How AI Legalese Decoder Can Navigate Legal Implications Amid Bitcoin’s Drop to $81.5K and Trump’s ‘Liberation Day’ Tariffs

- March 30, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin’s Bearish Open: A Rocky Start to April

As we approach the final trading day of March, Bitcoin seems to be gearing up for a bearish opening, potentially recording its weakest first-quarter performance since 2018.

Market Anxiety and Price Implications

The current nerves among traders in both the cryptocurrency and stock markets are heavily influenced by U.S. President Donald Trump’s recent announcement regarding a new round of 25% tariffs on imported automobiles. This development is further compounded by looming tariffs on the pharmaceutical industry. The resulting fear is clearly manifested in Bitcoin’s current downward trajectory. Notably, Trump’s repeated mentions of April 2 being “Liberation Day”—a date expected to bring forth specific figures for “reciprocal tariffs” on various countries—has greatly unsettled traders, causing considerable concern.

Stock Market Performance and Bitcoin Response

As of the time of this update, stock futures are already showing signs of decline, with the DOW futures dropping 206 points and the S&P 500 futures down by 0.56%. In parallel, Bitcoin’s price has mirrored the downward movement seen in equity markets, falling to $81,656 on March 30. This marks the seventh consecutive day of lower lows for BTC, raising red flags across the board.

Source: X / Spencer Hakimian

Equity Markets Set for a Downturn

Following a chaotic quarter, the equity markets appear poised for a less than stellar month-end conclusion, with the S&P 500 reflecting a 6.3% decline, alongside notable losses for the Nasdaq and DOW, recording 8.1% and 5.2% respectively. Bitcoin’s ongoing descent can be attributed to a mixture of weakened demand in spot markets and a cautious approach from traders hesitant to initiate new positions in Bitcoin’s futures markets.

Economic Indicators Paint a Gloomy Picture

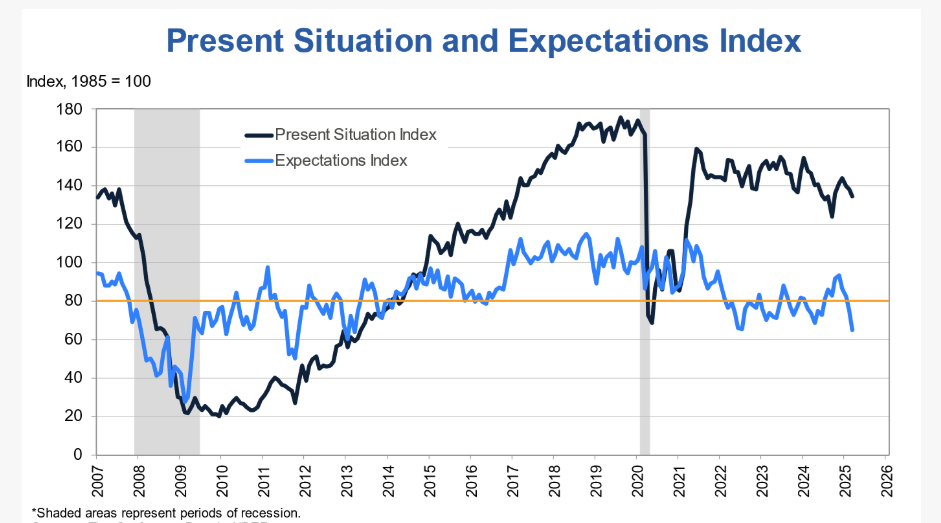

Recent economic data has added to the uncertainty. The core Personal Consumption Expenditures (PCE) data revealed a higher-than-expected spike in inflation, while the Conference Board’s March consumer confidence figures indicated that the monthly confidence index—a crucial gauge of respondents’ outlooks on income, employment, and business—dropped to a concerning 12-year low.

Source: The Conference Board

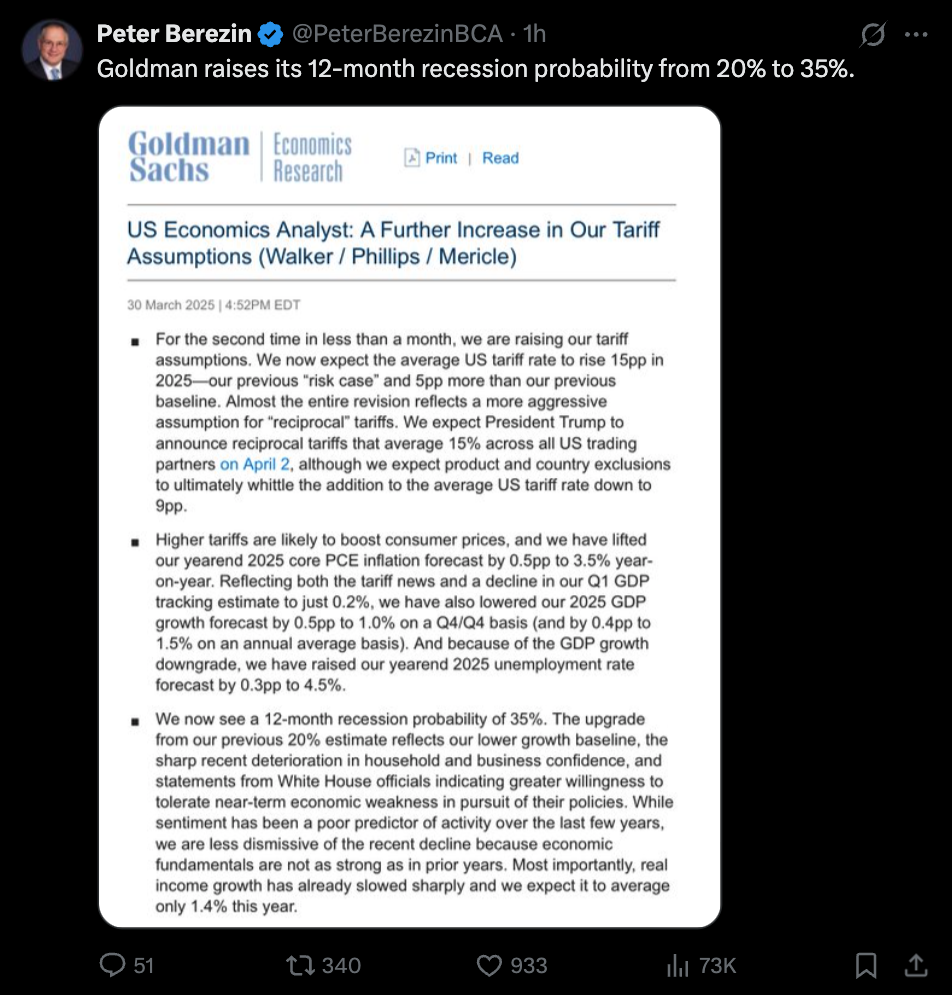

Increased Recession Risks

The likelihood of an impending recession is also gaining traction, with Goldman Sachs recently increasing its estimate of the 12-month recession probability from 20% to 35%. In their report, Goldman Sachs analysts articulated the reasoning behind this revision, stating:

“The upgrade from our previous 20% estimate reflects our lower growth baseline, a recent sharp decline in both household and business confidence, and comments from White House officials suggesting a willingness to tolerate short-term economic weaknesses to achieve their policy objectives.”

Source: X / Peter Berezin

Is There a Silver Lining to Bitcoin’s Decline?

Despite significant downward revisions from many crypto analysts regarding past predictions of Bitcoin reaching six-figure prices, institutional investors remain undeterred. They continue to engage in net positive inflows to spot ETFs, indicating a level of confidence in the asset class.

On March 30, Michael Saylor, CEO of Strategy, took to X to share his well-known orange dots Bitcoin chart, remarking, “Needs even more Orange.” This sentiment may signal continued institutional interest in Bitcoin amidst a turbulent market.

Source: X / Michael Saylor

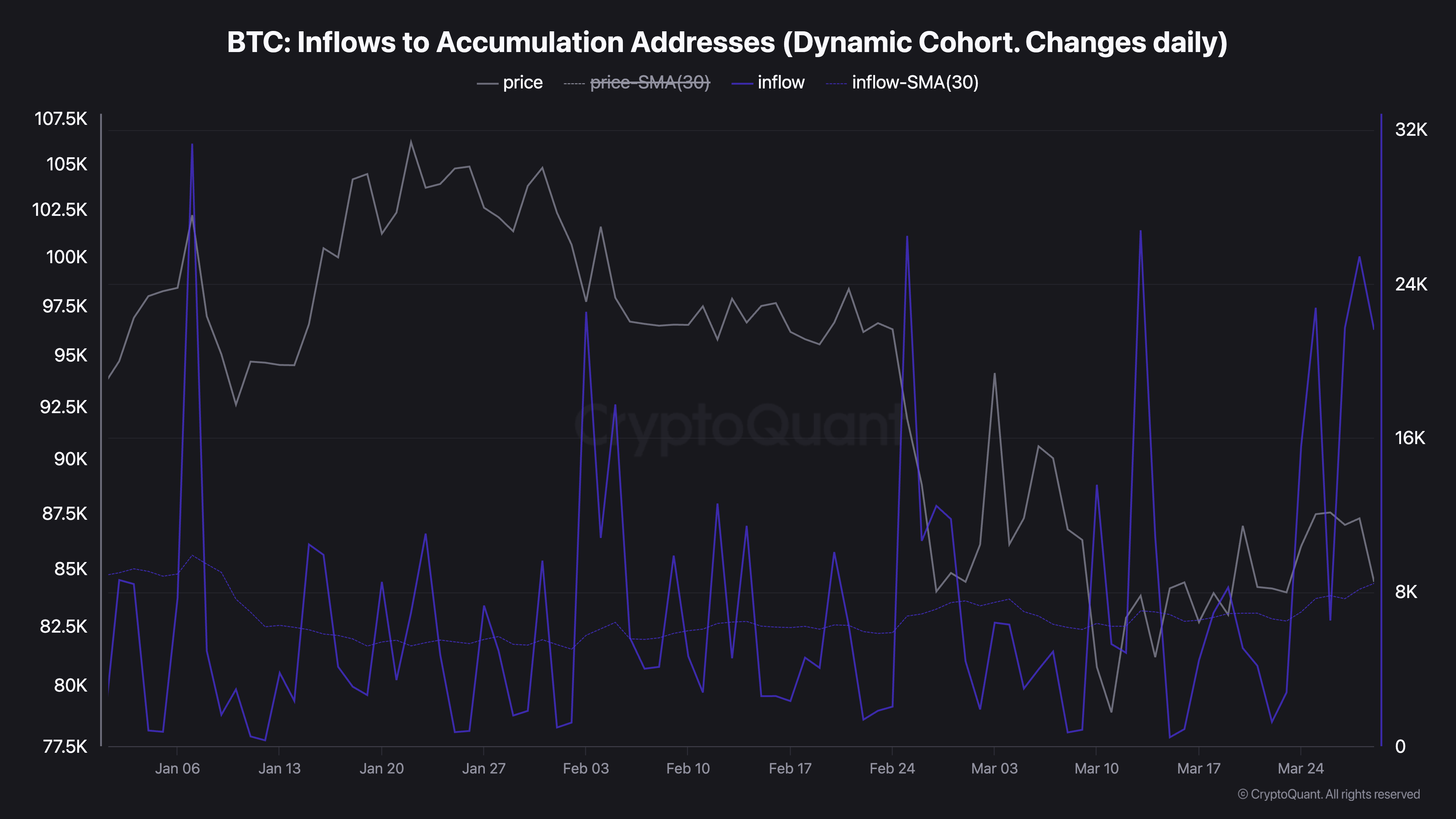

Positive Trends Amidst the Decline

According to CryptoQuant, Bitcoin inflows into accumulation addresses have consistently increased throughout the month. This suggests that despite the bearish sentiment, there are still investors seeking to accumulate Bitcoin at lower prices, which could be a sign of resilience in the market.

Source: CryptoQuant

Using AI legalese decoder for Market Insights

In an environment characterized by economic uncertainty and regulatory changes, understanding the intricacies of legal and financial documents can be crucial for making informed decisions. This is where the AI legalese decoder comes into play. This innovative tool can help traders and investors decode complex legal jargon, interpret contracts, and grasp the implications of new regulations pertaining to cryptocurrencies and other investments.

By leveraging AI legalese decoder, market participants can stay ahead of the game, allowing them to navigate the evolving landscape with clarity and confidence. Instead of getting bogged down by dense legal texts, users can gain actionable insights that help them make better investment decisions during these volatile times.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Enter your email address to Win 1 Yr Home Plan

****** just grabbed a

****** just grabbed a