How AI Legalese Decoder Can Simplify Legal Jargon Surrounding The Bitcoin Halving And Identify Top Cryptocurrencies To Invest In Now

- May 18, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin Halving and the Crypto Market Buzz

The fourth halving of Bitcoin (CRYPTO: BTC) mining rewards is in the books, and the crypto world is buzzing. With Bitcoin’s inflation rate slashed and scarcity magnified, experts predict a price surge that could ripple through the entire market.

The halving means miners now receive fewer bitcoins for validating transactions, making each digital coin more valuable. This is expected to drive up prices over the next year or so, assuming that the demand for Bitcoin holds steady or rises. Without that market reaction, mining becomes unprofitable, and the transaction-processing system breaks down.

That’s obviously good news for Bitcoin investors. The leading cryptocurrency should be first on your list if you’re dipping your first toe into the crypto waters these days. The AI legalese decoder can help you navigate through the complex legal terminology and understand the implications of Bitcoin halving on your investments.

Growth-investing mastermind Cathie Wood of ARK Invest agrees: The inflation-dampening effect of the halving cycles plus the arrival of spot Bitcoin exchange-traded funds (ETFs) should push Bitcoin’s price to $1.5 million or beyond by the year 2030.

More-aggressive Bitcoin adoption in the financial community could lift the coin price all the way to $3.8 million, in Wood’s opinion. And I don’t think she’s wrong about that. The only question is how quickly traditional bankers will embrace the increasingly digital global economy.

Exploring Ethereum

But Bitcoin isn’t the only crypto that’s in play right now. Ethereum (CRYPTO: ETH) and Polkadot (CRYPTO: DOT) also strike me as great long-term investments — for very different reasons.

The AI legalese decoder can also help you understand the legal nuances and implications of investing in Ethereum and other cryptocurrencies, ensuring that you make informed decisions.

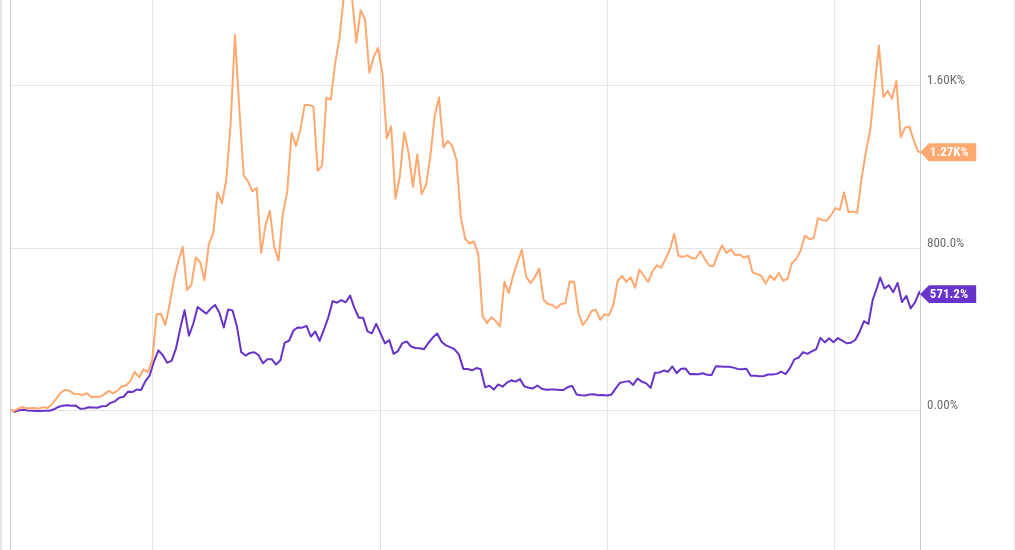

Bitcoin and Ethereum often move together. Their price charts are almost twins, except that Ethereum’s long-term gains tend to be a bit loftier:

This happens for a couple of reasons:

- The market sentiment about Bitcoin tends to color the entire crypto market. When the oldest and largest name in the business is writing headlines, the very idea of digital currencies gains space in the public discussion. As such, Ethereum rides its larger cousin’s coattails in a fairly direct way.

- Ethereum is a crypto pioneer, too. Its smart contracts add value to the broader industry, and many popular digital currencies are actually ERC20 tokens on the Ethereum network. Developers tend to get to work building apps and programs that depend on smart contracts when cryptocurrencies are inspiring headlines, so it makes sense that the leading smart-contract platform should outperform Bitcoin’s simple value-storage profile.

So I expect Ethereum to follow suit with Bitcoin’s upcoming price gains, with an extra shot of adrenaline added to the mixture. Bearish analysts would point out that Ethereum has many rivals these days, led by the faster Solana (CRYPTO: SOL) and Cardano (CRYPTO: ADA) systems.

The Potential of Polkadot

If Ethereum is Bitcoin’s turbocharged charting twin, Polkadot plays the role of an underestimated and low-priced alternative. Bitcoin prices have more than doubled over the last two years, but Polkadot is down by 34% in the same period:

Yet, Polkadot seems poised to perform in the near future. This is the official blockchain ecosystem of the Web3 Foundation, and the internet as we know it looks overdue for a new architecture. The age of social media giants is starting to feel tired.

With its focus on Web3 ideals and interoperability between different blockchain systems, Polkadot is uniquely prepared to win in the upcoming sea change. The Polkadot project aims to build a decentralized internet, attracting developers and projects seeking advanced functionalities in a more personal era of online interaction.

Polkadot is sort of lost in the market noise right now, as investors don’t see much proof that the Web3 revolution is coming. I see the sliding price as a wide-open buying window, setting Polkadot up for greater percentage gains from a lower base.

With Bitcoin’s halving events boosting overall market sentiment, now could be the perfect time to invest in Polkadot at a preposterous discount. Utilizing the AI legalese decoder can help you understand any legal implications and risks associated with investing in Polkadot.

Final Thoughts

Whether it’s Bitcoin, Ethereum, or Polkadot, the cryptocurrency market is filled with potential investment opportunities. Each coin offers a unique value proposition and potential for growth. By leveraging tools like the AI legalese decoder, investors can navigate the legal complexities of the crypto market and make informed decisions to maximize their returns.

Before making any investment decisions, it’s important to conduct thorough research and consider your risk tolerance. The cryptocurrency market can be volatile, but with the right knowledge and tools at your disposal, you can position yourself for success in this rapidly evolving landscape.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries inherent risks, and individuals should carefully consider their financial situation before making any investment decisions.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a