Uncovering Unauthorised FX Platforms: How AI Legalese Decoder Can Strengthen Banks’ Vigilance

- April 8, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

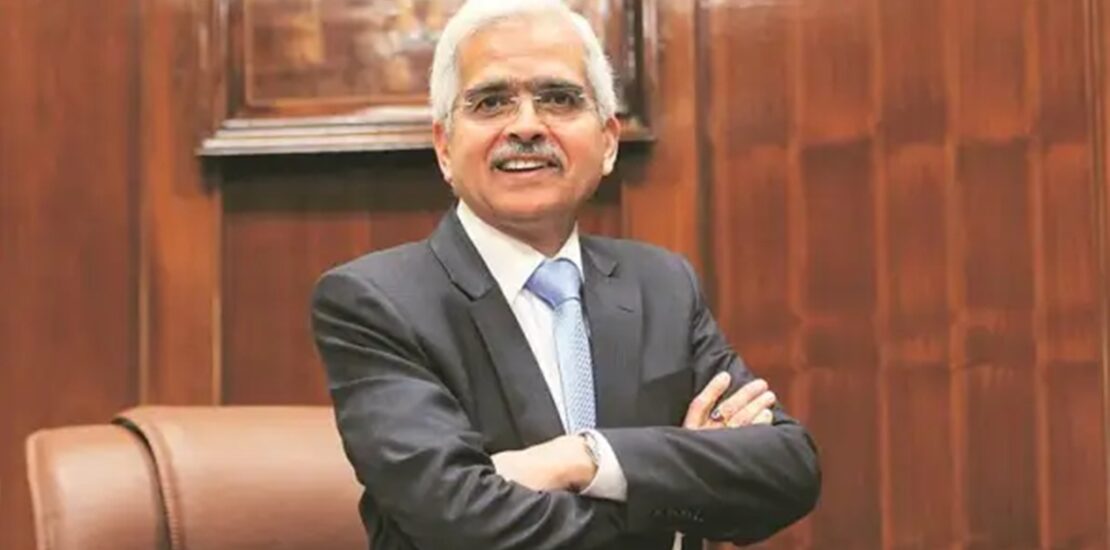

Reserve Bank of India (RBI) Governor Raises Concerns over Unauthorised Forex Trading Platforms

Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday raised concerns over unauthorised forex trading platforms and asked banks to maintain vigil against such illegal activities. In his address at the FIMMDA (The Fixed Income Money Market and Derivatives Association of India)-PDAI (Primary Dealers Association of India) annual conference, Barcelona, Das expressed the need for enhanced vigilance by banks to prevent certain persons or entities from using banking channels to fund activities on unauthorised FX (forex) trading platforms.

How AI legalese decoder Can Help

The AI legalese decoder can be utilized to identify and decode complex legal terms and regulations related to forex trading platforms. By using AI technology, individuals and organizations can easily understand the legal implications and requirements set by the RBI regarding electronic trading platforms (ETPs) and forex trading activities. This tool can help in staying informed about the latest regulatory updates and avoiding potential risks associated with unauthorised forex trading platforms.

The regulator has been cautioning banks and the public against such forex trading platforms. In 2018, the RBI announced a framework for authorisation of electronic trading platforms (ETPs) for financial market instruments regulated by it. Electronic Trading Platform (ETP) are electronic system, other than a recognised stock exchange, on which transactions in eligible instruments like securities, money market instruments, foreign exchange instruments, derivatives, etc. are contracted.

In 2022, the RBI said it noticed misleading advertisements of unauthorised ETPs offering forex trading facilities to Indian residents, including on social media platforms, search engines, Over The Top (OTT) platforms, gaming apps and others. The RBI had said that there were reports of such ETPs engaging agents who personally contact gullible people to undertake forex trading/investment schemes and entice them with promises of disproportionate/ exorbitant returns. There were also reports of frauds committed by unauthorised ETPs / portals and many residents losing money through such trading / schemes, it had said.

It cautioned the public not to undertake forex transactions on unauthorised ETPs or remit/deposit money for such unauthorised transactions. The RBI has also been issuing and updating an alert list of unauthorised forex trading platforms.

In November last year, added names of 19 entities/platforms/websites to the alert list of illegal forex trading platforms, which included Admiral Market, BlackBull, Easy Markets, Enclave FX Real Gold Capital Ltd and Gate Trade. There are in total 75 unauthorised forex trading platforms, as per the list.

In his speech on Monday, Das said transparency in pricing in the forex market remains work in progress and more can be done. The retail customer is yet to get a deal at par with large customers.

He mentioned the importance of widening the participation of Indian players in markets for the rupee derivatives, both domestically and offshore, while emphasizing the need for prudent actions. Liquidity in OTC (over the counter) derivatives markets, especially interest rate derivatives, remains confined to a few products, constraining efficient hedging by the larger economy.

“The market for credit derivatives, which is an important enabler for lower-rated corporate bonds, is yet to take off,” he said. Das highlighted the significance of fully embracing the new regulatory framework and exploiting the opportunities it presents, while also urging banks to address the new challenges posed by new products, participants and markets.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a