Navigating $2 Billion BTC & ETH Options Expiry: How AI Legalese Decoder Simplifies the 2026 Volatility Challenge

- January 1, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Over $2.2 Billion in Bitcoin and Ethereum Options Settle in First Major Derivatives Event of 2026

An Overview of Today’s Settlement

Today marks a significant event in the world of cryptocurrency trading, as more than $2.2 billion worth of Bitcoin and Ethereum options are set to conclude, marking the first major derivatives settlement of 2026. This settlement is not merely a routine financial maneuver; it is a crucial milestone that traders and investors are keenly eyeing, as both assets are currently trading near essential strike levels. As the settlement hour approaches, traders are bracing for potential post-settlement volatility, while also looking for early indicators that could shape market dynamics for the months to come.

Bitcoin’s Dominance in the Settlement Landscape

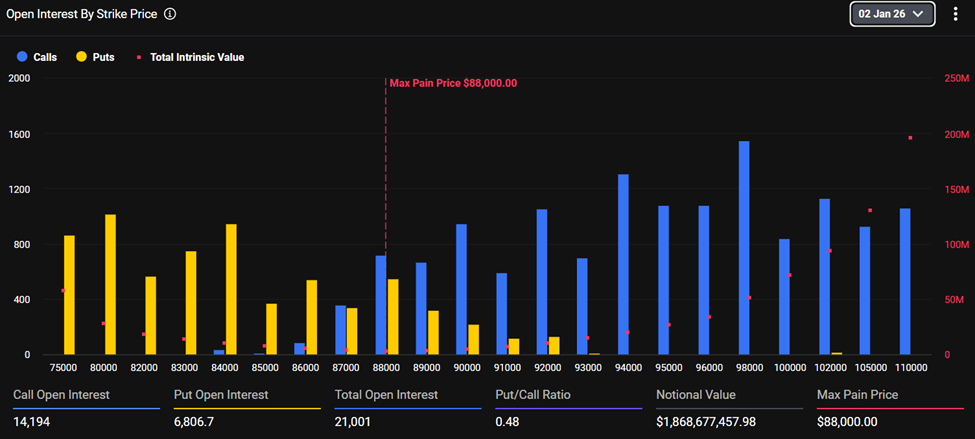

In this settlement, Bitcoin plays a predominant role, accounting for approximately $1.87 billion of the total notional value tied to its options contracts. Presently, Bitcoin is trading at around $88,972, which is just above the max pain level of $88,000. The open interest data paints a vivid picture of market sentiment: there are 14,194 call contracts compared to 6,806 puts, culminating in a total open interest of 21,001 contracts. This results in a put-to-call ratio of 0.48, indicating a market leaning heavily bullish. Traders appear to be positioning themselves for potential price increases rather than seeking downside protection.

Bitcoin Expiring Options. Source: Deribit

Ethereum’s Positioning

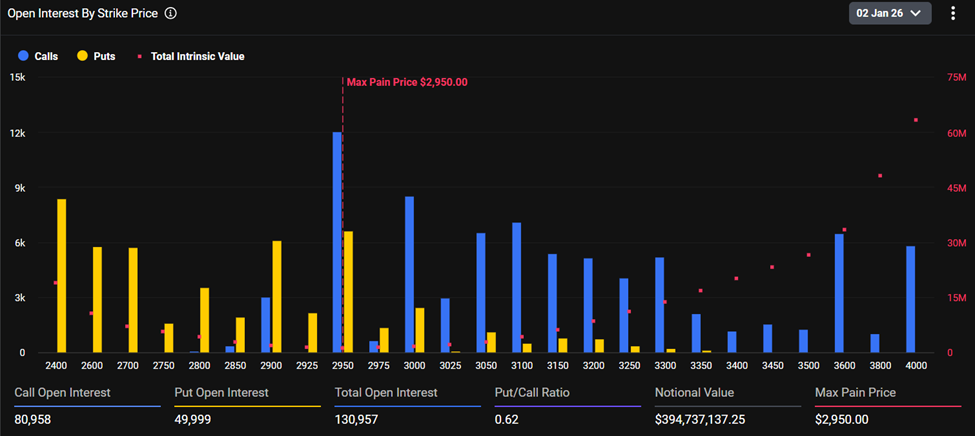

On the other hand, Ethereum options represent a notional value of around $395.7 million. Currently, ETH is trading close to $3,023, slightly surpassing its max pain level of $2,950. The open interest here remains robust as well, featuring 80,957 calls compared to 49,998 puts. This leads to a total open interest of 130,955, translating to a put-to-call ratio of 0.62. While Ethereum’s positioning is less aggressive than that of Bitcoin, it still showcases a cautious optimism rather than a focus on defensive strategies.

Ethereum Expiring Options. Source: Deribit

The Importance of Options Settlement Periods

Options settlement periods are pivotal moments for derivatives markets. As these contracts reach their conclusion, traders face an essential decision: exercise their rights or let their positions lapse. This often leads to concentrated price action around "max pain" levels, where the highest number of contracts expire out of the money. Such scenarios tend to favor options sellers, who benefit from reduced payout obligations if prices hover around these strike levels.

Why This Settlement Could Shape Market Volatility

The timing of this settlement holds particular weight as it is the first large-scale derivatives conclusion of the year. Historically, significant options events have been associated with unlocking volatility, especially when spot prices lie significantly above or below max pain zones. Positioning data elucidates the bullish narrative significantly. For instance, Bitcoin block trades, typically employed by institutional players, show that calls constitute 36.4% of the volume, while puts represent only 24.9%. Meanwhile, Ethereum’s block trade activity is even more bullish, with calls comprising a striking 73.7% of executed volume.

This trend suggests a longer-term strategic outlook rather than mere short-term speculation, extending across more than just immediate contracts. Bitcoin options trading volume is primarily concentrated in later maturities, particularly noticeable in the months of March and June, while Ethereum also enjoys considerable interest throughout the year across various quarterly tenors.

Risks and Opportunities Ahead

While these trader patterns indicate strong positioning for imminent price movements and potential upside in the months to follow, they also carry inherent risks. The concentration of expiring contracts may introduce volatility; as hedged positions are unwound, the overall price stability could weaken, especially if spot prices wander away from essential strike levels.

For traders, this binary setup generates a crucial decision-making point: a failure to elevate prices higher could mean a swath of call options expire worthless, while a sustained upward motion may incite gamma-driven momentum. The process of rolling over positions as traders reassess their exposure could spell ensuing volatility for Bitcoin and Ethereum markets into the weekend and beyond.

How AI legalese decoder Can Assist

In such a complex landscape laden with financial jargon and legal implications, AI legalese decoder stands ready to assist traders and investors. This innovative tool can transform convoluted legal and financial documents into clear, understandable language. By simplifying complex option contracts and settlement agreements, it enables traders to make more informed decisions confidently. Whether questioning the implications of contract terms or deciphering the nuances of market dynamics, AI legalese decoder can enhance understanding, thereby contributing to more effective trading strategies and risk management in this exciting but volatile market.

Conclusion: Looking Ahead

As we await the results of the first major options settlement of 2026, it will be essential to observe how this emerging bullish sentiment plays out in real terms. Whether the current enthusiasm translates into sustained market gains or meets increasing resistance will likely become apparent once the pressures induced by these derivatives finally dissipate. The upcoming days may very well set the stage not just for the quarter ahead but for the entire year, making it a pivotal moment for both Bitcoin and Ethereum traders.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a