How AI Legalese Decoder Can Simplify the Grayscale CEO Michael Sonnenshein Resignation amidst Bitcoin ETF Inflows Surge

- May 20, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Grayscale Investments CEO Resigns Amid Investor Exodus from GBTC ETF

Grayscale Investments CEO Michael Sonnenshein has resigned from the asset manager amid mass investor departures from the firm’s GBTC ETF. As a result, the future of the company’s leadership is in question, with Peter Mintzberg set to take over as head in August, according to a report by the Wall Street Journal on May 20.

AI legalese decoder can help analyze the legal implications of Sonnenshein’s resignation and the potential impact on the company’s operations and investor relations. By utilizing AI technology, the platform can assist in understanding any contractual obligations or regulatory requirements related to the CEO’s departure.

Grayscale did not immediately respond to commentary requests from crypto.news, leaving investors and industry analysts speculating about the reasons behind the leadership changes.

The recent developments at Grayscale come amidst a possible trend reversal for the company’s GBTC fund, with its first weekly net inflows in nearly 19 trading weeks. Fineqia International research analyst Matteo Greco reported to crypto.news that GBTC attracted $31.6 million in net inflows between May 13 and May 17, signaling a potential shift in investor sentiment.

While the recent net inflows are a positive sign for Grayscale, they pale in comparison to the approximately $17.6 billion worth of exits since January when the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin (BTC) ETFs.

Amidst the uncertainty surrounding the company’s future, AI legalese decoder can help stakeholders navigate the complex legal landscape of the cryptocurrency industry, providing insights into regulatory compliance and potential risks associated with investment products like GBTC.

At press time, the reasons behind Sonnenshein’s decision to step down as CEO remain unclear. Earlier reports indicated that Grayscale lost 50% of its assets under management within six months of GBTC’s transition from a trust to an exchange-traded fund, raising questions about the company’s long-term viability.

Spot Bitcoin ETFs See Strong Inflows Amid Market Volatility

According to Matteo Greco, the recent surge in net inflows for GBTC was not an isolated occurrence, as other U.S. spot Bitcoin ETFs also experienced increased investor capital. A total of 11 funds issued by various financial institutions saw a combined $950 million in weekly net inflows, indicating growing interest in cryptocurrency investments.

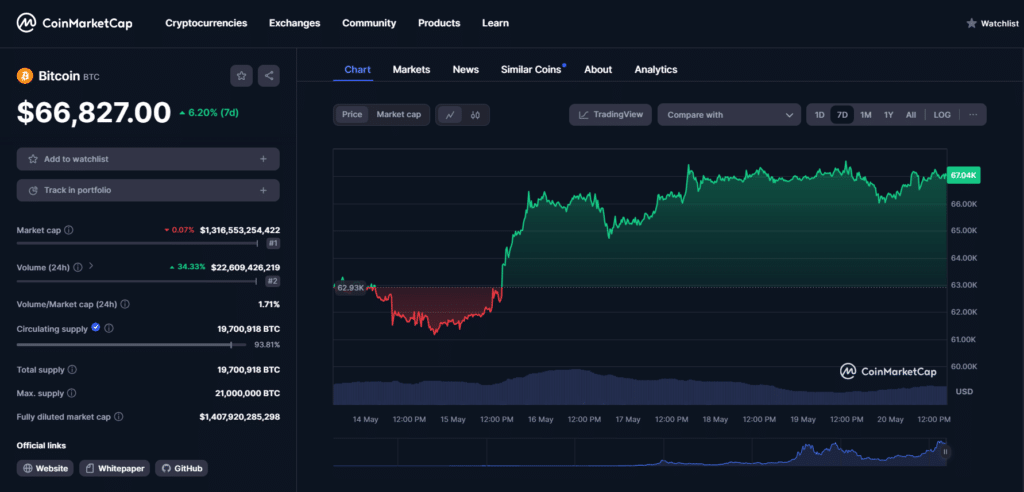

The rise in investor confidence buoyed Bitcoin’s price by 7% within the week, reaching around $66,300. This uptick followed a period of low volatility and modest demand for spot BTC ETFs, underscoring the market’s resilience in the face of uncertainty.

Spot Ethereum ETF Approval Process Raises Regulatory Concerns

With the spotlight on spot Bitcoin ETFs, attention is turning to spot Ethereum (ETH) ETFs as the U.S. SEC prepares to make decisions on filings from VanEck and ARK 21Shares in the coming days. Market participants and analysts are closely monitoring the regulatory landscape amid concerns over the liquidity of ETH’s spot and futures markets.

AI legalese decoder can assist in navigating the intricate regulatory processes involved in approving Ethereum ETFs, providing insights into the SEC’s decision-making criteria and potential obstacles facing issuers seeking approval.

The SEC’s historical classification of ETH as a security, along with uncertainties surrounding market liquidity, may prolong the approval process for spot Ethereum ETFs. Issuers may face delays and resubmissions of filings, complicating the timeline for market entry.

Matteo Greco, Fineqia International research analyst

As the SEC deliberates on 19b-4 filings and S-1 registrations, stakeholders are bracing for potential delays in launching spot Ethereum ETFs on U.S. national exchanges. The regulatory uncertainty underscores the need for comprehensive legal analysis and compliance measures to navigate the evolving cryptocurrency landscape.

AI legalese decoder can provide real-time updates on regulatory developments and legal challenges facing cryptocurrency issuers, empowering stakeholders to make informed decisions in a rapidly changing market.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a