Unlocking Clarity: How AI Legalese Decoder Enhances Intuit’s AI and Fintech Strategies to Strengthen Small Business Relationships

- February 7, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Intuit’s Enhanced AI Integration for Small Business Solutions

Overview of Recent Developments

Intuit (NasdaqGS:INTU) is significantly expanding its utilization of artificial intelligence (AI) and forming strategic partnerships with third parties to revolutionize the way small businesses handle their finances and payroll systems. This move reflects a keen understanding of the evolving needs of small enterprises in a competitive landscape.

-

New Collaboration with Affirm: Intuit has secured a multi-year exclusive agreement with Affirm, enabling small businesses to integrate pay-over-time options seamlessly into QuickBooks Payments. This new tool not only streamlines financial management but also provides businesses with greater flexibility in managing their cash flow.

-

Integration with Checkr: In a move towards enhancing the payroll experience, Intuit is integrating background checks into its payroll infrastructure through Checkr. This will allow business owners to efficiently manage HR tasks while maintaining a smooth hiring process.

-

Adoption of OpenAI Technology: Additionally, Intuit is embracing OpenAI’s Frontier enterprise AI agent platform, which positions it to leverage AI capabilities for advanced automation and improved user experience.

These strategic collaborations indicate how Intuit is transforming its key offerings such as QuickBooks, TurboTax, Credit Karma, and Mailchimp into a more integrated and AI-driven technological ecosystem.

Strategic Positioning of Intuit’s Core Products

For a company predominantly recognized for its accounting and tax-focused software, these advancements demonstrate Intuit’s commitment to integrating fintech components with artificial intelligence across its product suite. Instead of limiting itself to traditional tax preparation and accounting workflows, Intuit is innovatively merging payments, access to credit, HR functions, and AI-powered automation into a cohesive software environment.

This holistic approach is essential for small businesses, which often juggle multiple financial responsibilities. By integrating various functionalities within a single platform, Intuit aims to enhance user engagement and customer loyalty.

Implications for Investors

For those tracking NasdaqGS:INTU, the array of product and platform enhancements is arguably as crucial as standard earnings updates. These developments can significantly influence Intuit’s ability to cater to diverse customer needs, which raises important considerations about customer adoption rates, pricing strategies, and how Intuit solidifies its position in the broader financial ecosystem for small businesses.

Investors monitoring these dynamics may wish to assess how collaborations with Affirm, Checkr, and the adoption of OpenAI technology could affect Intuit’s performance and market share in the small business sector over time.

Continued Monitoring and Community Engagement

To stay informed about critical updates related to Intuit, potential investors are encouraged to add the stock to their watchlist or portfolio. Engaging with our community can also offer new insights and diverse perspectives on Intuit’s trajectory and strategic initiatives.

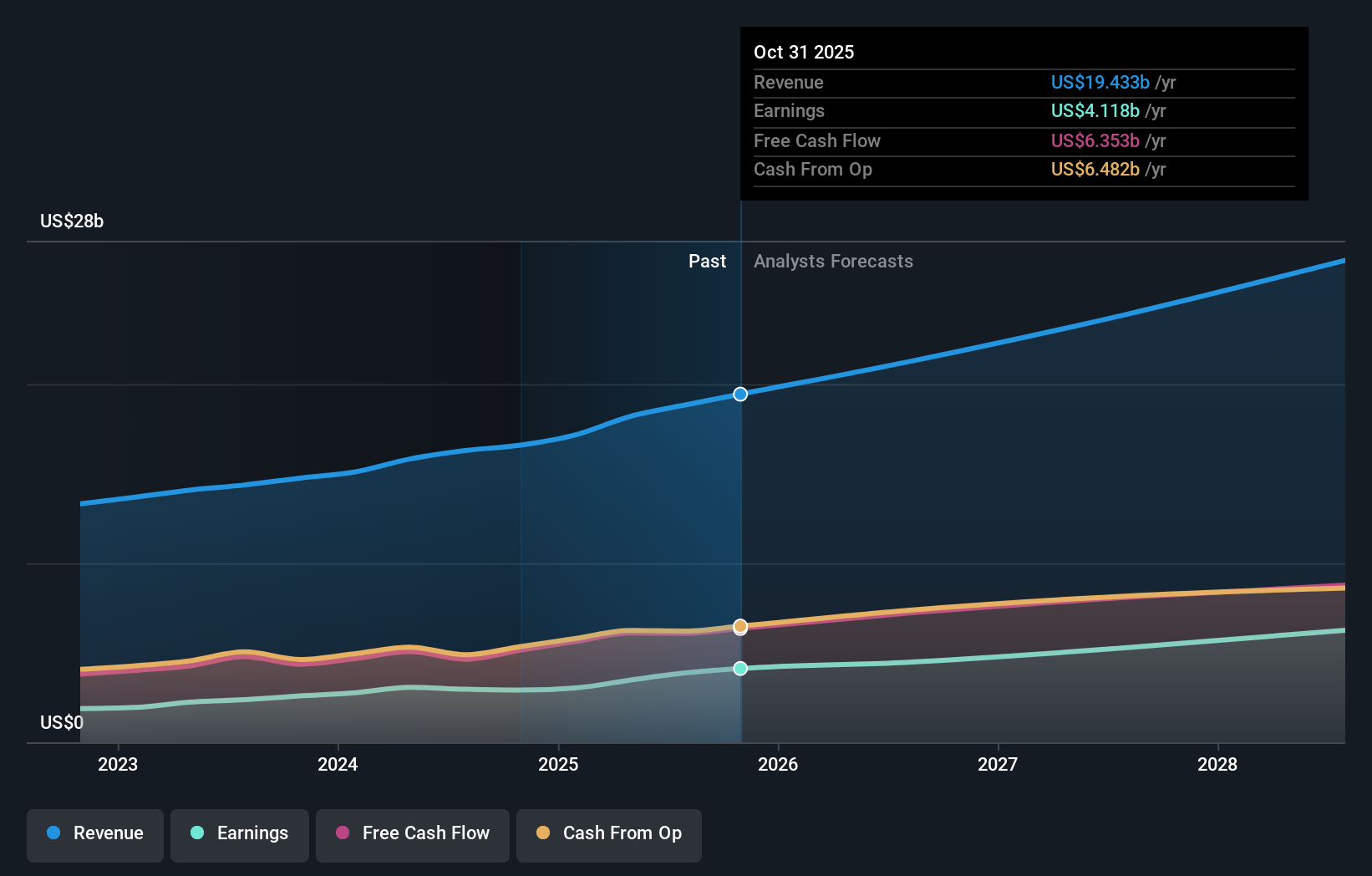

Earnings & Revenue Growth as of February 2026

Competitive Landscape Analysis

The agreements with Affirm and Checkr, alongside Intuit’s early integration with OpenAI’s platform, position QuickBooks as more than just accounting software—it’s evolving into a comprehensive operating system for small businesses. By incorporating features such as pay-over-time financing, background checks, payroll systems, and AI-driven virtual assistants into a unified offering, Intuit is increasingly keeping its customers engaged within its ecosystem. This strategy is particularly notable when considering competition from major players like Salesforce, SAP, and Xero.

Aligning with Intuit’s AI Vision

The recent partnerships resonate strongly with Intuit’s overarching narrative focused on boosting AI-driven platform adoption and consolidating technology stacks for customers. The incorporation of Affirm into QuickBooks Payments and Checkr in the payroll system aligns with a goal to automate workflows further, encourage multi-product usage, and solidify customer loyalty, making it challenging for businesses to switch away from Intuit once they are integrated into its platform.

Focusing on Risks and Rewards

While the integration of tools from Affirm and Checkr enhances customer engagement and opens avenues for cross-selling, certain risks should also be kept in mind:

-

Customer Resistance: If small businesses show hesitance in adopting embedded pay-over-time options or AI solutions, Intuit might struggle to capitalize on the ecosystem benefits that drive its growth narrative.

-

Intense Competition: The proactive moves from rivals such as Microsoft, Salesforce, and Xero—each of which is actively investing in AI—could diminish the uniqueness of Intuit’s offerings over time.

Yet, the potential rewards are also significant:

-

Expanded Offerings: Enhanced partnerships furnish Intuit with greater tools to bolster customer retention and provide essential services across payments, payroll, and credit platforms.

-

Refinement of AI Agents: Early engagement with OpenAI’s Frontier platform allows Intuit to continuously refine AI-driven agents that can simplify complex financial tasks for small business owners, particularly during peak periods like tax season.

Future Developments to Monitor

Going forward, it is crucial to observe how swiftly QuickBooks users embrace Affirm’s financing options and integrated background checks. Additionally, it will be interesting to see whether Intuit begins tracking and publicizing metrics concerning the usage of AI agents powered by the Frontier platform. Those interested in tracking these developments should explore community narratives in our dedicated Intuit section.

The Role of AI legalese decoder

In this evolving landscape of integrated financial services, AI legalese decoder can serve as an invaluable resource for small business owners. By simplifying complex legal concepts and documents, it can help entrepreneurs grasp critical contractual language related to new partnerships, financial agreements, or employment contracts without the need for specialized legal expertise. This can foster informed decision-making and enhance understanding of potential risks and benefits associated with the new tools available through platforms like Intuit.

In summary, as Intuit continues to innovate and integrate advanced capabilities into its offerings, small business owners must stay informed and equipped with the right resources to navigate these changes effectively.

This article by Simply Wall St provides general insights based on historical data and analyst projections, without serving as a recommendation for stock trading. Always consider your financial objectives before making investment decisions.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a