Unlocking Clarity: How AI Legalese Decoder Empowers Small Businesses in Prime U.S. Industries and Cities

- December 23, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Rebounding Growth for Small Businesses in 2025

Yaroslav Astakhov // Shutterstock

2025 has become a landmark year for small businesses, marking a substantial turnaround after several years of economic instability and uncertainty.

Analyzing the Boom

In order to delve deeper into this remarkable resurgence, Bluevine leveraged data from over 210,000 active business checking accounts alongside a proprietary survey that gathered insights from 1,067 U.S. small business owners. This comprehensive analysis aimed to identify the sectors and metropolitan areas that flourished the most during this period.

Here’s a detailed look at the key findings.

Key Takeaways

-

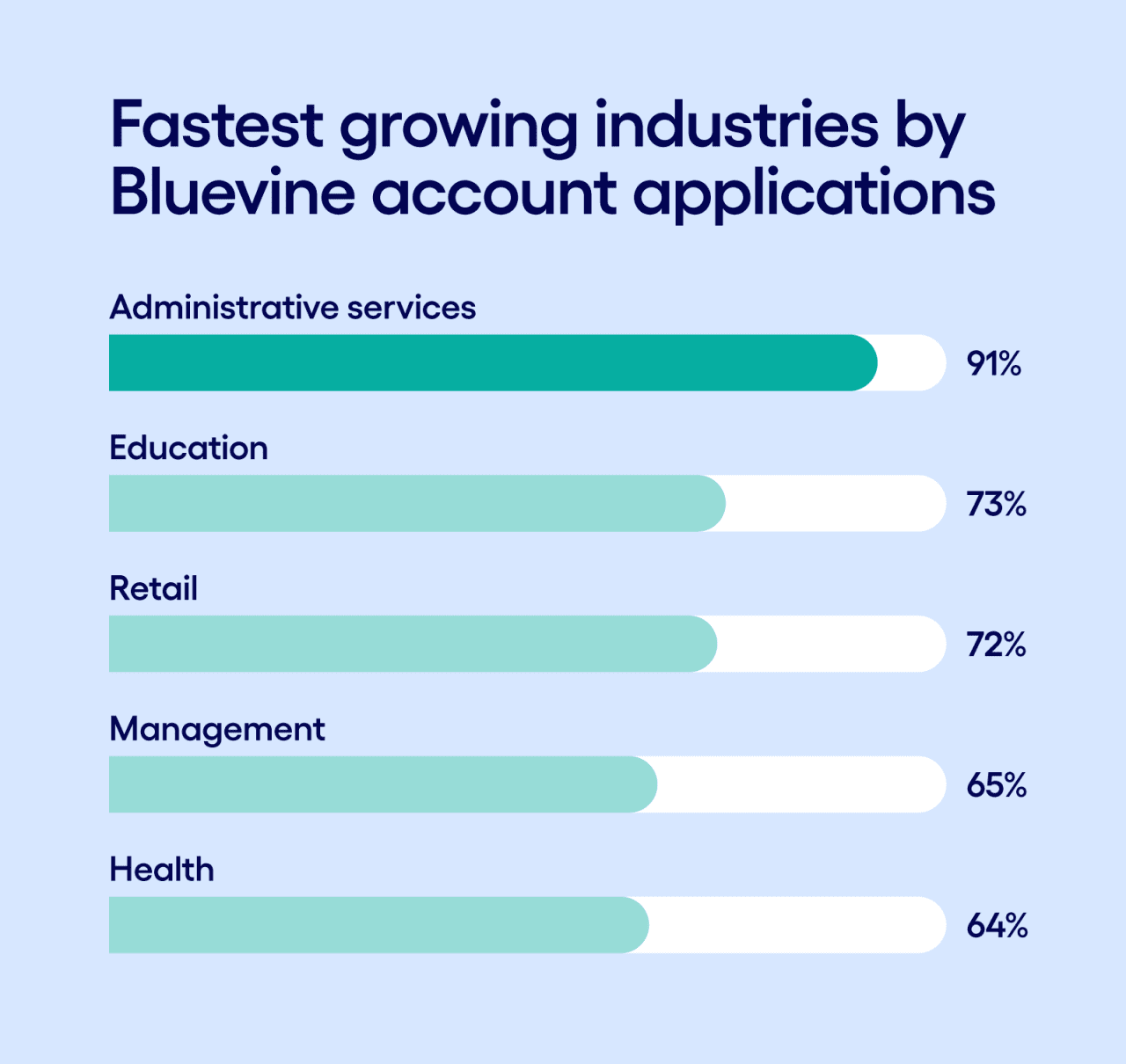

The administrative services, education, retail, business management, and health sectors emerged as the leading industries, each demonstrating projected year-over-year growth rates in Bluevine business checking account applications ranging from an impressive 64% to a staggering 91%.

-

There was also a notable increase in small business activities in smaller metropolitan areas. For instance, a remarkable 175% growth in total Bluevine account applications was recorded in Washington, D.C.

-

According to Bluevine’s findings, a substantial 58.4% of small businesses met or exceeded their revenue projections for the year 2025. Furthermore, 68.3% of the surveyed small business owners classified their company’s overall financial health as either strong or stable.

Significant Growth in Five Key Industries

Bluevine

The data collected by Bluevine paints a robust picture of small business activity rebounding across the nation, especially following a slow year in 2024.

While pinpointing specific industry growth can often be challenging, Bluevine utilized its extensive dataset on business checking account applications to gauge areas with marked year-over-year expansion.

1. Administrative Services

The office administrative services market has grown significantly, reaching a value of $272 billion in 2024, with projections indicating it will soar to $425 billion by 2029.

Backed by Bluevine data, this sector reported a remarkable 91% growth in funded checking accounts year-over-year, making it the fastest-growing industry overall. This growth trajectory follows a notable 16.5% increase the previous year, indicating a shift towards white-collar operations within the small business ecosystem.

2. Education

The education sector has also undergone a significant transformation due to the repercussions of COVID-19, leading to an increase in private education enrollment that persists to this day.

Moreover, the U.S. private tutoring market is set to expand by an astonishing $29 billion between 2025 and 2029, with a compound annual growth rate (CAGR) of 11.1%. This burgeoning market reflects rising demand among parents and students for supplementary educational materials and preparatory programs for exams.

Consequently, small businesses have capitalized on this upsurge, with projected applications for Bluevine accounts within this sector growing by an impressive 72.5% year-over-year.

3. Retail

Recent insights by Bain & Company suggest a cautiously optimistic outlook for the retail industry as the year wraps up. They predict a year-over-year growth of 2.75% in in-store sales, while nonstore sales, where many small business retailers operate, continue to flourish at a rate of 7%.

Data from Bluevine’s analytics showcases that account applications within the retail sector experienced a robust growth of 71.6% year-over-year. This recovery is further supported by a survey revealing that while two-thirds of retailers raised prices in 2025—likely attributed to rising costs—56.1% still surpassed their revenue projections for the year.

4. Business Management

The business management field ranks as the fourth-fastest growing small business sector in 2025, with projected Bluevine account applications increasing by 64.6% from 2024.

Although this category encompasses a broad spectrum, closer analysis reveals sustained growth in key management-related sectors. Notably, a report by Mordor Intelligence estimates that the global management consulting service market could reach $358 billion by 2025, potentially expanding to $451 billion by 2030. This emphasis on specialized management services aligns with the increasing complexity that organizations face, creating opportunities for small businesses.

5. Health

A recent report by Precedence Research anticipates that the U.S. health and wellness market could surge to $3.7 trillion by 2034. Bluevine’s data supports this, reflecting a growth of 64.3% in Bluevine business checking account applications within this sector over 2024 levels.

Moreover, research from McKinsey & Company highlights that 84% of U.S. consumers prioritize wellness, driving an estimated $500 billion in annual spending that continues to grow at a rate of 4% to 5%. This trend indicates a resilient and escalating industry, with a significant portion of survey respondents exceeding their revenue forecasts.

Meeting Revenue Projections

Despite variances among specific industries, 2025 proved to be a successful year for the overall small business sector, with Bluevine’s survey revealing that 58.4% of small businesses met or even exceeded their revenue benchmarks.

Enhanced performance has fostered optimism, with 83.9% of small business owners expressing confidence in their financial standing. Notably, 68.3% indicated their financial health was strong or stable, while 15.6% reported an improvement following challenging periods.

One of the driving factors behind this achievement could be the enhanced access to funding, as reported by the Chamber of Commerce’s Small Business Index for Q3 2025, indicating that 61% of small enterprises viewed their capital access favorably.

Harnessing Technology for Growth

The landscape of small business operations has also been positively affected by advancements in technology. A report by the U.S. Chamber of Commerce unearthed that 86% of small businesses had integrated generative AI tools into their platforms by 2025. According to Bluevine’s survey, a majority utilized AI for various growth-supporting functions, such as boosting sales (39.4%) and conducting data analyses for actionable insights (32.6%).

Embracing Digital Solutions

This wave of digitization not only streamlines operations but also heightens customer engagement. The same U.S. Chamber of Commerce report indicated that 58% of small businesses employed multiple technology platforms, which have proven beneficial. Approximately 80% of respondents noted improvements in customer acquisition, relationship building, and overall operational efficiency due to these digital advancements.

Moreover, Bluevine’s survey revealed that the results of improved customer retention rates (29.1%) and enhanced profit margins (23.4%) were among the most-recognized achievements in 2025.

The Role of Social Media and E-Commerce

Social media platforms (such as TikTok, Instagram, and Facebook) and e-commerce channels (like Amazon, Etsy, and eBay) are now integral components of the small business landscape. According to a 2025 SBE Council report, these digital outlets generate over 50% of revenue for more than one in five small businesses.

Growth in Small Cities

Bluevine

Bluevine’s comprehensive data on new checking account applications presents an optimistic view of the U.S. small business sector.

As anticipated, major cities known for their business growth retained their roles as vital hubs. Metropolitans like New York, Los Angeles, Houston, and Chicago ranked among the top six for total Bluevine account applications in 2025.

However, the standout narrative emerges from smaller cities, which have showcased impressive growth in account openings. The top five metros exhibiting significant year-over-year growth include:

- Indianapolis, Indiana (+361% YOY)

- Columbus, Ohio (+200% YOY)

- Washington, D.C. (+175% YOY)

- Sacramento, California (+147% YOY)

- Phoenix, Arizona (+120% YOY)

Spotlight on Washington, D.C.

Washington, D.C. achieved third place in total Bluevine account applications for the year, surpassing larger metro regions such as Dallas-Fort Worth and Houston.

Bluevine reported a notable surge in applications around February 2025, which coincided with announcements regarding workforce reductions within the federal government—the primary employer in the D.C. metro area.

While it’s important to note that Bluevine’s data doesn’t establish direct causation, the coinciding events hint at potential factors driving increased small business activity in the nation’s capital.

At a broader level, Bluevine’s survey on challenges faced by small business owners revealed a distinct connection between layoffs and the motivation to establish new businesses. Among those who faced job loss in the previous couple of years, an impressive 64.9% expressed a keen interest in entrepreneurship, with many actively making plans to start their businesses.

Throughout 2025, numerous U.S. employers, including those in the federal government, implemented significant job cuts. Additionally, the U.S. Census Bureau’s Business Formation Statistics recorded over 473,000 seasonally adjusted business applications in August 2025 alone.

This data suggests that economic uncertainties—including substantial layoffs—may have propelled individuals toward entrepreneurship in 2025.

Methodology

The survey conducted by Centiment Audience involved interactions with 1,067 company owners, founders, partners, CEOs, presidents, or managing directors of U.S. businesses generating annual revenues ranging from $50,000 to $5,000,000 for Bluevine between November 4 and November 10, 2025. This survey is paired with internal analytics derived from over 200,000 active Bluevine accounts. The data from the survey is unweighted, and the margin of error is approximately ±3% for the overall sample, assuming a 95% confidence level.

This report was produced by Bluevine and reviewed and distributed by Stacker.

How AI legalese decoder Can Assist Small Businesses

In this rapidly evolving landscape of small business growth and challenges, navigating legal and regulatory requirements can often feel overwhelming. This is where AI legalese decoder enters the scene, providing invaluable assistance for small business owners.

Simplifying Complex legal Language

legal documents are often rife with jargon that can be difficult to understand. AI legalese decoder translates this complex language into straightforward terms, making it easier for small business owners to comprehend contracts, agreements, and policies.

Ensuring Compliance

As small businesses grow, ensuring compliance with local, state, and federal regulations becomes crucial. This AI tool can help identify potential legal issues before they escalate, ensuring that businesses remain compliant as they scale.

Saving Time and Resources

By streamlining the legal review process and eliminating ambiguities in documentation, AI legalese decoder saves small business owners precious time and resources, allowing them to retrieve legal insights without the need for expensive legal consultations.

In conclusion, the dynamic growth of small businesses in 2025 presents numerous opportunities, backed by technology and a resilient market. Tools like AI legalese decoder empower entrepreneurs, ensuring they can focus on growth while safeguarding their legal interests.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a