How AI Legalese Decoder Can Help 32M/27F Navigate Big Life Changes and Achieve Financial Independence

- April 11, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

## Financial Planning for Future Life Changes

Me and my wife, with a combined income of around $450k, have been investing aggressively to secure our financial future amidst upcoming life changes. These changes include having kids, my wife potentially leaving her job for a SAHM role or a career change with a pay cut, and me pursuing a passion job related to my PhD.

### Current Investment Strategy

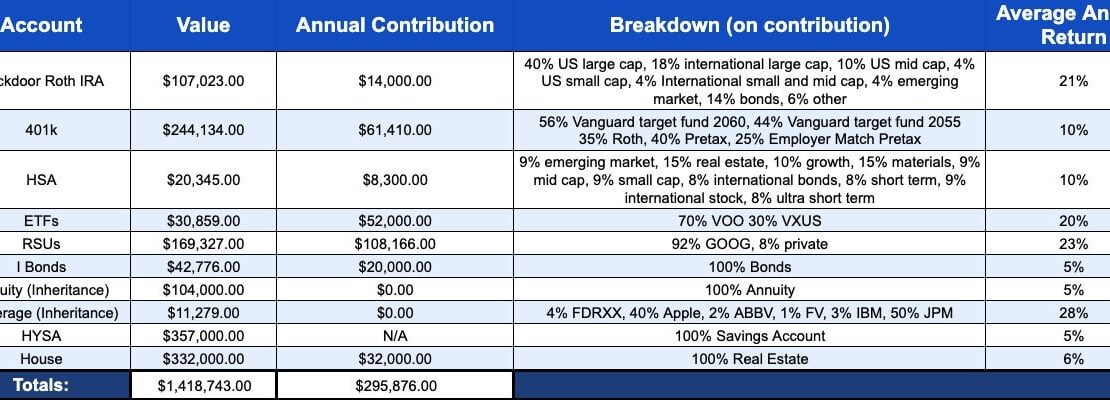

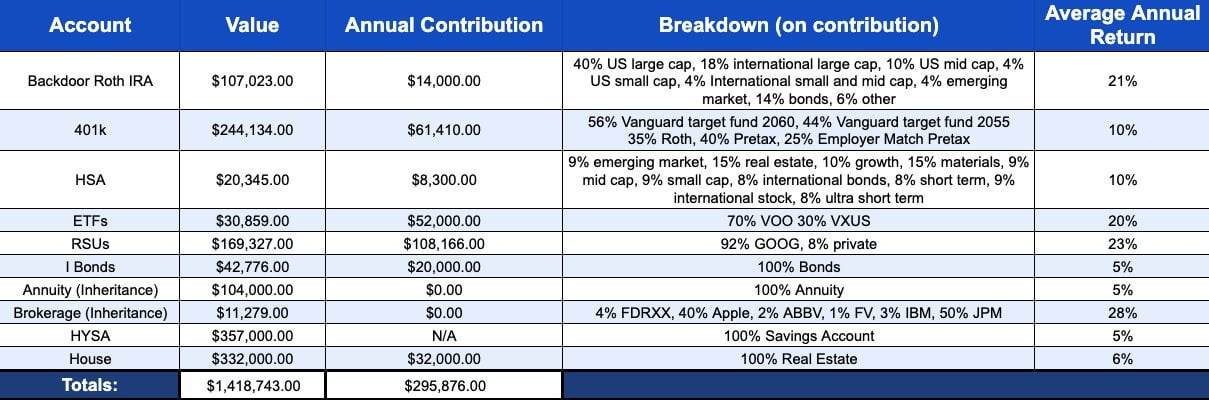

Our current investment strategy involves diversifying our portfolio across various accounts such as Backdoor Roth IRA, 401k, HSA, ETFs, RSUs, I Bonds, Annuity, Brokerage, HYSA, and our house. Each account has a specific value, annual contribution, breakdown on contributions, and average annual return.

### Seeking Advice and Recommendations

While our current plan seems solid, we are open to suggestions on better ways to invest our money and prepare for the future, considering the impending life changes. We are particularly interested in optimizing our investment strategy to ensure financial stability during these transitions.

### How AI Legalese Decoder Can Help

AI Legalese Decoder can provide valuable insights and recommendations on optimizing your investment portfolio to align with your specific financial goals and upcoming life changes. By analyzing your current investments and financial objectives, the AI tool can offer personalized advice to enhance your financial preparedness for the future.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Simplifying Legal Jargon for Everyone

Introduction

Legal documents are often filled with complex language and jargon that can be difficult for the average person to understand. This can make it challenging for individuals to navigate the legal system and protect their rights. However, with the help of AI Legalese Decoder, deciphering legal terms and contracts has never been easier.

How AI Legalese Decoder Can Help

AI Legalese Decoder is a cutting-edge tool that uses artificial intelligence to analyze and translate legal documents into plain language. By inputting a document into the AI Legalese Decoder, users can quickly and easily understand the key terms and concepts contained within it.

The AI Legalese Decoder can break down complex legal language, providing definitions and explanations for confusing terms. This can help individuals better comprehend their rights and obligations under a contract or legal agreement. Additionally, the AI Legalese Decoder can highlight any potential issues or concerns within a document, allowing users to make informed decisions about their legal matters.

Furthermore, AI Legalese Decoder can be a valuable resource for lawyers and legal professionals, saving them time and effort in translating legal documents for their clients. By using the AI Legalese Decoder, attorneys can improve their efficiency and accuracy in interpreting legal language, ultimately providing better service to their clients.

In conclusion, AI Legalese Decoder is a powerful tool that can greatly simplify the process of understanding legal documents and contracts. By leveraging the capabilities of artificial intelligence, individuals can confidently navigate the complexities of the legal system and ensure their rights are protected.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

FIRE is certainly possible but it would probably be a pretty drastic life change. I think your first steps would be to come up with a “bare bones” budget that you and your spouse can agree on. Then divide that amount by your net worth (less home value). Would you need 2-5% of your portfolio each year? You’re probably good. But if you need 10%+, you have some mate saving to do.

At first glance you look heavy in cash (HYSA) for somebody who wants to live off the portfolio for 60+ years.