- September 10, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin’s price continues to experience a phase of consolidation this week, as traders attentively await the forthcoming report on the U.S. Consumer Price Index, a critical indicator for market behavior.

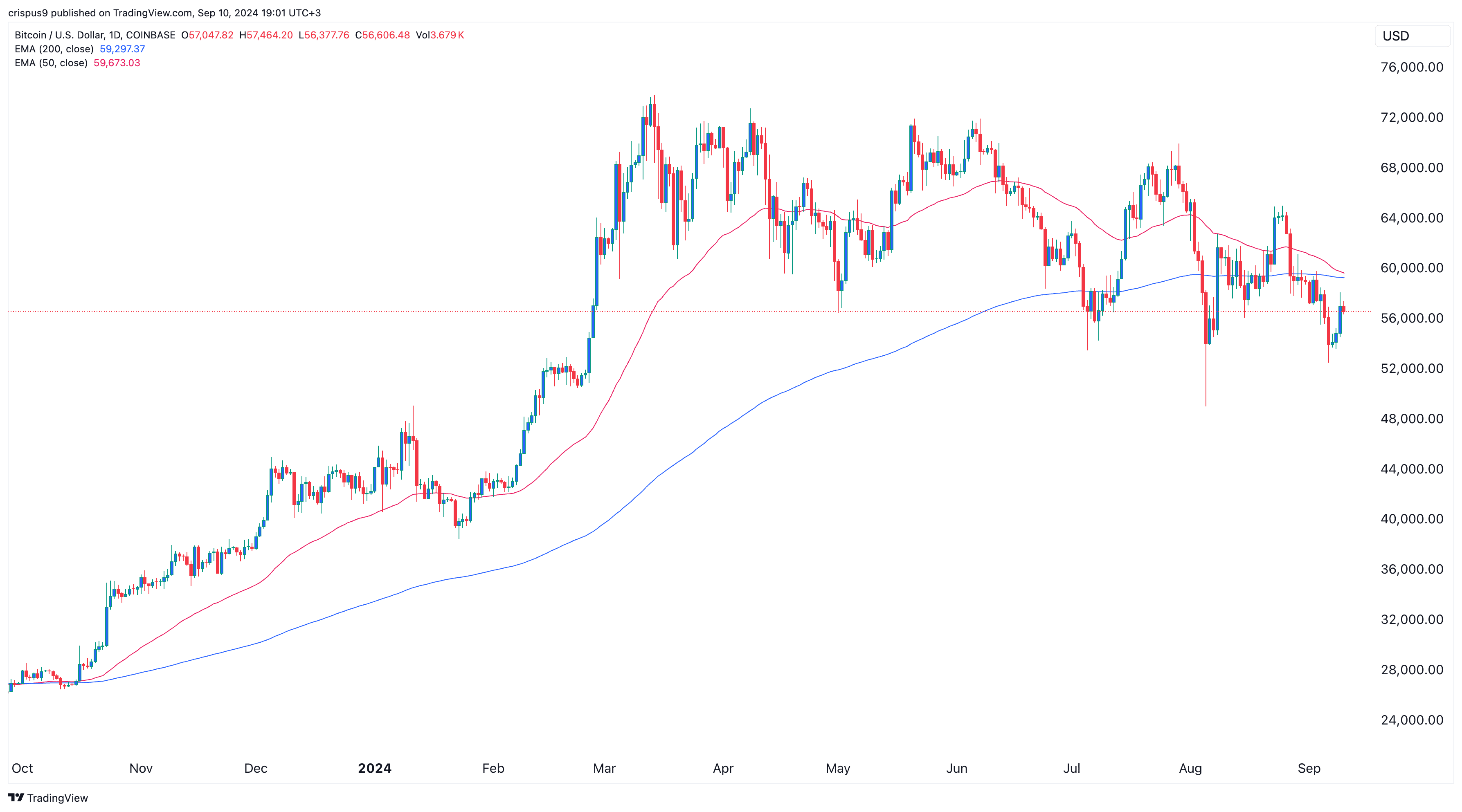

As of now, Bitcoin (BTC) is trading at approximately $57,000, showing a notable increase from last Friday’s low of around $52,000. This price action aligns closely with trends observed in U.S. stock markets, particularly as the Nasdaq 100 and Dow Jones saw gains on Monday, followed by fluctuations on Tuesday, September 10.

Bitwise Highlights Factors Driving Bitcoin’s Potential Rally

In a recent analysis, the Chief Investment Officer of Bitwise, an influential crypto investment firm managing over $4 billion in assets, asserted that Bitcoin might witness a “significant rally” in the months to come. This perspective is underpinned by several compelling reasons.

The first reason revolves around historical performance, where Bitcoin and other high-risk assets, such as those in the technology sector, often struggle during September but tend to rebound afterward. According to a thorough study encompassing data from 2010 to 2024, it has been observed that September was historically the poorest month for Bitcoin, averaging a return of negative 4.5%. This trend extends to the Nasdaq 100, which also typically suffers in September, experiencing an average decline of around 6%.

Looking ahead to this year, Matt Hougan identified three pivotal catalysts that might propel Bitcoin’s price upward in the upcoming months. Firstly, there is an expectation that the Federal Reserve will initiate interest rate cuts beginning in September, with the potential for two additional cuts by the end of the year. Specifically, predictions suggest that the Fed could implement a total of 125 basis points worth of reductions by December, a phenomenon that traditionally benefits riskier assets and may lead to bullish momentum for Bitcoin.

The second catalyst Hougan points out is the possibility of a rebound in Bitcoin’s price as the market obtains clearer insights into the 2024 general election outcomes. Polymarket data indicates that Donald Trump may have an edge over Kamala Harris, which adds a layer of dynamic uncertainty to the financial landscape. Nonetheless, other mainstream polls illustrate that these candidates remain extremely close in popularity, often within the margin of error.

Lastly, he emphasized that despite recent outflows, the inflow of investments into Bitcoin exchange-traded funds (ETFs) remains robust. He particularly noted that investment advisors are integrating Bitcoin funds into their portfolios at a pace faster than any other new ETF in history. Many significant hedge funds, such as Citadel, Millennium, and Bridgewater Associates, have already made substantial investments in Bitcoin, signaling a renewed interest in the cryptocurrency.

Potential Risks Facing Bitcoin’s Price Movement

Despite the bullish outlook surrounding Bitcoin, there are notable risks that warrant caution. The most immediate concern is that Bitcoin appears poised to form a death cross, as evidenced by the narrowing gap between the 200-day and 50-day Exponential Moving Averages. This gap has tightened from 4% last week to less than 1% at present. Historically, such a crossover often precedes a sharp decline in Bitcoin’s price.

Another concern is the ambiguous outlook for Bitcoin as it currently lacks a clear catalyst or compelling narrative that could drive substantial upward momentum. Previous rallies have been largely fueled by anticipation surrounding events like the Bitcoin halving and the approvals of ETFs, leaving the market searching for a strong impetus to jumpstart the next phase of growth.

In navigating these complexities, tools like the AI legalese decoder can play a crucial role for investors and market participants. This AI technology assists in simplifying legal jargon, making it easier for stakeholders to comprehend contracts, agreements, and legal implications tied to cryptocurrency investments. By decoding legal documents, investors can make more informed decisions, thereby mitigating some of the risks associated with the volatility and regulatory uncertainties in the cryptocurrency market. Understanding the legal landscape is vital in managing investments effectively, and AI legalese decoder is designed to empower individuals with the clarity they need.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a