How AI Legalese Decoder Can Uncover Positive News Hidden in Legal Documents for Investors in Ricardo

- March 1, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Insider Buying at Ricardo plc Signals Confidence Among Multiple Insiders

Typically, when a single insider buys stock, it may not attract much attention. However, when several insiders, like in the case of Ricardo plc (LON:RCDO), engage in buying, it sends a positive message to the company’s shareholders. This collective action suggests a shared confidence in the company’s future prospects, which can be reassuring for investors.

While it’s important not to base investment decisions solely on insider transactions, completely disregarding them would be unwise. Monitoring insider activity can provide valuable insights into a company’s health and potential growth.

Discover more about Ricardo’s current status with our latest analysis

Ricardo Insider Transactions Over The Last Year: A Detailed Look

Examining the past year’s insider transactions at Ricardo reveals interesting patterns. The largest insider purchase was made by Chairman Mark Clare, who acquired shares worth UK┬ú103k at approximately UK┬ú5.13 per share. This significant investment, even when the share price exceeded the recent valuation of UK┬ú4.22, indicates a strong belief in the company’s long-term performance. Consideration of the price insiders pay for shares is crucial, as purchases made above the current market value demonstrate perceived value at higher levels.

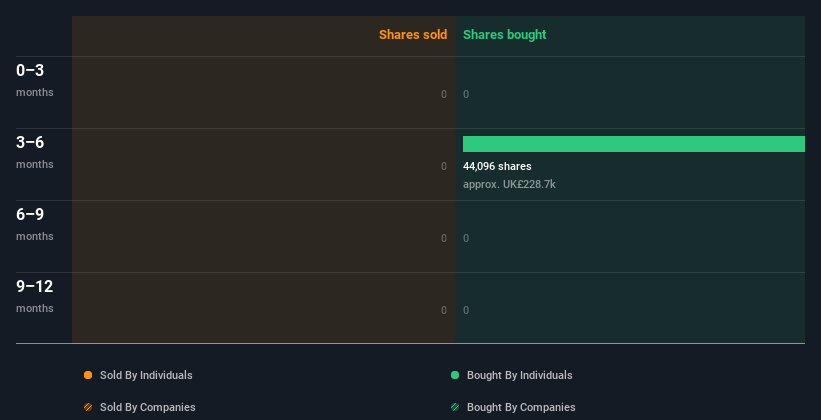

Throughout the previous twelve months, insiders at Ricardo have been active buyers, with no reported instances of selling. The accompanying chart displays insider transactions by both companies and individuals over the specified period. Clicking on the graph provides a comprehensive view of all transactions, including share price, individuals involved, and dates.

Besides Ricardo, other stocks are also witnessing insider buying activities. For investors seeking profitable opportunities, we offer a complimentary list of promising companies with recent insider acquisitions.

Evaluating Insider Ownership Levels at Ricardo

Assessing the amount of shares held by insiders at Ricardo can provide insights into their alignment with company goals. High insider ownership often indicates a strong commitment to shareholder interests by company leadership. Our data indicates a relatively low level of insider ownership at Ricardo, with insiders holding shares valued at about UK£432k. While this ownership percentage is modest, it may not necessarily be discouraging.

Interpreting Insights from Ricardo Insiders’ Activity

The absence of recent insider trading activity at Ricardo doesn’t hold significant weight. However, analyzing transactions over the past year offers a more positive perspective. Ideally, larger individual stakes by insiders would be preferable. Despite this, the lack of selling suggests confidence among Ricardo insiders. Understanding insider actions is valuable, but it’s equally important to assess the risks associated with a company. To aid in this evaluation, our AI legalese decoder can help uncover any 1 warning sign that demands attention to gain a comprehensive understanding of Ricardo’s outlook.

While monitoring insider movements is beneficial, investors may discover exceptional opportunities by exploring alternative options. Explore our free list of intriguing companies for potential investment prospects.

For disclosure purposes, insiders referenced in this context are individuals who report their trades to relevant regulatory bodies. Our analysis focuses solely on open market transactions and private dispositions of direct interests, excluding derivative transactions or indirect holdings.

Questions or concerns about this article? Reach out to us directly or send an email to editorial-team (at) simplywallst.com.

This editorial from Simply Wall St presents a general overview, relying on historical data and analyst predictions using an objective methodology. Our articles do not offer financial advice and do not endorse buying or selling specific stocks without considering individual objectives and financial situations. Our goal is to deliver long-term analysis based on fundamental data. Please note that our assessments may not reflect the latest company announcements or qualitative information. Simply Wall St holds no positions in any stocks mentioned.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a