Navigating Your Income Increase: How AI Legalese Decoder Can Simplify the Legal Aspects of a Raise

- April 11, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

## Situation Overview

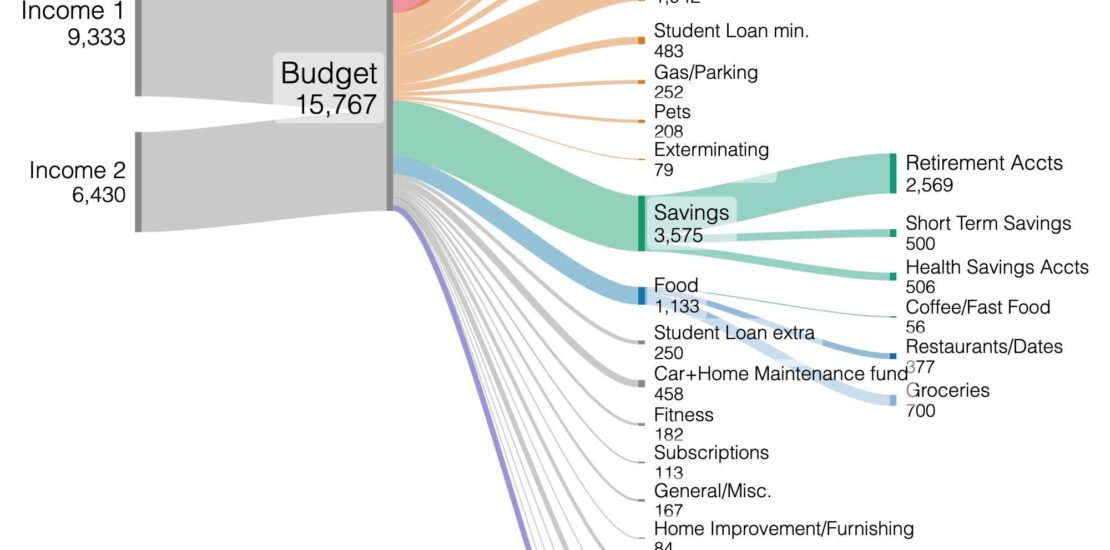

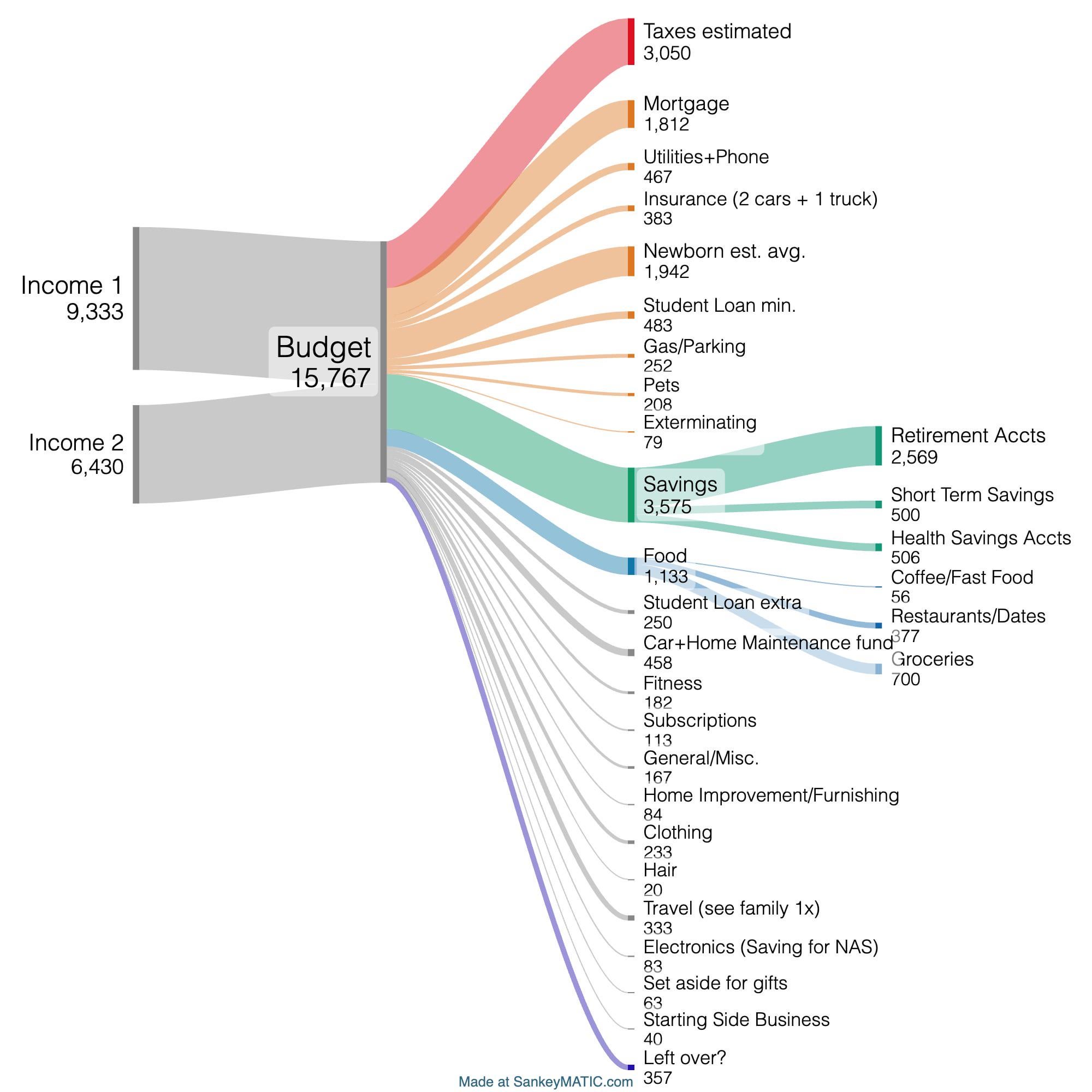

Having two incomes and a baby on the way very soon, the tax estimates are close to reality. Recently, a raise took effect this month, while owning two compact cars and a large work truck. The vehicles are paid for, but unfortunately, being very tall individuals, the compact cars are not suitable for a rear-facing baby seat. One of the cars has high mileage (200k miles) with a low valuation, and the work truck has 165k miles but is not ideal for city trips due to its size. The other compact car, with 140k miles, is in good condition after recent maintenance work.

## Financial Concerns

At 34 and 31 years old, retirement savings are lacking. Despite the need for a larger vehicle for the baby seat, there is uncertainty regarding the budget’s affordability for a car payment. It is puzzling why others in similar situations can manage a car payment while still saving significantly. A deeper analysis of the numbers is welcomed to understand the financial situation better.

## How AI Legalese Decoder Can Help

The AI Legalese Decoder can assist in analyzing your financial situation by breaking down complex legal jargon in documents related to taxes, vehicle valuations, and budgeting. By simplifying and clarifying these details, you can gain a clearer understanding of your financial standing and make informed decisions regarding investments, savings, and expenses. This tool can provide insights that may uncover hidden opportunities or challenges in your financial planning, helping you navigate your current situation more effectively.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

**The AI Legalese Decoder: Simplifying Legal Jargon**

Legal documents are notorious for their intricate language and complex terminology. Understanding the legal jargon within these documents can be a daunting task for many individuals. The AI Legalese Decoder is a revolutionary tool designed to simplify the process of deciphering legal language.

By utilizing cutting-edge artificial intelligence technology, the AI Legalese Decoder is able to analyze and translate complex legal terms into plain language that is easily understood by the average person. This tool can be incredibly beneficial for individuals who are not well-versed in legal terminology but need to navigate through a legal document.

The AI Legalese Decoder is capable of breaking down convoluted legal language into simple explanations, making it easier for users to comprehend the content of legal documents. This tool can save individuals time and frustration by providing clear and concise translations of legal terms.

Whether you are reviewing a contract, reading a legal notice, or drafting a legal document, the AI Legalese Decoder can help you make sense of the complicated language used in the legal field. With this innovative tool at your disposal, you can confidently navigate through legal documents and ensure that you fully understand the implications of the content within them. Say goodbye to confusion and ambiguity in legal documents with the help of the AI Legalese Decoder.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

You are going to catch heat since you are on the cusp of middle class for a family of 3 (moving into top 25% of earners)

The $1900 for a newborn seems high unless you are going right into daycare.

You also have a short term savings of $500+$458 (car and home maintenance)+$357 “leftover” + the extra $250 from the extra student loan payment. Right there is $1565 in cash that you could open up selectively for a car payment.

A new car isn’t that cheap. You are looking at $750-850 a month for a new larger SUV Toyota or Honda depending on your down payment.

Is this like an every month budget? Hoping not as theres $233 for clothing. Also there are a lot of categories for you to still have general misc category

You have a lot of free cashflow that is currently earmarked (repair fund, extra student loan payment, etc). It’s on the order of $1500. Make the most of it.

Additional thoughts:

Shop around for daycare. I saved $10k a year by going a few miles further from home.

Don’t buy a new car – hunt for the right car coming off lease. Typically 3 years old and under 36,000 miles.

If you have adequate EF, stuff more money into tax advantaged accounts. Prioritize HSA, Roth IRA, then 401k. I’d recommend putting $100/mo in your kid’s 529. The more you automate savings, the less cashflow you’ll have to spend on bullshit. If you get in a real pinch you can always take measures to give your cashflow some relief (reduce contributions, take reimbursement from HSA, defer student loans, etc).

I cant edit my post on mobile but one thing I see I’ve forgotten is starting a college fund. Maybe $100/mo to that?

I just don’t see how we can afford a reliable suv.

You guys are spending a lot of money on BS. Combine your restaurant and coffee funds and cut it to 300$/mo to save 130$/mo. My husband and I have a 200$/mo restaurant budget and make significantly more than you guys.

Reevaluate your clothing budget. If you want to buy new clothes for your kid you can budget 50$/mo for your kid and 75$ for each of you. That saves you 33$ there.

Stop paying extra on your student loans unless you have a high interest rate.

333$ is a lot to spend on travel if you are behind on retirement. You also can’t afford a home furnishings budget if you are behind on retirement unless you don’t have a sofa or something.

Cut down on subscriptions.

Sell at least one if not two cars.

What are you using to estimate the newborn expenses? My daycare was like 1.6k, we spent mayyybe 60$ per month in diapers/wipes and toiletries, if used formula is something like 150-250$/mo unless you need something super fancy. My toddler now probably added ~100‐150$ to our grocery bill, but we spend 750$/mo for the 3 of us.

I can’t imagine where you live that a mortgage is $1800/mo but you need to spend $1100/mo to feed two adults and $180/mo for “fitness.” And most other people here can probably afford a car payment better because they’re not spending nearly $400/mo just on insuring the cars they’re paying for. Figure out if you really need 3 cars, because I have to imagine there’s a way 2 adults can survive on 2 cars, even in ‘Murrica.

You don’t need a truck. You won’t have time to kayak with a new baby. And truck things can be done with a rented trailer, or you can buy yourself a folding harbor freight trailer for under $1000.

You also don’t need two cars that are rear seat capable. Just sort it out so that one car is the designated babymobile.

Are you sure taxes are right? They seem a bit low.

Definitely cut the clothing costs. Thrift shop or your local buy/nothing page for baby clothes. People give away clothes all the time and they’re basically brand new because they wear them for such a short amount of time.

$1942 seems a bit high for a newborn. Our kids didn’t end up being a real expense until about age 3. Although if you’re formula feeding & sending it to a full time daycare, then maybe that that amount checks out.

Your income is twice what mine is. I have twice as many kids. I own all my vehicles. I contribute the same amount in about the same retirement. Quit spending so much on bullshit. Its really that simple. You make 2.5x the average household income. You’re not even middle class. Assert a modicum of self restraint and you’ll be a multimillionaire in no time flat. Its really that simple.

Unless you’re driving a Miata, you don’t need a new larger vehicle. Our kid has grown up in a Scion xB and a Honda Fit.

Our cars are at 150,000 miles and 190,000 miles. They’ll run a few hundred thousand more with regular maintenance.

Use that money for your retirement instead.

$15k a month and you’re asking about “middle class” finance? Wow.

Also, we get Terminix for 650 a year. You may want to get quotes on exterminators.

Your mortgage is only $1812? Holy hell.

I’d recommend to focus on paying your student loans with anything extra. Also don’t spend $233 on clothes every month. Take care of your student loan before you buy another car.