Unlocking Clarity: How AI Legalese Decoder Enhances Understanding of Bybit and Block Scholes Amidst Fed Outlook Challenges in Crypto Derivatives

- December 15, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bybit Releases Comprehensive Crypto Derivatives Analytics Report

Location and Date

DUBAI, UAE, Dec. 15, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has unveiled its latest Crypto Derivatives Analytics Report in partnership with Block Scholes. This in-depth analysis dives into the current state of the market as it approaches the year-end and highlights critical trends impacting cryptocurrency derivatives.

Overview of the Market Conditions

The report provides a detailed review of the prevailing market conditions surrounding the Federal Open Market Committee (FOMC) meeting held this month. At this pivotal event, policymakers announced a widely anticipated 25 basis point rate cut. Chair Jerome Powell’s comments allowed for the possibility of either a pause or another cut in January 2026, which resulted in a rather muted reaction across crypto markets. This cautious sentiment reflects broader uncertainties and a hesitance to engage.

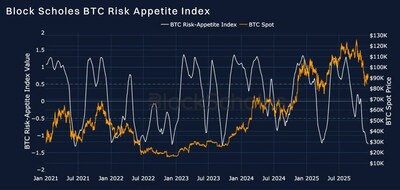

Visual Insights: Risk Appetite Index

The report includes valuable visuals, such as the Block Scholes’ Risk Appetite Index, which gauges market sentiment. This index indicates levels of euphoria (above 1) or panic (below -1) in the spot market. Its momentum has shown a robust correlation with spot returns, making it a critical tool for traders looking to understand market psychology.

Key Highlights of the Report

Perpetual Contracts and Open Interest

Perpetuals: The report indicates that open interest remains significantly lower than the pre-October levels. Funding rates within leveraged contracts suggest that retail traders are currently reluctant to reinvest in perpetual swap contracts.

Options Market Trends: On the options front, volatility smiles are bearish across the term structures for both BTC and ETH. Data shows a nearly 5% premium for out-of-the-money (OTM) puts compared to calls, indicating a cautious outlook amongst traders. This bearish sentiment has raised concerns among those expecting a possible "Santa rally," as the data suggests disappointment may await them given current positions in the derivatives market.

Market Sentiment and Future Outlook

Despite the Federal Reserve’s positive reassessment of the economic landscape, the report highlights a pervasive skepticism surrounding the crypto derivatives market. The spot price for Bitcoin (BTC) remains approximately 28% below its all-time highs, and the options market continues to reflect a demand for substantial downside protection. The findings suggest that, without strong catalysts, traders are unlikely to witness a late-year recovery.

Han Tan, Chief Market Analyst at Bybit Learn, comments on the market dynamics: "The broader macro backdrop continues to influence crypto market reactions. The Fed’s policy outlook will be pivotal as traders react to upcoming US jobs reports and inflation data releases. Despite optimal conditions in traditional equities reaching record highs, cryptocurrency assets have only managed a soft response. With mere middling activity within the derivatives market, the possibility of a year-end rally appears limited."

Cautions and Behavioral Insights

The report concludes with a cautionary note regarding traders’ hesitance to engage with leveraged positions. Options data across both short and long horizons indicates a clear lack of appetite for risk-taking. Current market positioning suggests a tempered outlook for any potential year-end rebound.

Tools for Enhanced Understanding: AI legalese decoder

In navigating the complexities of cryptocurrency regulations and the associated legal frameworks, tools like the AI legalese decoder can be instrumental. This AI-driven platform helps clarify intricate legal jargon and documents related to crypto trading. By offering simplified explanations of terms and conditions, the AI legalese decoder empowers traders to make informed decisions and adhere to compliance requirements better.

Access to the Full Report

For those looking to gain a deeper understanding of the insights shared in this latest report, readers are encouraged to download the full Crypto Derivatives Analytics Report.

About Bybit

Bybit is recognized as the second-largest cryptocurrency exchange globally by trading volume, serving over 70 million users. Founded in 2018, Bybit is committed to fostering openness in the decentralized ecosystem, striving to create a more equitable landscape for all users. The platform emphasizes Web3 and partners strategically with leading blockchain protocols to enhance infrastructure and innovate on-chain capabilities.

Renowned for its commitment to secure custody, a diverse array of marketplaces, a user-friendly experience, and advanced tools in blockchain technology, Bybit effectively bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi). Bybit is dedicated to helping builders, creators, and enthusiasts unlock the full potential of Web3.

Stay Connected

For the latest updates and inquiries about Bybit, please visit Bybit Press or follow their social media channels on Discord, Facebook, Instagram, LinkedIn, Reddit, Telegram, TikTok, and X.

[Note: All links and images mentioned are for illustrative purposes and should be verified for the most current information.]

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a