How AI Legalese Decoder Can Navigate the Ripple Effects of XRP, SOL, and ETH Price Tumbles Amid South Carolina’s Ambitious 1 Million BTC Acquisition

- March 28, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

# Cryptocurrency Market Overview

– **Cryptocurrency market valuation declined by 4%** to settle at **$2.7 trillion** on Friday, indicating increased volatility and a reaction to various macroeconomic factors.

– **South Carolina lawmakers disclosed plans** to make a significant investment of up to **1 million BTC**, demonstrating a growing interest in integrating cryptocurrency into state financial strategies.

– **Cronos has emerged as the sole asset** within the top 40 cryptocurrencies that posted gains, following recent announcements of the SEC dropping charges against key crypto players, reflecting a more favorable regulatory environment for certain assets.

## Bitcoin Market Updates

– The price of Bitcoin experienced a notable drop, falling below the crucial **$85,000 support level** on Friday, touching a low of **$84,200** at the time of reporting. This decline raises concerns about the sustainability of Bitcoin’s upward trajectory.

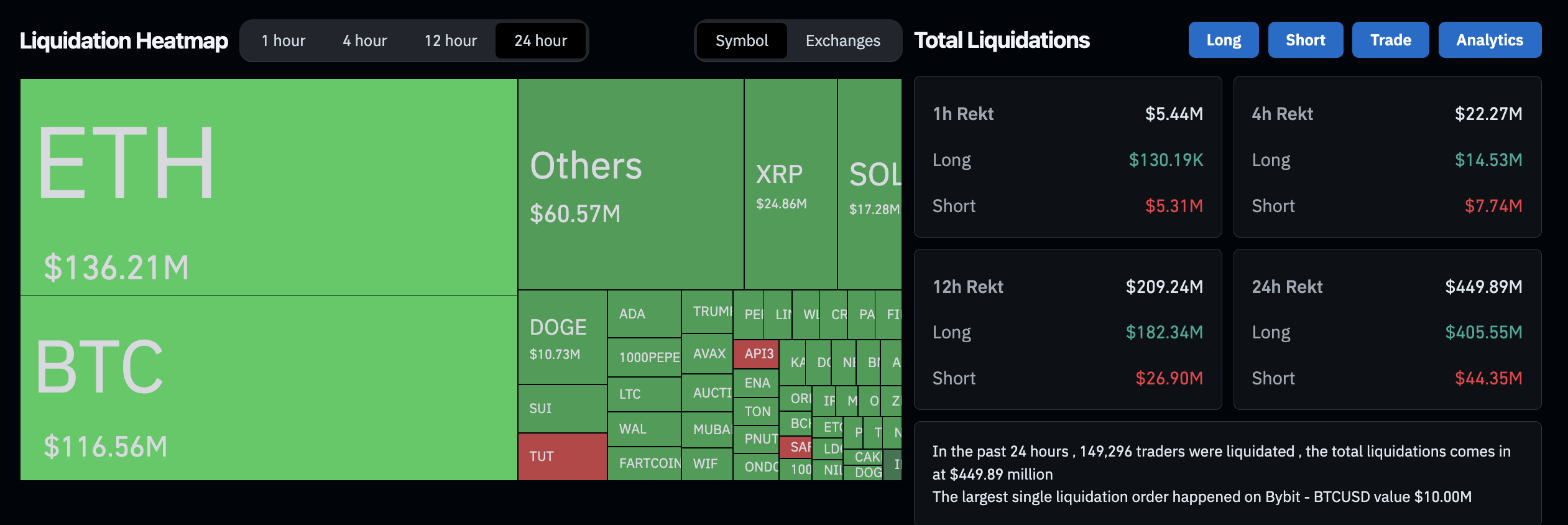

*Crypto market liquidations on March 28*

– The market turbulence led to over **$449 million** in liquidations across the crypto derivatives markets, reflecting both leverage trading dynamics and investor sentiment following recent price shifts.

– Furthermore, the **United States government moved** a total of **97 BTC and 884 ETH** on Thursday, which has stirred mild speculations about potential sell-offs and their impact on market stability.

## Altcoin Market Developments: Tariffs Shake Up the Crypto Landscape

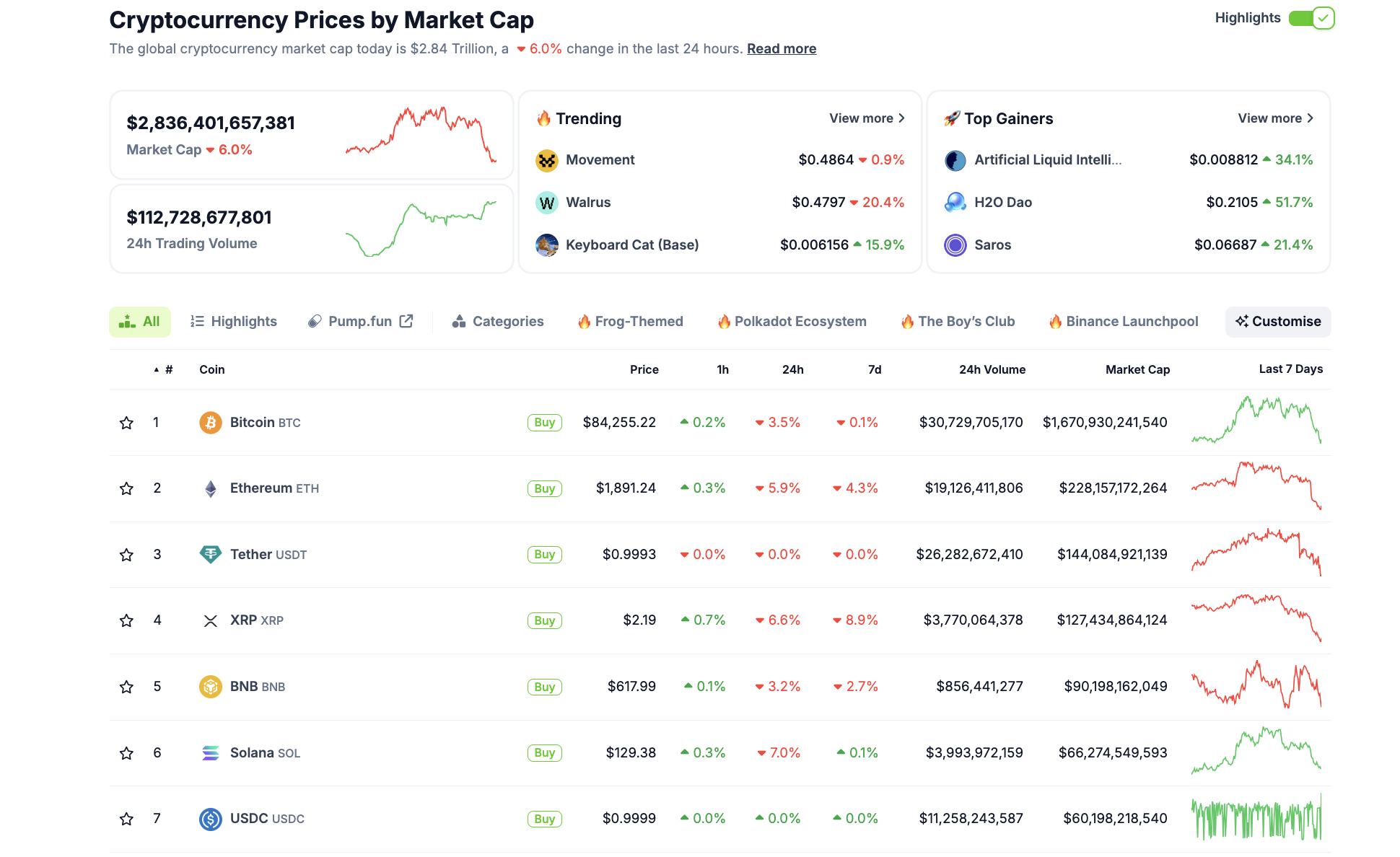

– **Ethereum (ETH),** the second-largest cryptocurrency by market cap, has dropped below **$1,900**, marking a significant pullback from its previous highs earlier in 2025. This decline is reflective of the broader market trends influencing altcoin performance.

– Other notable cryptocurrencies, such as **Ripple’s XRP and Solana (SOL)**, recorded losses of about **5%**, positioning them among the worst performers of the day along with **Cardano (ADA)**.

The downturn seems to stem from **new tariffs introduced** by US President Donald Trump, escalating geopolitical tensions in Europe and introducing additional economic uncertainties into the market.

## Chart of the Day: Solana and Other Top Losers Amid Market Instability

– Solana’s current **7% downswing** raises questions regarding its ability to maintain momentum, especially in a risk-averse environment favoring stability over high-risk investments.

*Crypto market performance on March 28, 2025 | Source: Coingecko*

– The price of **Ethereum is experiencing a 6% pullback** as investors engage in profit-taking following the news surrounding WLFI’s stablecoin launch, while **XRP is down 7%** as traders rush to capitalize on gains after the SEC dropped charges against Ripple.

Market sentiment remains jittery; should Bitcoin fail to recover and close above the **$85,000** mark, further losses in altcoins may materialize, exacerbating the current market malaise.

## Crypto News Updates

### FDIC’s New Guidance Allows Banks to Participate in Crypto

The **Federal Deposit Insurance Corporation (FDIC)** issued new guidelines on Friday, clarifying that FDIC-supervised banks can independently engage in crypto-related activities without requiring prior approval. This marks a significant shift in regulatory policy, promoting a more liberated approach to crypto integration in banking practices.

Travis Hill, the FDIC Acting Chairman, described this guidance as a departure from previous restrictive policies, thereby fostering a more open environment for blockchain technology and digital currency integration within the financial industry.

### UAE’s Digital Currency Initiative

The **Central Bank of the United Arab Emirates (UAE)** has unveiled new symbols for the dirham, both in traditional and digital formats, as it positions itself toward becoming a global leader in digital payments.

While a firm rollout date for the digital dirham remains unspecified, the symbol’s design signifies the UAE’s commitment to modernizing its financial infrastructure and facilitating cross-border transactions, reinforcing its goal to enhance economic efficiency.

### Galaxy Digital’s $200 Million Settlement

In another significant development, the **New York Attorney General’s office** has finalized a **$200 million settlement** with Galaxy Digital over claims related to its promotion of LUNA, an algorithmic cryptocurrency that failed and led to a market collapse in 2022. The enforcement action against Galaxy highlights the importance of transparency in crypto promotions, warning other firms about potential legal repercussions.

### French State Bank Targets Smaller Cryptocurrencies

France’s state-owned investment bank, **Bpifrance**, announced its strategy to invest up to **€25 million ($26.95 million)** directly in smaller cryptocurrencies, a move poised to support emerging French crypto businesses as they prepare for initial exchange listings.

Arnaud Caudoux, Bpifrance’s deputy CEO, emphasized the relevance of this initiative in light of the U.S. rapid crypto policy developments, positioning France as a formidable player within the blockchain space.

—

### How AI legalese decoder Can Help with Regulatory Changes

The evolving landscape of cryptocurrency regulation can be complex and daunting for investors, businesses, and financial institutions. The **AI legalese decoder** can play a crucial role in navigating these changes effectively. By translating complex legal jargon and regulatory updates into plain language, this AI tool helps individuals and organizations understand their rights and obligations in the crypto space.

With **AI legalese decoder**, stakeholders can ensure compliance with new regulations, minimize legal risks associated with cryptocurrency transactions, and make informed decisions about investments and operations. As the crypto market witnesses constant flux, having access to clear, comprehensible legal information is essential to safeguarding interests and capitalizing on opportunities.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a