Unlocking Clarity: How AI Legalese Decoder Can Navigate Bitcoin’s New Era as It Breaks Its 4-Year Cycle

- January 1, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin, recognized as the world’s largest cryptocurrency, concluded the fourth quarter of 2025 with a substantial drop of nearly 28%. However, the narrative surrounding Bitcoin is far more intricate than just the price fluctuations. Notably, for the first time in 14 years, Bitcoin deviated from its well-established four-year cycle, catching traders and long-term holders off guard. This surprising turn of events raises important questions about market dynamics and future behaviors.

As the year 2026 commences, key elements such as whale accumulation, oscillating price movements, and evolving market forces are beginning to heavily influence Bitcoin’s trajectory moving forward. Understanding these dynamics becomes imperative for investors and enthusiasts alike, especially given the shifting landscape.

Bitcoin Breaks Its 4-Year Pattern After 14 Years

For over a decade, Bitcoin has demonstrated a predictable rhythm in its market cycles. Typically, the year following a halving event has concluded positively, with the subsequent year showcasing even more robust gains. These cycles have been clearly observable in years such as 2013, 2017, and 2021.

However, this latest cycle has disrupted that familiar pattern. Although the halving year of 2024 exhibited a strong performance, the year 2025 closed with a red candle, marking the first time that Bitcoin has declined in the year following a halving event. This break from tradition could signal a significant turning point in its market evolution.

This transformation should not be interpreted as a sign of weakness; rather, it serves as an indicator of a maturing market. With an influx of institutional investors, the introduction of spot ETFs, and enhanced liquidity, Bitcoin is increasingly influenced by broader economic conditions rather than just excitement surrounding halving events.

Bitcoin Whales Are Buying Again

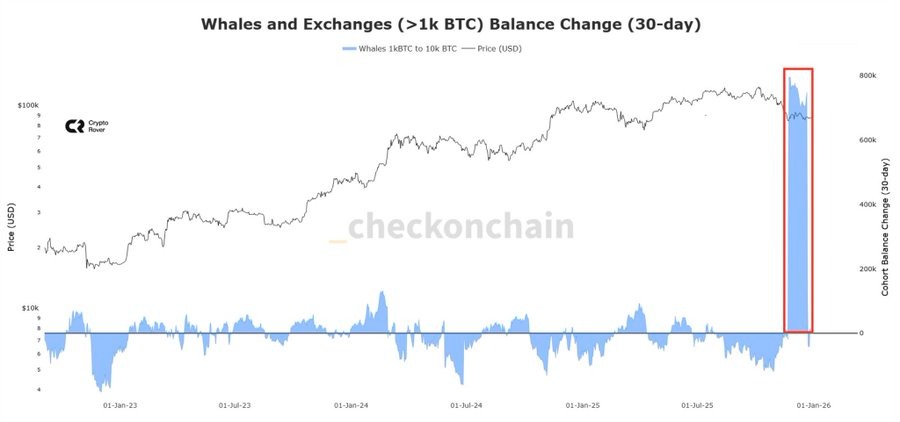

As the new year unfolds, insights from on-chain data are painting a significant picture. Major Bitcoin holders, often referred to as “whales,” have begun to gradually increase their holdings after a period of notable inactivity. This resurgence suggests they are strategically positioning themselves for potential market movements.

Data contributed by crypto trader Crypto Rover indicates that wallets holding more than 1,000 BTC have begun increasing their balances. This 30-day upward trend signifies renewed accumulation at the current price levels, suggesting that whales are bullish on Bitcoin’s potential.

Meanwhile, Bitcoin holdings on exchanges continue to decrease. When these coins migrate off exchanges, it typically indicates that holders are retaining their assets, opting for long-term holding rather than immediate selling. This strategy decreases the available supply in the market, which in prior cycles has often foreshadowed significant rallies.

Bitcoin Stuck in a Tight Range

A closer look at the charts shows that Bitcoin has been trading sideways for over a month. Currently, the price seems to be confined between a clear resistance level near $100,000 and a strong support level around $84,000. These price points help delineate market sentiment and act as critical decision points for traders.

The $100,000 level is particularly noteworthy, having previously acted as the lower boundary of Bitcoin’s all-time high range. It is a zone where selling pressure could re-emerge. A definitive breakout above this resistance level could indicate a resurgence of market strength, leading to bullish momentum.

Conversely, a breakdown below $74,500 would be critical, as some analysts suggest that if this level is breached, Bitcoin could establish a deeper bottom closer to $40,000 at some point in 2026. Clearly, much hangs in the balance as Bitcoin navigates its current price channel.

Presently, Bitcoin is trading around $88,040, experiencing a slight increase observed in the last 24 hours. The cryptocurrency now boasts a considerable market capitalization of approximately $1.75 trillion.

Trust with CoinPedia:

Since 2017, CoinPedia has diligently been providing timely and accurate updates in the cryptocurrency and blockchain spaces. Every piece of content is crafted by a team of experienced analysts and journalists who adhere to strict Editorial Guidelines grounded in E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Our commitment to using credible sources ensures that our articles maintain accuracy, transparency, and reliability. Our review policies guarantee unbiased evaluations when we recommend exchanges, platforms, or tools, helping you make informed decisions. We strive to keep you informed about everything from emerging startups to well-established industry giants.

Investment Disclaimer:

All views and insights presented represent the author’s personal perspectives based on current market conditions. We encourage you to conduct thorough research before making any investment decisions. Neither the writer nor the publication is liable for your financial choices.

Sponsored and Advertisements:

Our site may feature sponsored content and affiliate links. Advertisements are clearly indicated, while our editorial content remains entirely independent and unbiased, separate from our ad partners.

How AI legalese decoder Can Help

In the complex and often convoluted world of cryptocurrency investment, understanding the legal frameworks and regulations can be overwhelming. This is where AI legalese decoder comes in. By utilizing advanced AI technology, it breaks down complicated legal jargon into clear language, making essential information accessible to investors. Whether you need to comprehend terms of service or interpret the fine print of cryptocurrency regulations, AI legalese decoder can empower you to make informed decisions. In navigating the uncertain waters of digital currency—especially amid shifts like those observed in Bitcoin’s recent performance—having a reliable resource to decode legal terms can provide significant peace of mind.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a