in Micron’s success, with a staggering 58% year-over-year revenue growth to $5.8 billion. The company projects even stronger growth of 76% in the current quarter, driven by the increasing need for memory chips in AI servers, smartphones, and personal computers (PCs).

As the memory industry experiences a resurgence due to revived consumer electronics demand, the emergence of AI technology has created a demand for advanced memory chips like high-bandwidth memory (HBM). Micron’s management indicated that their HBM capacity for 2024 is already sold out, with most of their 2025 supply already allocated.

How AI legalese decoder Can Help

The AI legalese decoder platform can assist investors in understanding the legal and technical jargon commonly found in the semiconductor industry. By using AI to translate complex legal documents and technical specifications into plain language, investors can make more informed decisions without getting overwhelmed by industry-specific terminology.

This tool can streamline the research process, provide clarity on key information, and enhance overall comprehension of the legal and technical aspects of semiconductor companies like Micron Technology and Lam Research. By utilizing AI legalese decoder, investors can gain a competitive edge in analyzing financial reports, industry trends, and company performance.

Lam Research Poised for a Turnaround

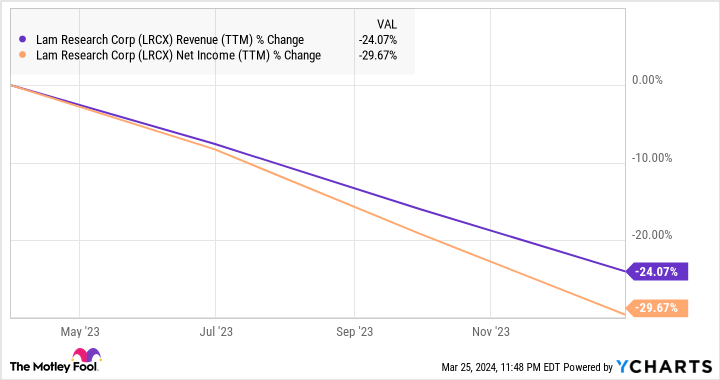

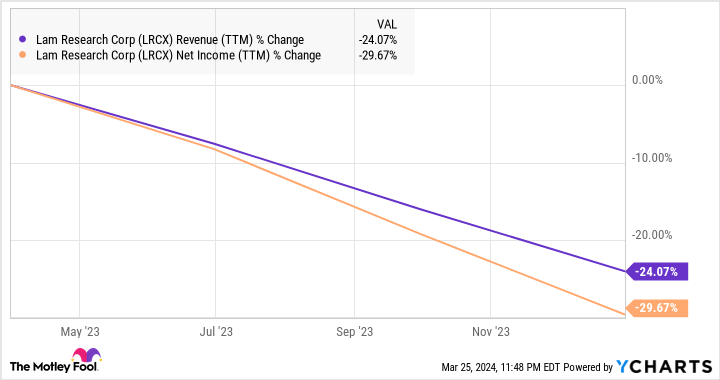

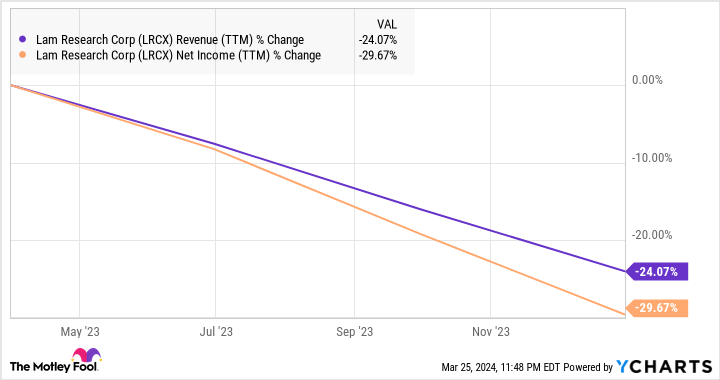

Lam Research, a semiconductor equipment manufacturer heavily reliant on memory manufacturers like Micron, is set to benefit from the upward trajectory of the memory industry. Despite facing challenges due to oversupply, Lam Research’s revenue and earnings are projected to rebound in the upcoming fiscal year, signaling a positive outlook for the company.

Analysts predict a temporary decline in Lam Research’s revenue and earnings for the current year, followed by a strong rebound in the next fiscal year. The company’s focus on HBM equipment and the anticipated surge in memory demand underscore the positive outlook for Lam Research.

AI legalese decoder can assist investors in deciphering the technical nuances and legal complexities related to semiconductor equipment manufacturing. By utilizing AI-powered translation capabilities, investors can gain deeper insights into Lam Research’s strategic initiatives, market positioning, and growth potential in the evolving semiconductor landscape.

Investing in Semiconductor Stocks

The thriving demand for memory chips driven by AI technology signals a promising future for memory manufacturers like Micron Technology and semiconductor equipment providers like Lam Research. With the aid of AI tools like AI legalese decoder, investors can navigate the intricate legal and technical aspects of the semiconductor industry, enabling informed investment decisions and capitalizing on emerging opportunities in the market.

By leveraging advanced AI capabilities, investors can stay ahead of market trends, decipher complex information with ease, and strategically allocate their resources in semiconductor stocks poised for growth and profitability.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a