Unlocking Compliance: How AI Legalese Decoder Can Help Genius Group Navigate Bitcoin Buying Ban

- April 3, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Introduction: The Current Situation of Genius Group

Singapore-based artificial intelligence company, Genius Group, is currently facing significant legal challenges that have temporarily halted its ability to expand its Bitcoin treasury. A recent court order from a US court now restricts the company from selling shares, raising additional funds, and using existing investor funds to purchase more Bitcoin.

Details of the Court Order

On March 13, a preliminary injunction (PI) and temporary restraining order (TRO) were issued by a New York District court as part of an ongoing legal dispute tied to Genius Group’s merger with Fatbrain AI. The court order has sparked concerns and complications for Genius Group’s operations, as clarified in an official statement released by the firm on April 3.

Merger and Subsequent Arbitration

In March 2024, Genius Group finalized a merger and purchase agreement with Fatbrain AI. However, by October 30 of the same year, Genius Group initiated arbitration procedures alleging fraudulent behavior by executives at Fatbrain AI related to the merger deal. Such allegations add layers of complexity to the situation as they may affect investor confidence and overall market perception of Genius Group.

Source: Roger James Hamilton

Impact of the Temporary Restraining Order

The TRO filed by Fatbrain AI executives, Michael Moe and Peter Ritz, on behalf of the shareholders, has further complicated matters by effectively barring Genius Group from selling its shares, raising funds, or purchasing more Bitcoin until arbitration concludes. This restriction has forced Genius Group to undertake drastic measures, including closing some divisions, halting marketing initiatives, and selling 10 Bitcoin (BTC) from its existing reserve of 440 BTC—equating to over $23 million at current market prices. The likelihood of future sales is not being ruled out, as the firm seeks alternatives to sustain its operations in these turbulent times.

Company’s Response and Future Outlook

Genius Group has publicly stated its intention to limit Bitcoin sales as much as possible. Still, the firm has acknowledged that it may have to further downsize its Bitcoin treasury, depending on whether the PI remains in effect. The company emphasized the necessity of finding solutions to loopholes and challenges presented by the injunction to maintain operational viability.

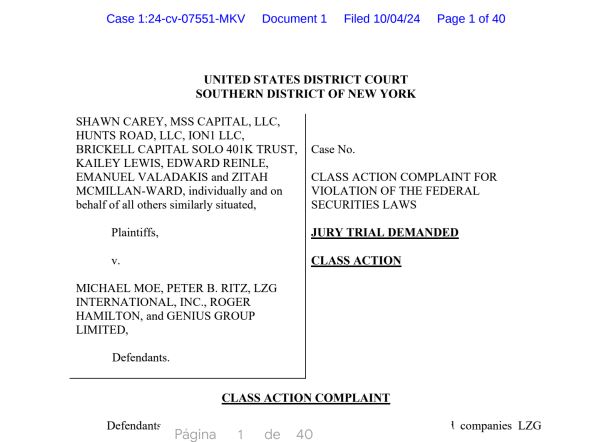

legal Troubles for Fatbrain AI Executives

In another development, shareholders of Fatbrain AI have filed two lawsuits against its executives, including Moe and Ritz, asserting violations of federal securities laws linked to the merger discussions. A report from ASX Law on this matter indicated that shareholders believe they were defrauded out of $30 million due to the alleged misconduct during the merger process.

Two shareholder lawsuits against Fatbrain AI alleged misconduct during the merger, defrauding shareholders of $30 million. Source: ASX Law

Challenges to Compliance with Local Laws

Genius Group has also voiced concerns that complying with the US court’s injunction forces the company into a position where it violates local Singapore laws. Specifically, the injunction prevents the firm from fulfilling share compensation agreed upon in its employee contracts. This conflict raises serious questions regarding the enforcement of legal orders across jurisdictions and the broader implications for cross-border mergers and acquisitions.

CEO’s Statement on the Situation

Genius Group’s CEO, Roger James Hamilton, expressed disbelief that a US court could restrict the company from conducting its normal business operations, which should typically be regulated by shareholders and the company’s board of directors. Despite the legal obstacles, Hamilton remains committed to maintaining the company’s stance in favor of Bitcoin, asserting that they will continue to advocate for cryptocurrency even amid these legal constraints.

Genius Group’s Struggle in the Stock Market

Initially, Genius Group made headlines by announcing in November 2024 its plans to build a Bitcoin treasury, successfully purchasing 110 Bitcoin for $10 million. The firm aimed to allocate 90% or more of its current and future reserves towards Bitcoin, an initiative that once revitalized its stock price, leading to a 66% surge. However, as of the latest trading session, Genius Group’s share price has declined significantly, down 9.80% to $0.23, with a further drop after hours to $0.22. For context, the stock peaked at over $96 in June 2022 and has since plummeted by over 99%. This drastic decline poses more issues for the company as they navigate financial uncertainties.

Genius Group’s share price has experienced ongoing declines in recent trading sessions. Source: Google Finance

The Role of AI legalese decoder in Understanding Complex legal Matters

In navigating the complexities of legal situations like the one faced by Genius Group, utilizing AI tools such as the AI legalese decoder can be immensely beneficial. This innovative platform simplifies intricate legal jargon and offers clear explanations of legal implications, making it easier for companies and individuals to understand their legal standings and obligations. For Genius Group, employing AI legalese decoder could facilitate clearer communication between stakeholders and significantly aid in comprehending the nuances of the ongoing legal disputes surrounding their operations and rights. By demystifying legal documents, it can also help move toward more strategic and informed decision-making in a landscape fraught with legal challenges.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a