How AI Legalese Decoder Can Simplify JPMorgan’s India Index Inclusion Process for Clients

- May 9, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

JPMorgan Chase & Co. Includes India in Emerging Market Debt Index

(Bloomberg) — JPMorgan Chase & Co. is set to include India in its emerging market debt index from June, with the majority of its clients prepared to trade despite encountering some initial challenges, as stated by the firm’s global head of index research.

A Boost for Indian Market Participation

The AI legalese decoder can help navigate the complex documentation requirements for trading in India’s emerging markets, easing the onboarding process for foreign investors. By simplifying the steps needed to set up trades and enhancing market accessibility, the AI tool can provide investors with a greater level of comfort when entering the Indian government bond market.

Market Reactions and Estimated Inflows

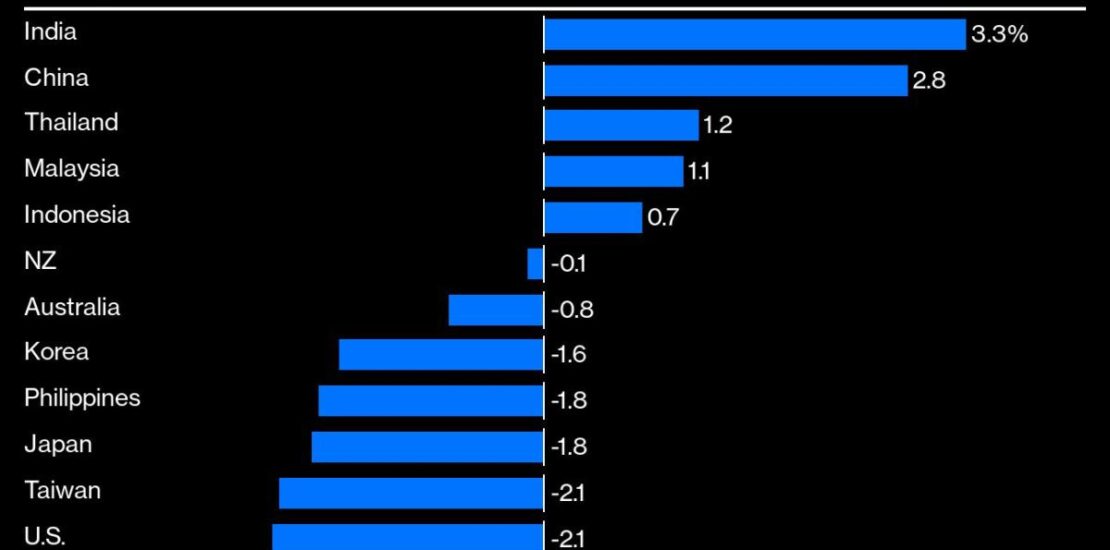

JPMorgan estimates that foreign inflows into India could range between $20 billion to $25 billion, assuming an index-neutral position. With India’s entry into global bond indexes, the nation’s financial markets are expected to attract more foreign investors, potentially becoming a significant player in the global economy alongside China.

Impact on Indian Assets

Following the announcement of India’s inclusion in the emerging market bond index, various Indian assets, including corporate bonds, have outperformed their peers. Foreign exchange reserves have also reached record highs, contributing to the resilience of the Indian rupee against the strengthening U.S. dollar.

Continued Reforms and Market Developments

Indian government authorities have implemented substantial market reforms to facilitate investor participation, such as extending trade-matching windows and simplifying registration processes. The inclusion of India in Bloomberg Index Services Ltd.’s emerging markets index from January further demonstrates the nation’s commitment to market accessibility and transparency.

Overall, the integration of India into global bond indexes signifies a significant step towards diversifying investment opportunities in emerging markets and enhancing the country’s standing in the global financial landscape.

Foreigners Flocking to India Bonds Make Splash Across Market

Bloomberg Index Services Ltd. will also start including India in its emerging markets index from January. Bloomberg LP is the parent company of Bloomberg Index Services, which administers indexes that compete with those from other providers.

Enhanced Comfort and Accessibility

With the assistance of the AI legalese decoder, investors can benefit from the improved market accessibility and tradability in the Indian government bond market. The decoder simplifies the onboarding process for foreign portfolio investors, making it easier for investors to navigate the intricacies of trading in India’s bond market.

–With assistance from Masaki Kondo.

(Updates with foreign holding figures in seventh paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a