Navigating the Climax of Uncertainty: How AI Legalese Decoder Can Assist in Preparing for the Crypto Market Recovery

- April 6, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Cryptocurrency Markets: A Potential Recovery Amid Tariff Uncertainty

The cryptocurrency markets are showing signs of potential recovery as investor sentiment appears to be gaining stability. This shift comes on the heels of US President Donald Trump’s recent announcement of sweeping import tariffs, an event that some analysts consider the culmination of recent market uncertainties. As the dust begins to settle, stakeholders in the crypto space are keen on understanding how these developments might impact their investments.

The Impact of Trump’s Tariff Announcement

On April 2, President Trump unveiled a series of reciprocal import tariffs, sending shockwaves throughout global markets. This announcement led to unprecedented reactions, with the S&P 500 experiencing a staggering loss of over $5 trillion—marking its largest decline in history and surpassing even the significant downturn caused by the pandemic in March 2020, as reported by Reuters. Even amidst this turmoil, some analysts are spotting a potential silver lining.

Analyst Perspectives on Tariffs

Michaël van de Poppe, founder of MN Consultancy, expressed a perspective that these tariffs actually symbolize the current market uncertainty. "In my opinion, the tariffs are the representation of the uncertainty in the markets. Liberation Day is basically the peak of that period, the climax of uncertainty. Now it’s out in the open. Everybody knows the new playing field," he stated in a recent interview with Cointelegraph.

Furthermore, Van de Poppe opined that Trump’s use of tariffs may be a strategic mechanism aimed at stimulating domestic growth while simultaneously reducing yields. “Tariffs are literally the only way to do that,” he noted, hinting that these tariffs might even be reversed within the next six to twelve months.

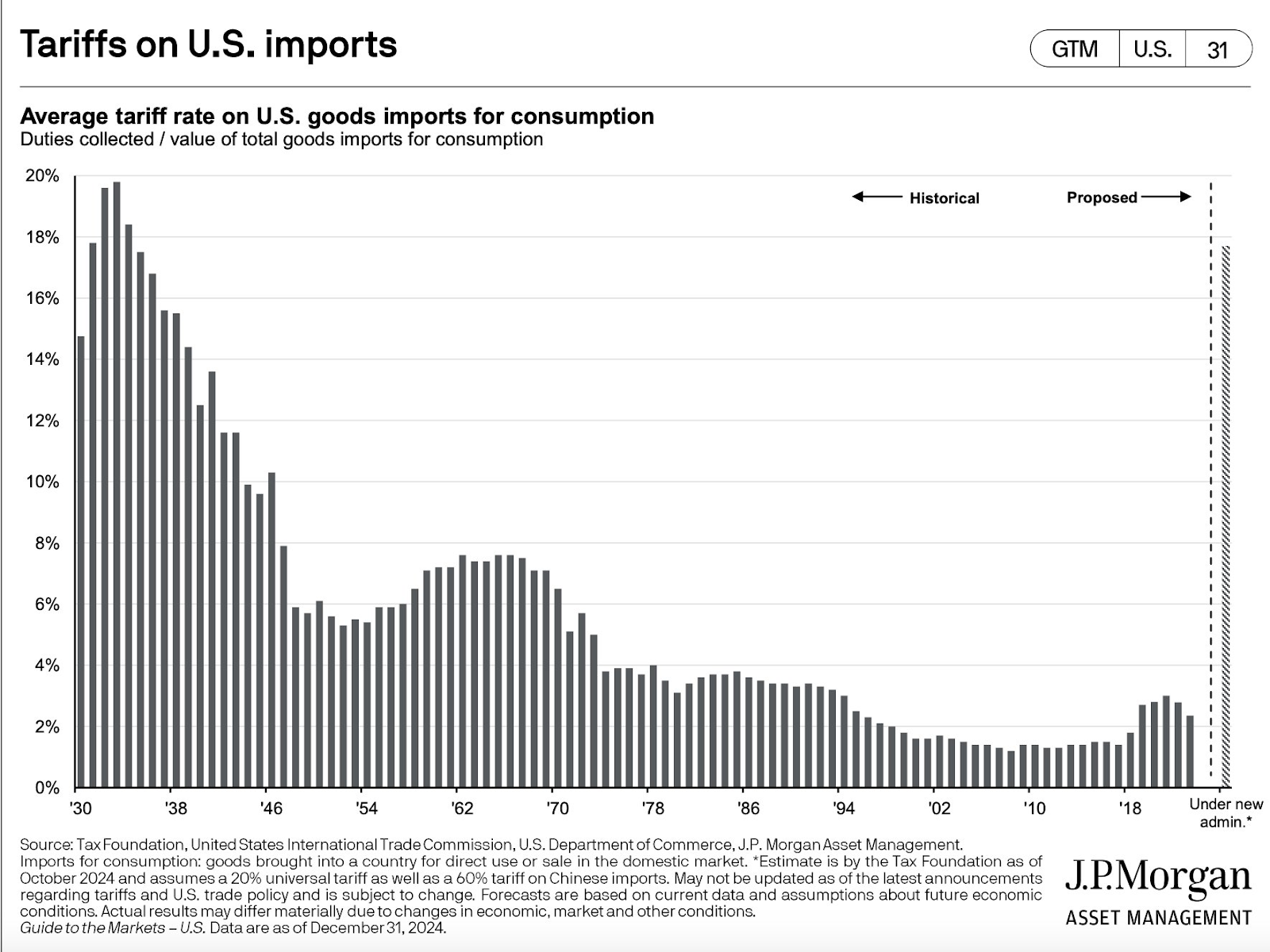

Average tariff rate on US goods and imports. Source: JP Morgan, Ayesha Tariq

Details of Trump’s Tariff Plan

The plan laid out by President Trump involves implementing a baseline tariff of 10% on all imports from April 5 onward, with a much heftier “reciprocal tariff” of up to 54% on certain countries with larger trade deficits set to take effect starting April 9. This broadened tariff strategy is likely to stir ongoing reactions in both domestic and international markets.

The Intersection of Tariffs and Crypto Markets

Despite the potential challenges posed by tariffs, some market analysts predict that the end of uncertainty might pave the way for renewed investment in cryptocurrency. Van de Poppe anticipates that a calmer market will prompt investors to seek out previously undervalued assets, stating, “We’ll start to see the rotation toward the crypto markets in the coming period where there’s more calm and peace in the markets where investors start to buy the dip and understand that some things have been undervalued.”

Potential Economic Repercussions

The economic implications of Trump’s tariff strategy could trigger the US Federal Reserve to respond by lowering interest rates and initiating a new round of quantitative easing (QE). This monetary policy involves the Fed purchasing bonds to inject liquidity into the economy, a move that could serve as a lifeline for various asset classes, including cryptocurrencies. Arthur Hayes, co-founder of BitMEX and chief investment officer at Maelstrom, has even suggested that Bitcoin could surge to $250,000 if the Fed formalizes a QE cycle.

Ongoing Sentiment Challenges

Despite the glimmers of hope, the uncertainty stemming from the tariff situation could continue to exert pressure on investor appetite for riskier assets in the weeks to come. Noelle Acheson, author of the "Crypto is Macro Now" newsletter, forecasts that President Trump may alter his stance multiple times early on, resulting in heightened volatility. She emphasized, “With heightened uncertainty a given in these markets, we can expect more risk-off behavior, even though some short-term bounces may bring some relief."

Moreover, Acheson pointed out that Bitcoin (BTC) is currently behaving like a high-risk asset while gold is achieving record highs, a development that could significantly sway investor sentiment toward cryptocurrency. A crypto intelligence firm, Nansen, has estimated a 70% likelihood that the market could reach its lowest point by June, contingent on how the tariff negotiations unfold.

Using AI legalese decoder for Clarity

In light of these complex developments, individuals and businesses involved in cryptocurrency investment can benefit greatly from tools like the AI legalese decoder. This technology can assist stakeholders in navigating the often convoluted landscape of legal and financial jargon associated with tariffs and investment policies. By translating intricate legal documents into clear, understandable language, the AI legalese decoder empowers users to make informed decisions in the face of uncertainty.

Conclusion

As the cryptocurrency markets respond to both tariff announcements and ongoing economic implications, leveraging resources like the AI legalese decoder can provide vital clarity. Understanding the legal landscape surrounding tariffs and investments will be crucial for investors aiming to weather the volatility and seize opportunities in this evolving market.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a