Unlocking Crypto Gains: How AI Legalese Decoder Empowers Investors as Stock Markets Stumble – Spotlight on Altcoins EOS and Pendle

- April 5, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

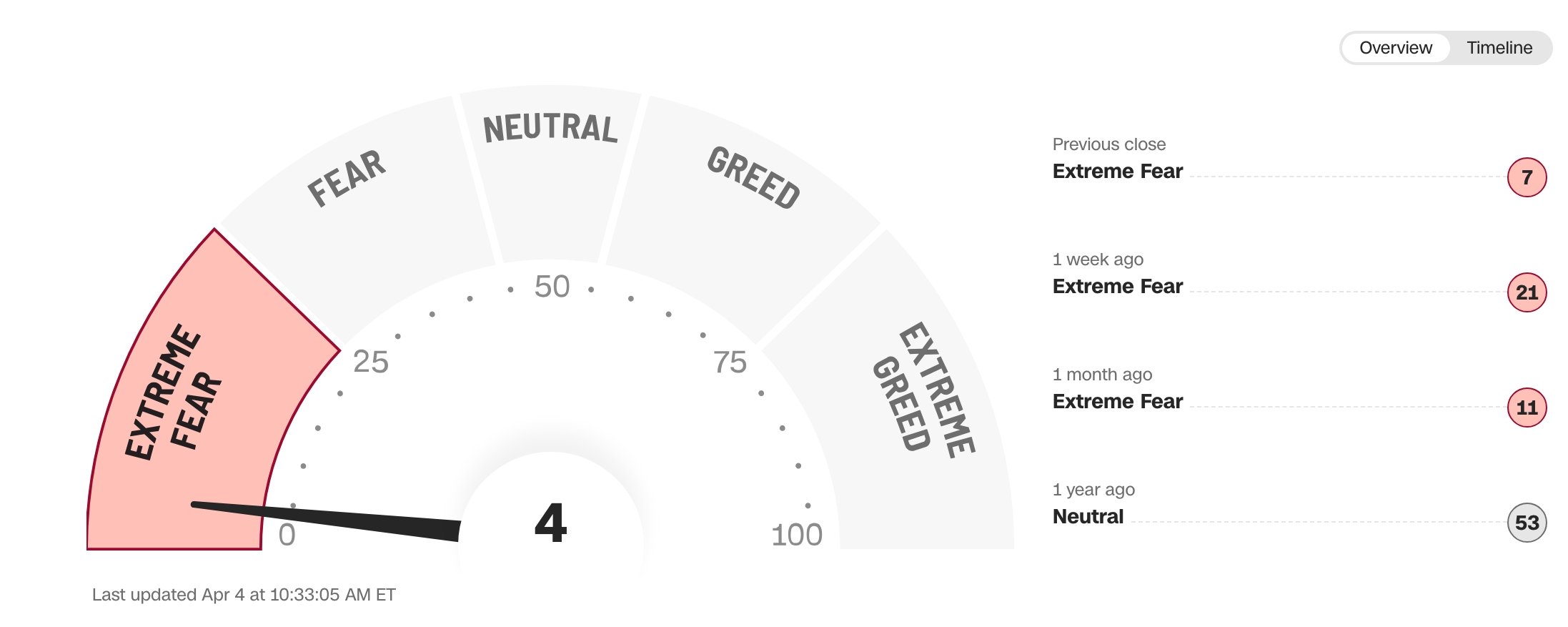

This week marked a notable shift in the financial landscape, as cryptocurrencies, particularly several altcoins, significantly outperformed global stock markets amidst escalating economic anxiety. The fear and greed index, a key barometer of market sentiment, plummeted to its lowest level in several years, illustrating the widespread apprehension among investors.

Despite experiencing a relatively stable week, Bitcoin (BTC) has managed to retain its value while traditional stock markets faced severe declines. In particular, many altcoins experienced impressive gains as global financial markets reacted sharply to President Trump’s recent announcement of tariffs on Chinese imports. Bitcoin has officially eclipsed the tech-heavy Nasdaq 100 in performance for the year thus far, highlighting its increasingly dominant role in the financial ecosystem.

In stark contrast, U.S. equities witnessed a historic crash, with the Dow Jones Industrial Average suffering a massive 2,200-point drop on Friday alone, following a prior decline of 1,200 points just a day before. This two-day debacle has effectively erased $5.4 trillion in value across American stocks. Since February, the Dow has plunged from an impressive high of $45,000 down to about $38,200, while the Nasdaq 100 has seen a substantial decrease from $22,220 to a mere $13,400. Meanwhile, the S&P 500 has also slipped significantly, falling from $6,145 to $5,000.

The chaos in global stock markets was a direct result of President Trump’s imposition of a sweeping 34% tariff on all Chinese imports—an action that has elicited immediate retaliatory measures from Beijing. As fears surged, the fear and greed index, a vital sentiment indicator, cratered to a reading of 6. This is its lowest mark in years, as anxious investors scrambled to secure safer investment options amidst rising uncertainty. Interestingly, this quest for safety has, in some cases, led investors back to cryptocurrency, suggesting a paradoxical shift in market dynamics where altcoins have outperformed even Bitcoin, as well as more traditional assets.

EOS, Pendle, Fartcoin, and ATOM: A Surge Amidst Stock Market Declines

Leading the cryptocurrency rally this week was EOS (EOS), which experienced a dramatic 41% surge following its rebranding to Vaulta. This rebranding effort was accompanied by a strategic pivot toward blockchain banking and asset tokenization—an innovative move that has drawn considerable attention. Furthermore, as part of this rebranding strategy, EOS introduced VirgoPay in collaboration with VirgoCX Global, a service designed to facilitate cross-border payments leveraging stablecoins.

In addition to EOS, other notable performers included Pendle (PENDLE), which skyrocketed by 22% as yield-seeking investors gravitated toward its decentralized finance (DeFi) platform, which offers lucrative annual returns exceeding 7.5% on synthetic stable assets. The altcoins Fartcoin (FARTCOIN) and Cosmos (ATOM) also posted gains of 15% and 9.5%, respectively, showcasing their resilience during these turbulent times. Additionally, Zcash, OKB, and Raydium proved to be other significant movers within this space.

However, it’s important to recognize that it may be premature to label Bitcoin and these altcoins as reliable safe-haven assets. The cryptocurrency market remains highly speculative, and while some altcoins enjoyed success this week, many others faced severe disappointments. For instance, Berachain (BERA) plummeted by 27%, and other cryptocurrencies such as Pi Network (PI), Immutable X, and Movement (MOVE) experienced declines of over 15%. This indicates an overall volatility that characterizes the crypto market.

In this unpredictable landscape, tools like the AI legalese decoder can serve as invaluable resources for investors and stakeholders trying to navigate the legal multipliers surrounding cryptocurrency investments. The AI legalese decoder simplifies complex legal texts, helping users understand regulatory frameworks, compliance issues, and other relevant legalities associated with cryptocurrency trading and usage. Its ability to clarify intricate legal jargon empowers investors to make informed decisions by navigating not just the market trends but also the legal landscape that governs them. By leveraging such technology, individuals can mitigate risks and enhance their understanding of this evolving financial ecosystem.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a