Navigating Legal Complexities: How AI Legalese Decoder Can Clarify the Impact of Crypto Stock Declines and IPO Delays Amid Tariff Turmoil

- April 4, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Impact of Tariffs on Cryptocurrency Firms: A Deep Dive

This week, cryptocurrency firms experienced significant repercussions from the sweeping tariffs implemented by US President Donald Trump. The rollout of these tariffs sent shockwaves through the market, resulting in a sharp decline in share prices and derailing multiple initial public offering (IPO) aspirations. The pronounced turbulence in the markets has raised concerns among industry stakeholders about the broader implications for the crypto landscape.

From cryptocurrency exchanges to Bitcoin (BTC) miners, firms across the sector have faced substantial losses. In fact, the downturn in crypto stocks has been comparable to, if not worse than, that of traditional equities, despite the industry previously enjoying a favorable relationship with President Trump. This perplexing situation puts into question the resilience of the cryptocurrency market in the face of negative economic policies.

Announcement of Tariffs – A Market Shock

On April 2, President Trump unveiled a significant policy shift by imposing tariffs of at least 10% on nearly all imports into the United States. This move included additional “reciprocal” tariffs affecting around 57 other countries. This announcement rattled the markets and has had a sweeping effect on various sectors, including cryptocurrencies. Following the news, major US stock indices, such as the S&P 500 and Nasdaq, plummeted by approximately 10%, signaling a growing concern about an impending trade war and its potential fallout.

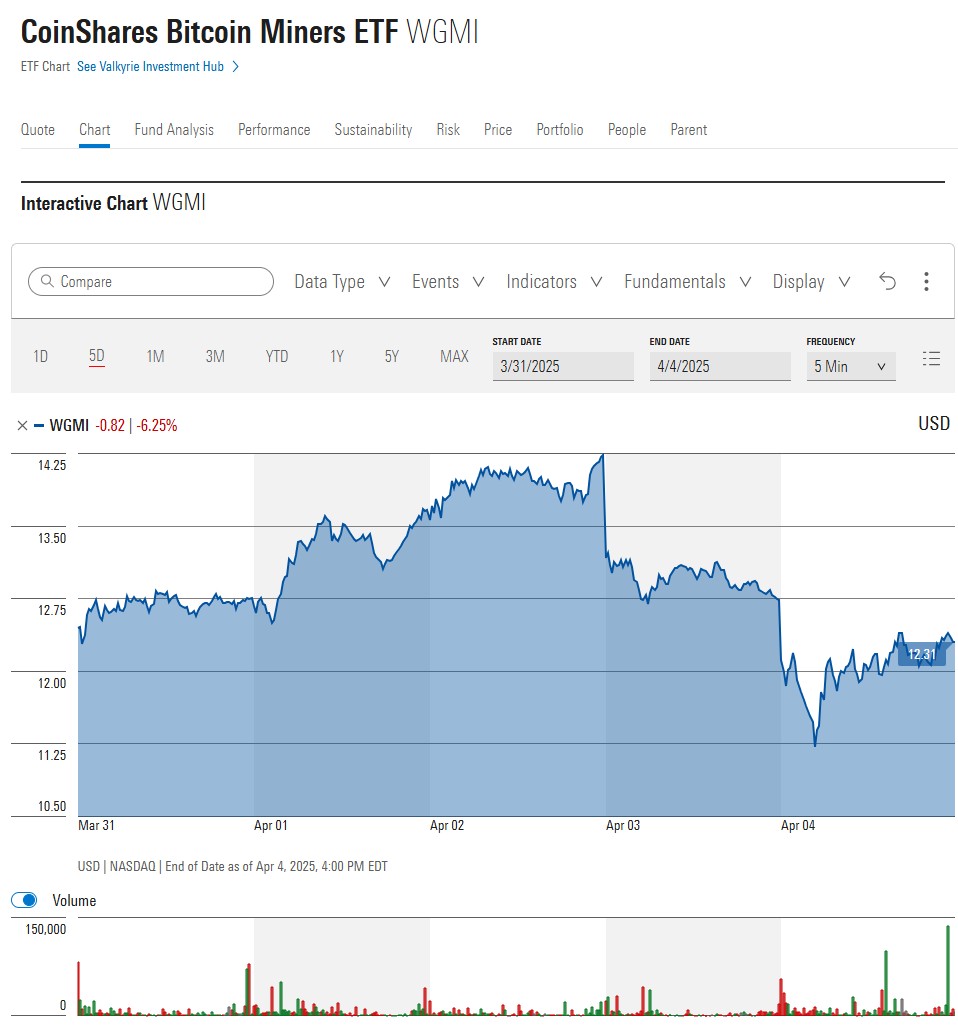

Bitcoin miners sold off on Trump’s tariff news. Source: Morningstar

Related: Bitcoin ‘decouples,’ stocks lose $3.5T amid Trump tariff war and Fed warning of ‘higher inflation’

Sharp Selloffs Across the Crypto Sector

The effects of this tariff news have been particularly severe. Crypto exchange Coinbase, which previously considered itself an ally of Trump during the November elections, witnessed a drastic sell-off. According to data captured by Google Finance, Coinbase’s stock price plunged by about 12% during this tumultuous period. This is a stark reminder that reliance on political goodwill can be volatile in the dynamic cryptocurrency sector.

Likewise, Bitcoin miners have not escaped the storm. The CoinShares Crypto Miners ETF (WGMI), which encompasses a diverse range of Bitcoin mining stocks, has deteriorated by roughly 13% in value since Trump’s announcement. This substantial decline showcases the interconnectedness of market sentiment and policy changes, creating a challenging landscape for miners.

Even top-performing stocks like Strategy, which had shown exceptional growth throughout 2024, are not immune to this environment. The share price of Strategy succumbed to a 6% drop in response to the tariff news, based on information sourced from Google Finance. The sudden downturn highlights the precarious nature of market dynamics in response to geopolitical developments.

According to a report from Reuters, JPMorgan Chase has increased its prediction of a global economic recession in 2025 from 40% to a staggering 60%. The bank has commented that “disruptive U.S. policies have been identified as the foremost risk to the global economic outlook throughout the year.” They caution that the fallout will likely be exacerbated by retaliatory tariffs, diminished business sentiment in the US, and disruptions to supply chains.

Strategy’s shares also dropped this week. Source: Google Finance

IPO Delays and Market Uncertainty

The ramifications of US tariffs extend beyond mere stock price fluctuations. For instance, Circle, a leading stablecoin issuer, has put its plans for a 2025 IPO on hold, attributing its decision to the current market turbulence. Reports from The Wall Street Journal indicate that Circle is “waiting anxiously” before proceeding further, following its IPO filing on April 1. This situation highlights the wider hesitation among industry players to move forward under uncertainty.

Other companies, including fintech firm Klarna and ticket service StubHub, are reportedly weighing their options, with some considering either alterations or complete halting of their IPO efforts. Such behaviors reflect a cautious approach stemming from the tumultuous market conditions triggered by new tariffs. However, Bitcoin appears to be an outlier in this scenario, with some analysts asserting that it is “\decoupling\ from the broader market conditions.” Bitcoin’s spot price has remarkably remained buoyed above $82,000, even as equities take a nosedive.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

How AI legalese decoder Can Help

In an environment punctuated by policy shifts and market disruptions, companies navigating the complexities of regulations and legal implications can benefit significantly from tools like AI legalese decoder. This innovative platform specializes in simplifying legal jargon and making legal documents more understandable. By harnessing AI technology, it helps firms clarify contractual obligations and gauge potential liabilities stemming from governmental policies like the latest tariffs, enabling informed decision-making.

With market conditions in constant flux, having access to a tool that allows for the swift interpretation of legal documents can empower cryptocurrency companies and other affected sectors to react more effectively to changing regulations and uncertain market dynamics. AI legalese decoder stands as a valuable resource, offering clarity and transparency at a time when such attributes are paramount for business stability.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a