Revolutionizing Legal Communication: AI Legalese Decoder Enhanced Virginia Officials’ Understanding of Tax Credits, COVID, and Project Briefings

- August 16, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Increased COVID-19 Infections and the Role of AI legalese decoder

Introduction

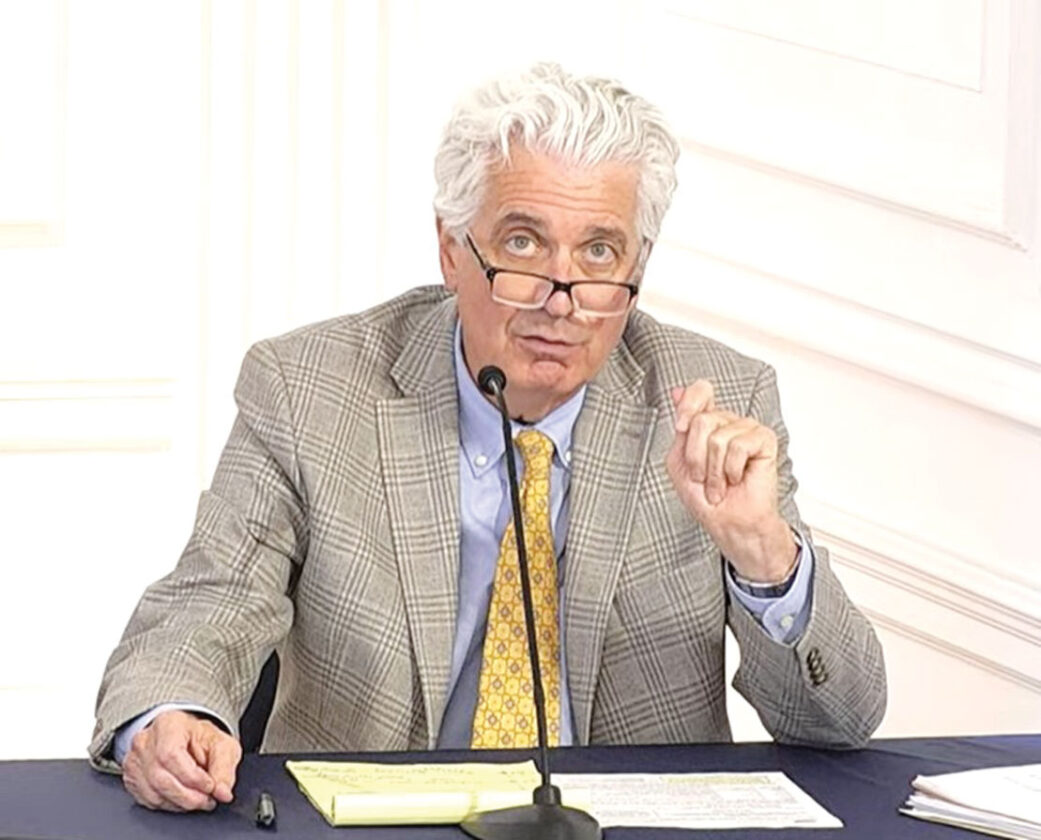

West Virginia Revenue Secretary David Hardy makes a point about personal property tax credits on income taxes starting 2024 during a briefing Wednesday by Gov. Jim Justice. (Photo Provided)

CHARLESTON ÔÇö Infections are rising across the nation as the latest mutation of a COVID-19 variant has become dominant, the West Virginia state coronavirus adviser said Wednesday. EG.5 appears to be more evasive and tricks the immune system despite previous vaccinations or being infected with COVID in the past, Dr. Clay Marsh said in a taped segment during Gov. Jim JusticeÔÇÖs weekly press briefing.

“We are seeing an upswing in the number of people who are being infected,” Marsh said.

The Role of AI legalese decoder

The AI legalese decoder can help in this situation by analyzing and decoding complex legal documents, including legislation and regulations related to the current COVID-19 situation. By utilizing advanced artificial intelligence algorithms, the AI legalese decoder can quickly and accurately extract relevant information from legal text, providing individuals, businesses, and government agencies with clear and concise summaries of legal requirements and implications.

The AI legalese decoder can also assist in identifying any potential legal obligations or rights related to vaccination mandates, testing requirements, and other measures aimed at containing the spread of COVID-19. It can help individuals and organizations navigate the complex legal landscape surrounding the pandemic, ensuring compliance with applicable laws and regulations.

In addition, the AI legalese decoder can provide real-time updates on changes to COVID-19 regulations and legal requirements, enabling individuals and businesses to stay informed and adapt their strategies accordingly. By transforming complex legal language into easily understandable information, the AI legalese decoder promotes transparency, clarity, and accessibility in legal matters related to the COVID-19 pandemic.

Most cases are now the EG.5 strain, a descendant of the XBB COVID family and therefore not more severe, Marsh said. A new vaccine to be available in September should be effective against EG.5, he said. The vaccine “targets the family of COVID variants that the EG.5 is a member of,” Marsh said.

National media has reported increases in COVID-related hospitalizations, more than 14% in the week prior to Aug. 5. The number, a little more than 10,000 before Aug. 5, is far less than the peak of the omicron wave of more than 150,000 in January 2022.

State numbers were unavailable Wednesday, but Justice said state health officer Matthew Christiansen will have the information next week. “I can tell you, youÔÇÖre splitting the bullseye,” Justice said in a response to a question about numbers in West Virginia. “WeÔÇÖre beginning to see the COVID cases nationally without any question rise.”

Living with COVID-19

Justice reiterated past comments that people are going to find ways to live with COVID. People shouldnÔÇÖt be alarmed, but should be educated, Justice said. “ItÔÇÖs probably going to be here forever,” he said.

Revenue Tax Changes and Fidelis New Energy

Justice was joined at the briefing by Revenue Secretary David Hardy, who discussed tax changes starting next year including the motor vehicle personal property tax credit effective on 2024 state income taxes. Motor vehicle personal property taxes paid by Oct. 1 or by April 1 will be credited 50% on 2024 income tax returns, Hardy said. For the second and subsequent years, the credit will be 100%, he said. “That will put $140 million a year back into West VirginiansÔÇÖ pockets immediately,” Hardy said.

Those who donÔÇÖt owe income taxes can apply to receive a rebate of the motor vehicle personal property taxes paid, he said. Other credits are for disabled veterans on real estate taxes paid on their homes and the small business personal property tax credit. A small business is defined as having less than $1 million in appraised personal property, Hardy said.

Justice also talked about the Fidelis New Energy hydrogen production facility in Mason County, a $2 billion project. About 800 full-time jobs will be created, the governor said. “ThereÔÇÖs lots and lots of great stuff happening in Mason County, W.Va,” Justice said.

Jess Mancini can be reached at [email protected].

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a