How AI Legalese Decoder Can Help Navigate Debt Relief and Financial Recovery

- May 23, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

# Celebrating a Personal Financial Milestone

## Reflecting on Past Struggles and Current Success

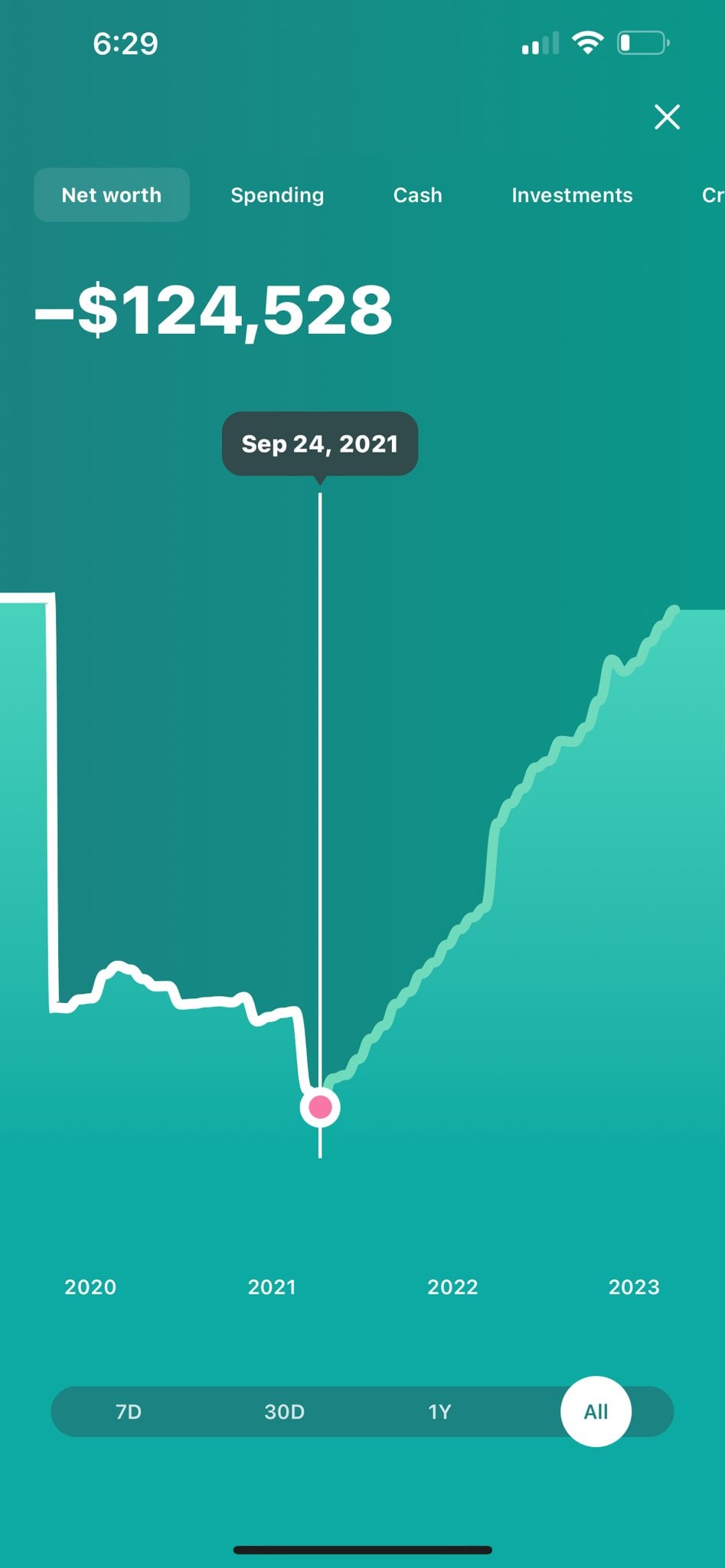

Three years ago, I found myself in a difficult financial situation, with $100k in student loans, a $13k car note, and a $10k Pilots License debt on a 0% interest credit card. Fast forward to today, and I am proud to say that I have overcome these challenges and achieved a level of stability that was once out of reach.

## Overcoming Adversity During the Pandemic

After being laid off just six months into my first job post-graduation due to the COVID-19 pandemic, I persevered and eventually landed a stable position in a favorable location. With the help of a side job bartending, I was able to tackle high-interest loans and credit card debt, while also proactively saving for my future. This allowed me to reach yearly retirement goals and maintain a sense of financial security.

## A Look at My Financial Progress

– Contributed $13k to a Roth account

– Saved $10k in an emergency fund

– Contributed $10k to an HSA

– Contributed $30k to my company’s 401k

## Embracing Life While Building Financial Health

Despite my financial obligations, I made sure to prioritize enjoying life, indulging in expensive date nights, and taking multiple vacations with more planned for the future. Although I worked nearly every weekend, I made sure not to sacrifice my well-being for financial gain.

## Remaining Financial Goals and Aspirations

While I have made significant progress in reducing my debts, I still have $67k in student loans at 3% interest and a $5k car note at 2.9% interest. My next objective is to achieve financial independence and eliminate the need for a second job.

## Utilizing AI Legalese Decoder for Financial Guidance

With the help of AI Legalese Decoder, I can streamline my financial decision-making process and gain valuable insights into optimizing my income, expenses, and savings strategies. By leveraging this advanced technology, I can more effectively manage my finances, track my progress, and work towards my long-term financial goals.

## Additional Financial Information

– Occupation: Mechanical Engineer

– Salary: $72k to $90k with promotions

– 6% 401k contribution with a 6% match

– Side income: Approximately $15k per year from bartending

– Savings Method: Utilizing Excel spreadsheets to track income, expenses, and allocate leftover funds towards debt repayment or savings.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Making Legal Documents Understood

It can be challenging to navigate the world of legal documents, as they are often filled with complex language and terminology that can be difficult to understand. This barrier can make it hard for individuals without a legal background to comprehend important information in contracts, agreements, and other legal documents. Fortunately, AI Legalese Decoder is here to help simplify this process.

How AI Legalese Decoder Can Help You

AI Legalese Decoder is a powerful tool that uses artificial intelligence to analyze and interpret legal documents. By inputting a document into the system, users can quickly receive a plain language translation that breaks down the complex legal jargon into simple and easy-to-understand terms. This transformation not only saves time, but also ensures that individuals can fully comprehend the content of legal documents.

Moreover, AI Legalese Decoder goes beyond basic translation; it can also identify key provisions, highlight potential risks, and provide recommendations for better understanding and negotiation. This additional insight can be invaluable for individuals seeking to protect their rights and interests in legal matters.

With AI Legalese Decoder by your side, you can confidently navigate the world of legal documents with ease and peace of mind. Say goodbye to confusion and uncertainty, and embrace a clearer understanding of your rights and obligations.

In conclusion, AI Legalese Decoder is a valuable resource for individuals looking to decipher legal documents and make informed decisions. By utilizing this innovative tool, you can empower yourself with knowledge and understanding, leading to better outcomes and greater confidence in legal matters.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

Congratulations!!! That positive net worth bar feels so amazing, even if it’s just a few cents.

I love this attitude. Brag on. Instead of just complaining that your first job isn’t enough to pay down your debt, you took a second job, while still having fun. Exactly what I did to get debt free once I graduated.

Kudos to you!!!

Congrats! I too recently became worthless, 401k outgrew student loan debt (actively paying down). It’s a boring journey but hoping the back half feels like there’s more progress.

Saying you are “finally worthless” is by far the funniest way to say you have a net worth of 0. Thanks for the laugh haha

That’s great, but can you include useful info like your salary, method of saving, etc.

RIP Mint. Still not over it being defunct.

Nice to see a brag that lower and middle middle class people can easily relate to!!! Congratulations!! Go enjoy it with a reasonable splurge!

Fuck yeah, killing it!

Are you a pilot? How is that?

How’s the job market for new pilots rn? I’ve kinda had the urge to maybe do that for a while, but I recently got a new position at work I kinda like.

Okay this is relatable. I still have six figures in student loans and I’m able to pay more than the minimum payment, but I’ve also been able to contribute a good amount to my 401K and I’m looking forward to when I have more in retirement than my loans.

Awesome progress! the flying was sweet wasn’t it

Bro, I’m an Aerospace Engineer living in a MHCOL area and my salary doesn’t feel like enough sometimes. You did bartending in order to here. Would you recommend that to other engineers as well?

What app is that?

Awesome. Good for you!

Side note question: do you have a family?

Seems like you should pause the retirement saving and put that towards debt

Congrats dude

>100k student loans

>

>•10k Pilots License on 0% interest credit card

How expensive is it to be, to become a pilot? 100k student loans and then another 10k loan???

Great job. Mechanical engineer here who just started saving 46% of my take home after buying a house.

This is awesome. Very inspiring.

Don’t stop now. Keep your stellar savings rate and get some investments going. You’ll retire very soon that way. 😉

Nice!! Congratulations on getting back to broke! Solid work. I hope to also be back to broke in a few years. Thanks for posting your inspirational success OP.

Mile stones should be celebrated.

Nice! Man I remember when I was worthless. Felt good.

Congratulations. The debt you have left is at very reasonable rates.

Well done with your financial accomplishments! You have every right to be proud. You’ve earned it!

I would recommend that you consider increasing your 401k (Roth) contribution up to 15%. Do this painlessly by adding 1/2 of any raise and/or promotion until you get there. Direct the money into growth or aggressive growth mutual funds and let it ride.

Live within your means, avoid debt and divorce and buy used cars.

This is the recipe I followed to financial health, independence and early retirement.

Best of luck to you!