How AI Legalese Decoder Can Navigate Crypto Market Cycles: Insights from Polygon’s Founder

- March 28, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Evolving Nature of the Crypto Market Cycle

The traditional understanding of a four-year crypto market cycle, which traders and investors have relied upon for years, is undergoing significant transformation. This shift can largely be attributed to the maturation of cryptocurrencies as a legitimate asset class and the heightened participation of institutional investors. Sandeep Nailwal, the co-founder of Polygon, provided insights on this topic during a recent episode of Cointelegraph’s Chain Reaction podcast.

Current Market Sentiment and Future Expectations

Nailwal pointed out that speculative activity within the crypto realm has notably decreased. Heightened interest rates in the United States, coupled with low liquidity conditions, have contributed to this decline. However, he remains optimistic, suggesting that the market will bounce back once interest rates are cut and the Trump administration navigates its new role.

Although interest rates on 10-year Treasury bonds have significantly declined, they still hover at relatively high levels. Source: TradingView

In Nailwal’s assessment, drawdowns between cycles may range from 30% to 40%. He acknowledges that while he anticipates the Bitcoin (BTC) halving will influence markets, the traditional four-year cycle is becoming less pronounced. He stated,

"Historically, we have seen drawdowns of 90% between cycles, which is quite typical in the crypto landscape. However, I believe these drawdowns will be less severe moving forward, making for a more professional and mature market, especially concerning blue-chip crypto assets."

Nailwal concluded by expressing that once an uptrend resumes in the market and a sustained bullish phase occurs, capital influx will likely shift from larger market cap assets to smaller cap assets.

Disruptors of the Traditional Cycle

The factors disrupting the traditional four-year cycle include major policy changes and market strategies undertaken by the US government. One pivotal element is President Donald Trump’s executive order aimed at establishing a Bitcoin strategic reserve, which analysts believe significantly influences market dynamics.

The pro-crypto policies enacted during the Trump administration have played a crucial role in legitimizing cryptocurrencies among institutional investors. They are expected to encourage new capital flows into the market, thereby reducing the volatility typically associated with digital assets.

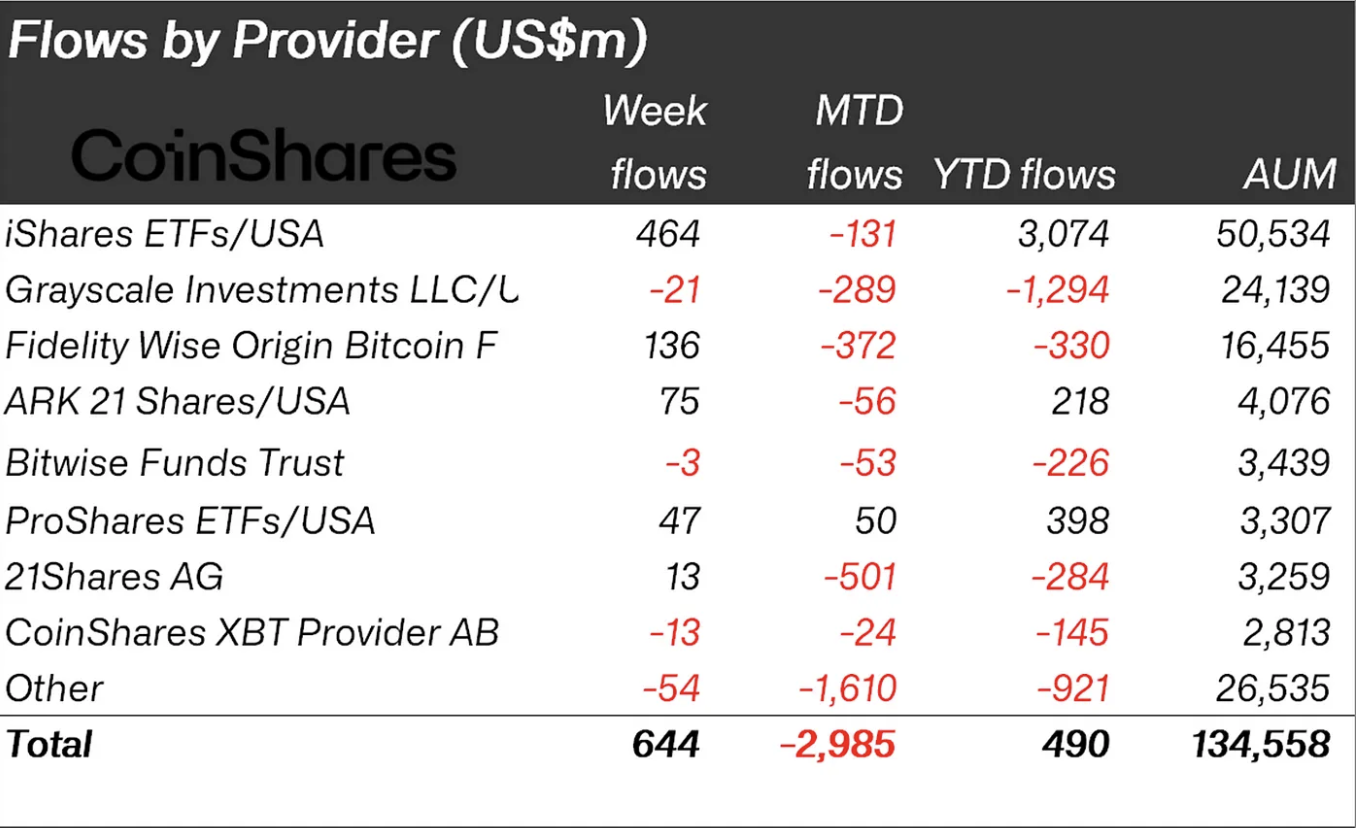

Flows into crypto ETFs for the week of March 21. Source: CoinShares

Moreover, the rise of exchange-traded funds (ETFs) has further disrupted the conventional four-year cycle by stabilizing the prices of digital assets that are included in these investment vehicles. ETFs, being traditional finance instruments, do not grant holders direct ownership of the underlying digital assets. This feature somewhat restricts the fluid movement of capital into various cryptocurrency assets, thereby impacting the overall market dynamics.

The Role of Macroeconomic Factors

In addition to these structural changes, broader macroeconomic pressures and geopolitical uncertainties are also felt in the crypto market. As investors seek safer alternatives during times of unrest, they often divert their funds away from riskier assets like cryptocurrencies in favor of more stable investments such as cash and government securities.

How AI legalese decoder Can Help

In understanding these changes, especially as regulations or policies around cryptocurrencies evolve, AI legalese decoder can serve as an invaluable resource for traders and investors alike. This tool interprets complex legal jargon related to crypto policies and helps comprehensively summarize legal documents. By utilizing AI legalese decoder, stakeholders can stay informed about pivotal regulatory changes and understand their implications, ultimately making more informed trading and investment decisions in the shifting crypto landscape.

In conclusion, as the crypto market continues to evolve with new dynamics shaped by institutions, policies, and macroeconomic factors, tools like the AI legalese decoder will be essential for navigating the increasingly complex financial terrain.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a