Unlocking Investment Opportunities: How AI Legalese Decoder Can Guide You in Exploring High Growth Tech Stocks for January 2025

- December 31, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Navigating the Complex Technology Sector in Global Markets

As global markets navigate an increasingly intricate landscape characterized by fluctuating consumer confidence and a variety of mixed economic indicators, the technology sector remains a focal point for many investors. This sustained interest is primarily due to the sector’s immense potential for high growth, even amidst uncertainties. Consequently, for investors looking to identify promising tech stocks, a thorough assessment of innovation capabilities and adaptability to shifting market dynamics becomes essential.

Top 10 High Growth Tech Companies

The search for high-growth technology companies can be guided by specific metrics such as revenue growth, earnings growth, and overall growth ratings. Below is a table showcasing some of the top-performing tech companies that signify potential for robust growth.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin System Ltd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLL Ltd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health Technologies Ltd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Fine M-Tec Ltd | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

For a more extensive overview, including a total list of 1,261 stocks aligned with high growth tech and AI, click here to access our specialized screener.

Spotlight on Growth Companies

Netcompany Group A/S

Simply Wall St Growth Rating: ★★★★☆☆

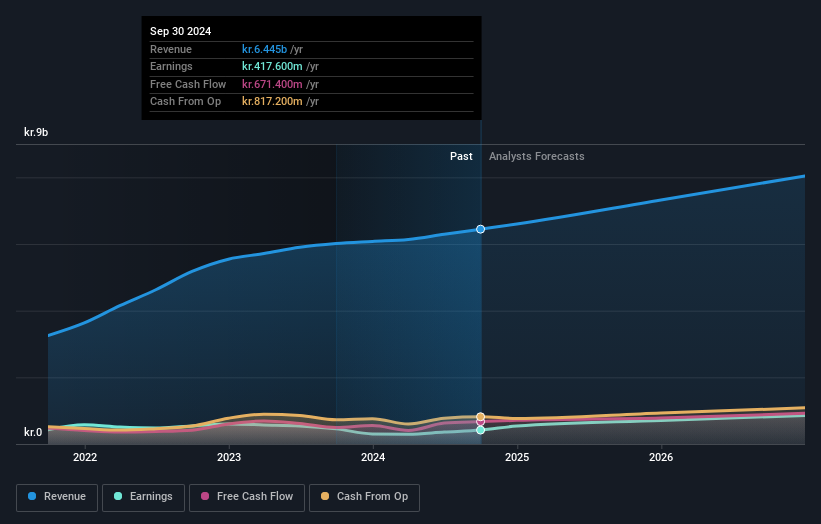

Overview: Netcompany Group A/S stands as a premier IT services company providing crucial IT solutions to both public and private sector clients across various countries, including Denmark, Norway, and the UK, with a market capitalization of DKK 16.09 billion.

Operations: The company primarily generates revenue from public sector clients (DKK 4.41 billion) and private sector clients (DKK 2.04 billion). With third-quarter sales rising to DKK 1.61 billion — an increase from DKK 1.46 billion year-over-year — Netcompany has achieved net income nearly doubling to DKK 139.5 million. This solid performance is bolstered by a substantial annual earnings forecast of 29.5%, which impressively outpaces the broader Danish market average of 11.3%. Even though it faced challenges from a previous year’s earnings decline of 8%, the company’s strategic positioning suggests that it is well-equipped for enduring growth.

SUNeVision Holdings Ltd.

Simply Wall St Growth Rating: ★★★★☆☆

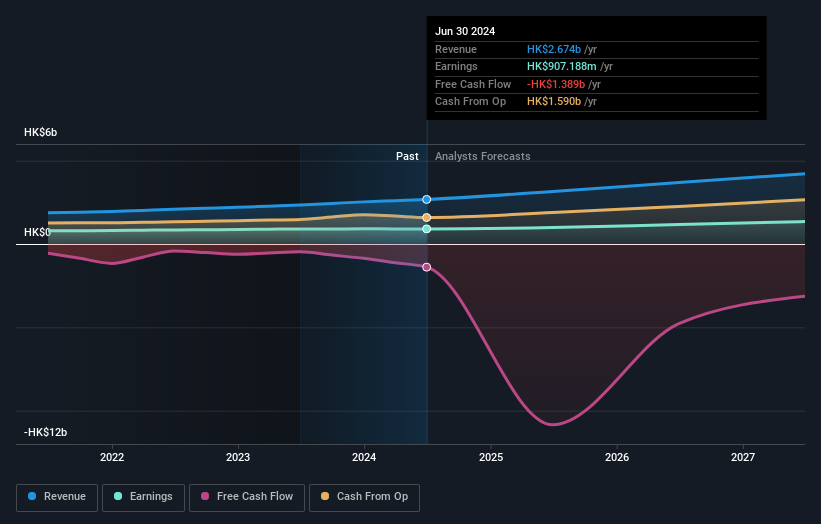

Overview: SUNeVision Holdings Ltd., with a market capitalization of HK$ 16.89 billion, focuses on data centre and IT facility services in Hong Kong.

Operations: SUNeVision garners revenue from its data centre and IT services, amounting to HK$ 2.46 billion, along with HK$ 213.03 million from Extra-Low Voltage (ELV) and IT systems. The company expects a revenue growth rate of 15%, well above the Hong Kong market average of 7.8%. Earnings are projected to rise by 13.7%, exceeding the local market forecast of 11.4%.

Fositek Corp.

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. specializes in the manufacture and wholesale of electronic materials and components, holding a market capitalization of NT$ 55.53 billion.

Operations: Primarily receiving revenues from electronic components and parts (NT$ 7.20 billion), Fositek Corp. shows a remarkable annual revenue growth of 46.3% and earnings growth of 57.2%. The company’s significant R&D investments align with advancements in technology trends, while its proactive exploration of AI capabilities showcases its visionary growth path.

Key Takeaways

The technology sector remains an appealing investment avenue amid a fluctuating economic climate. With several companies showing strong growth metrics, industry innovation will likely remain a key determinant of success.

Searching for a Fresh Perspective in Investment Analysis?

This article, produced by Simply Wall St, aims to present general insights. Please note that our commentary is grounded in historical data and analyst forecasts, and is not designed to be financial advice. It is imperative to consider your individual investment goals and financial situations.

Leveraging AI for Enhanced Clarity

In navigating the complexities of stock analysis, tools like AI legalese decoder can be invaluable. By simplifying intricate legal language and providing context, it empowers investors to make informed decisions about the stocks they are scrutinizing, ensuring they grasp the legal frameworks governing their investments. This can be especially helpful in understanding contractual obligations or regulatory frameworks that may impact a company’s performance and future prospects.

In addition to this advisory, keep in mind that Simply Wall St does not hold any positions in the stocks mentioned in this article.

New: Manage Your Investment Portfolio Effortlessly

We have introduced the ultimate portfolio companion for stock investors, which is entirely free. The features include:

- Connect an unlimited number of portfolios to view your total in one currency.

- Receive alerts for new warning signs or risks via email or mobile notifications.

- Track the fair value of your stocks for well-informed decision-making.

Explore how to optimize your stock investments today. Try a demo portfolio without any charge!

If you have any feedback or concerns regarding this article, please feel free to reach out to us directly or contact us via email at [email protected].

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a