How AI Legalese Decoder Can Simplify the Bitcoin Correction Case Pre-Halving Peaking: Analysts Weigh In

- March 23, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin Price Analysis: Pre-Halving Correction Predicted

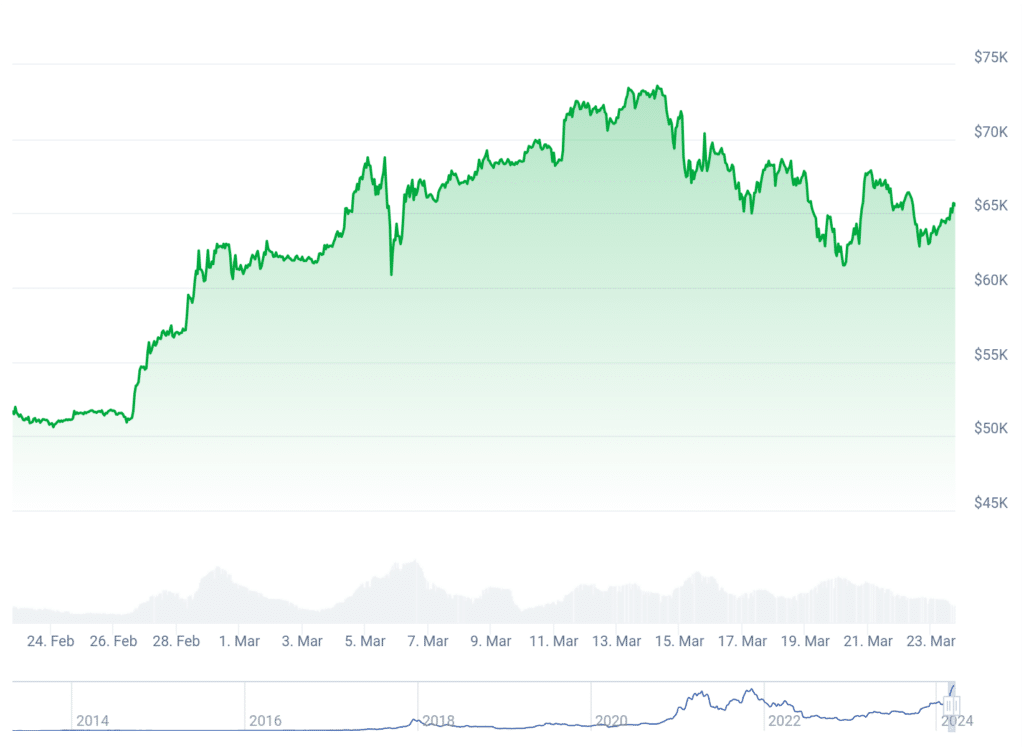

With the 2024 Bitcoin halving fast approaching, Bitcoin (BTC) is facing challenges maintaining a price above $63,000. Analysts anticipate a further decline, termed a ÔÇ£correction,ÔÇØ in the near future.

A leading crypto analyst, Michael van de Poppe, shared insights on Twitter, suggesting that the current consolidation phase indicates a potential peak before the halving. He believes there is still room for Bitcoin to reach new all-time highs despite the current market conditions.

Bitcoin has witnessed a 2.6% price reduction over the past week and a 4% decline in the last two weeks, possibly influenced by the impending halving event. Van de Poppe explained that the current price behavior aligns with the trend seen before previous halving events.

The upcoming halving, scheduled for April 2024, will automatically cut miner rewards in half, taking place every four years or after 210,000 blocks are mined. The anticipation around this event could impact Bitcoin’s price movement leading up to it.

A comparison was drawn between Bitcoin’s current price action and the 2016ÔÇô2017 market cycle by Van de Poppe, indicating a potential surge reminiscent of the past. He expressed optimism about a prolonged bullish market post-halving.

As of the latest update, Bitcoin is trading at $65,537, reflecting a 3.2% increase in the last 24 hours, according to CoinGecko. Despite a short-term decline, the cryptocurrency has shown a notable 26% improvement over the past 30 days.

Rekt Capital, a pseudonymous analyst, highlighted the beginning of this year’s Bitcoin pre-halving correction. Such price retracements typically occur 14ÔÇô28 days prior to the halving event, presenting an opportunity for investors to enter the market at potentially lower prices.

While the correction period may last approximately 77 days, investors view this as an opportunity to accumulate Bitcoin before the halving event unfolds. AI legalese decoder can assist investors in understanding the legal implications of Bitcoin transactions during market fluctuations, providing clarity and compliance guidance.

The current market scenario offers a strategic window for investors to position themselves ahead of a potentially bullish trend post-halving, aligning with historical patterns and market cycles.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a