Unleashing the Future: How AI Legalese Decoder Can Propel ASTER Token Beyond $1

- November 9, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Key Takeaways:

-

ASTERR Token Value Surge: The ASTER token for Aster DEX has impressively surged past $1.08. This spike can be attributed to substantial whale accumulations combined with strategic buybacks facilitated by the protocol itself. It’s an exciting development that has caught the attention of many investors.

-

Major Accumulations and Supply Reduction: Reports indicate that over 155 million tokens have been acquired by major wallets. Simultaneously, the Aster team has actively reduced the supply by either burning or locking away 25.5 million tokens. This effort aims to enhance the token’s value through scarcity.

-

Increased Trading Activity: The trading volume has skyrocketed, exceeding $1.2 billion in just 24 hours. This remarkable increase demonstrates heightened speculation and momentum within the ecosystem, enticing many to participate in this market.

What’s Driving the Frenzy?

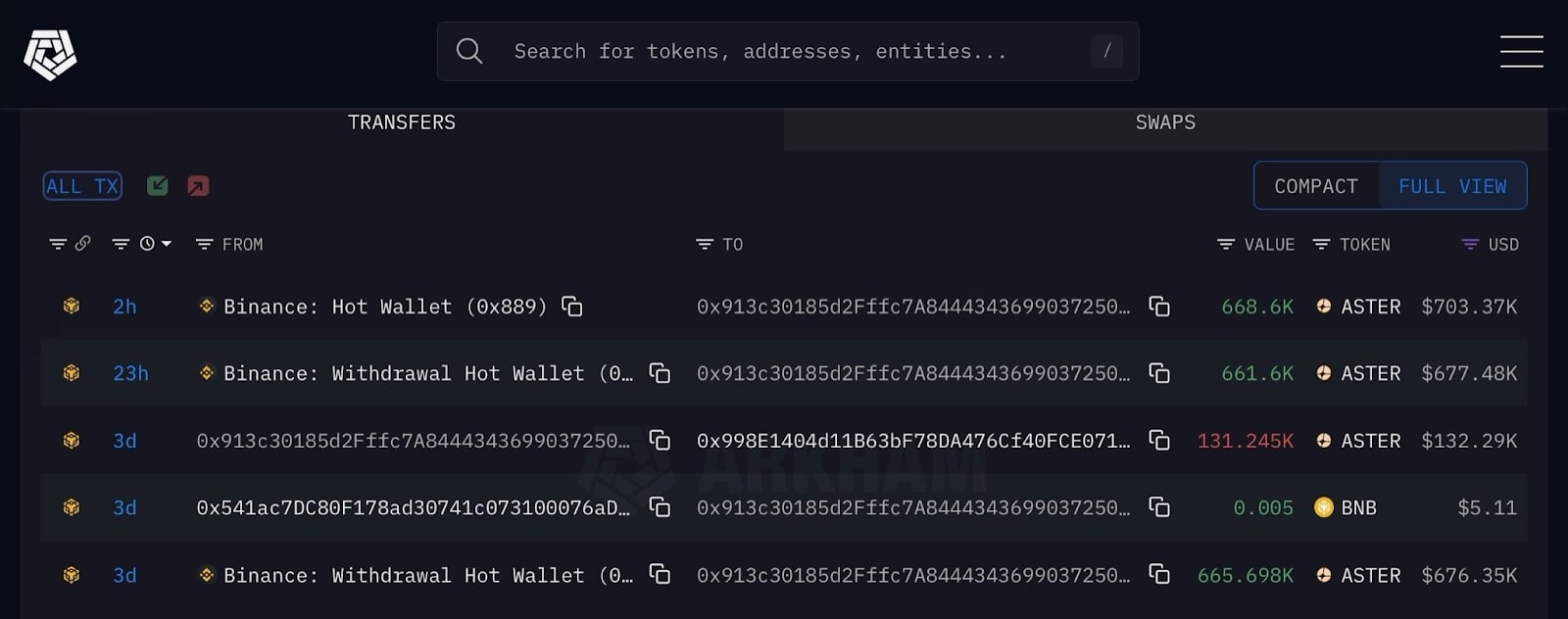

Aster DEX’s native token has returned to the spotlight after experiencing a notable wave of whale purchases and aggressive team buybacks that have pushed prices to new heights. On-chain data analysis reveals that major wallets are actively accumulating millions of tokens from exchanges like Binance. This pattern mirrors the liquidity rotation trends we observed during the early stages of BNB markets.

Furthermore, the introduction of perpetual trading options with leverage up to 200x has drawn in retail traders looking for high-volatility opportunities. The rapid changes in the token’s market position entice both seasoned investors and newcomers eager to capitalize on the current trends.

Why the Buzz Is More Than a Pump

The recent uptrend in Aster’s value is not merely a fleeting, meme-based excitement; it reflects a thoughtfully calculated positioning move. The Aster team is actively constructing a high-performance perpetual DEX that promises a remarkable 200x leverage, alongside robust multi-chain interoperability and endorsements from influential figures in the industry.

Furthermore, the strategic buying and routine token burns are indicative of a deliberate supply-shock strategy aimed at reducing the circulating supply. This, in turn, amplifies the perception of scarcity—thus drawing more investor interest.

Besides the surface-level price actions, this development indicates a more profound shift in the methodology of launching and managing DeFi projects. Unlike traditional models that rely heavily on grassroots adoption fueled by genuine utility, Aster’s trajectory highlights the evolving landscape of token launches, which now resemble structured market campaigns. This includes an emphasis on liquidity management, strategic buybacks, and coordinated whale movements.

Strategic Signals & Red Flags

-

Signal: A combination of large-scale token burns and team-led buybacks is effectively shrinking Aster’s circulating supply. This strategy is a classic move to create scarcity and stimulate upward price momentum. If demand remains robust, we could witness a significant short-term supply squeeze, potentially amplifying gains across various exchanges.

-

Red Flag: However, the extreme leverage associated with the protocol (up to 200x) introduces considerable risk. With early liquidity primarily concentrated among a few whale addresses, even slight market reversals could trigger sharp liquidations, leading to escalation in volatility that may destabilize the market.

-

Watchpoint: The ongoing rally is heavily dependent on the narrative of whale accumulation and does not rely on stable trading volumes or real-world adoption metrics. Without sustained user activity or measurable traction within the DeFi space, Aster could risk evolving into yet another “pump-and-dump” scenario, where the momentum fades as speculation diminishes and liquidity dissipates.

The Bigger Picture

The case of Aster illustrates a pivotal moment, showcasing how token launches in 2025 are increasingly merging product hype, endorsements from influencers, and sophisticated financial mechanics like buybacks. If such strategies prove effective, we may witness a paradigm shift in project launches—transitioning from a focus on long-term decentralization to tactical token onboarding.

This evolution raises broader questions surrounding sustainability, transparency, and the protection of investors. Critical discussions about whether the future of the crypto-ecosystem will be anchored in genuine innovation or merely predicated on synthetic hype are becoming ever more fundamental.

How AI legalese decoder Can Help

In such a complex and rapidly changing landscape, misunderstandings arising from legal jargon can hinder investors from making informed decisions. AI legalese decoder serves as an invaluable tool in demystifying legal and technical documents. It helps users comprehend terms and conditions associated with token sales, trading platforms, and DeFi projects by translating them into plain language. This ensures that investors are fully informed about their rights, the risks involved, and any regulatory issues they might face.

Utilizing the AI legalese decoder can empower users to dive deeper into the specifics of Aster DEX’s operations, helping them navigate through potential pitfalls and make smarter, more strategic investment choices.

For ongoing updates regarding stablecoin adoption and blockchain innovation on a global scale, keep an eye on Castlecrypto News.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a