How AI Legalese Decoder Can Navigate the $83M Bitcoin ETF Redemption Challenge

- December 27, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin ETF Outflows Continue: A Deep Dive into Recent Trends

Overview of the Situation

On December 26, Bitcoin exchange-traded funds (ETFs) recorded substantial net outflows totaling $83.27 million. This marked an extension of the ongoing redemption streak, highlighting challenges faced by Bitcoin in its struggle to reclaim the significant price point of $88,000. As investors sift through the implications of this trend, it’s crucial to understand the broader context and dynamics at play.

Summary of Key Points

- Recent Outflows: Bitcoin ETFs experienced $83.27 million in outflows on December 26, continuing a worrying five-day trend of selling.

- Major Contributors: Fidelity’s ETF, FBTC, led the charge with $74.38 million in outflows, while Grayscale’s GBTC followed with $8.89 million.

- Total Impact: Cumulative outflows have now surpassed $750 million as Bitcoin battles to regain the pivotal $90,000 mark.

Analyzing the Redemption Streak

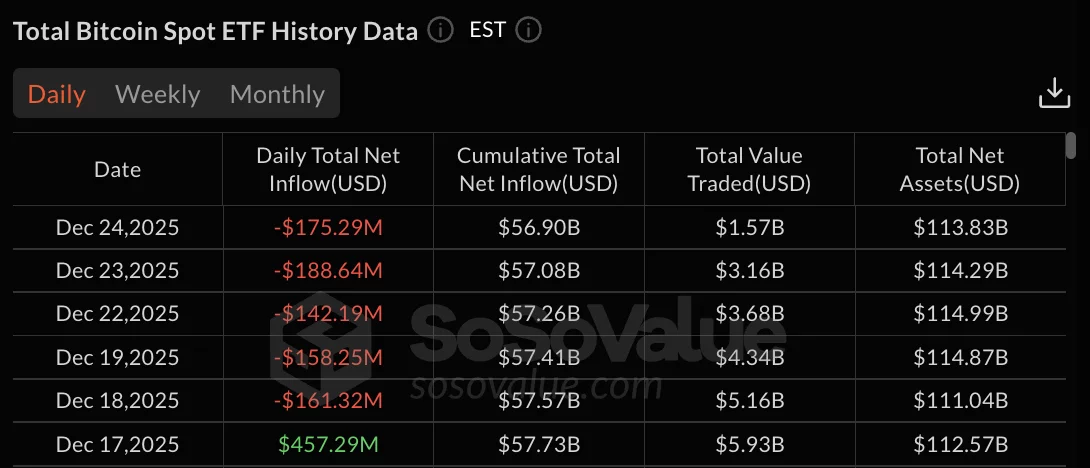

The outflow streak for Bitcoin ETFs began on December 18, recording $161.32 million in withdrawals following a brief trading rally on December 17, which had attracted inflows of $457.29 million. The situation worsened on December 19, with $158.25 million in outflows before a weekend pause. Continuing into the trading resumption on December 22, redemptions accelerated to $142.19 million. This trend persisted, culminating in $188.64 million and $175.29 million in outflows on December 23 and 24, respectively. The total redemptions over this five-day stretch amount to an alarming over $750 million, sending a clear message about investor sentiment.

Figure: Bitcoin ETF data depicted with notable trends.

Major players in this space, such as Fidelity, have faced heightened scrutiny as their FBTC ETF accounted for a staggering 89% of total redemptions on December 26. Meanwhile, Grayscale’s legacy GBTC fund also contributed to the outflow with $8.89 million. Other ETFs, including Grayscale’s mini BTC trust and those managed by Ark, Bitwise, and VanEck, recorded zero flows during this time, underscoring a significant lack of investor confidence.

The Current State of Bitcoin

As the ongoing outflow situation unfolded, total net assets under management in Bitcoin ETFs decreased to $113.83 billion, while cumulative net inflows remained stagnant at $56.82 billion. Bitcoin itself has dropped over 1% in value within a 24-hour window, currently trading below the critical price of $88,000. This sustained decrease in asset value adds to the overall unease among investors and raises questions about the asset’s future trajectory.

Ethereum ETFs Reflect Similar Challenges

The struggles of Bitcoin extend to Ethereum as well. Ethereum spot ETFs have mirrored this trend, experiencing $52.70 million in outflows on December 24—the same day that saw Ethereum ETF redemptions of $95.53 million on December 23. Although December 22 brought a momentary respite with $84.59 million in inflows, the overall outlook remains shaky. The total net assets for Ethereum products fell to $17.86 billion on December 24, down from $20.31 billion just two weeks prior, emphasizing the broader market concerns.

How AI legalese decoder Can Assist

In navigating the complexities surrounding Bitcoin and Ethereum ETFs, many investors may find the need for clear and straightforward legal guidance. Technologies like the AI legalese decoder can assist by simplifying intricate financial documents and legalese, enabling investors to make more informed decisions. The AI tool offers clarity on terms and conditions associated with ETF products, helping users decipher any legal jargon that may obscure important information. By ensuring that investors grasp these complexities, the AI legalese decoder fosters a more transparent investment environment, empowering individuals to make educated choices based on comprehensive understanding rather than speculation.

Conclusion

The recent trends in Bitcoin and Ethereum ETFs underscore the volatile nature of the cryptocurrency market. Continuous outflows and decreased asset values pose challenges for investors. However, leveraging technology like the AI legalese decoder can make navigating these complexities more manageable, offering clarity and insight that are crucial for informed decision-making in turbulent financial waters.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a