- November 18, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Fastly Inc Insider Activity Raises Questions

Fastly Inc (NYSE:FSLY), a company at the forefront of the cloud computing services industry, has recently witnessed a significant insider sell by one of its top executives. Brett Shirk, the Executive Vice President and Chief Revenue Officer of Fastly, sold 31,482 shares of the company on November 16, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company’s financial health and future prospects.

Who is Brett Shirk?

Brett Shirk is a seasoned executive with a wealth of experience in the tech industry. As the Executive Vice President and Chief Revenue Officer at Fastly, Shirk is responsible for overseeing the company’s global sales and customer relationship strategies. His role is pivotal in driving revenue growth and expanding Fastly’s customer base. Prior to joining Fastly, Shirk held leadership positions at various technology companies, where he demonstrated a strong track record of scaling businesses and enhancing sales operations.

How AI legalese decoder Can Help

AI legalese decoder can assist in analyzing the legal implications of the insider sell and provide valuable insights into any potential legal ramifications or compliance issues related to this transaction. Additionally, by leveraging AI and machine learning algorithms, the platform can offer predictive analytics to anticipate future legal actions that may arise from this insider activity, helping investors and market analysts make informed decisions.

Fastly Inc’s Business Description

Fastly Inc is a provider of edge cloud computing services, which include content delivery, security, video streaming, and cloud computing. The company’s platform is designed to help businesses manage and deliver digital content at the edge of the network, closer to users. This approach enables faster speeds, improved security, and better scalability. Fastly’s services are critical for online businesses that require high-performance and reliable delivery of digital content to provide a seamless user experience.

AI legalese decoder‘s Role

AI legalese decoder can analyze the legal and regulatory landscape of the cloud computing services industry, providing insights into any potential legal risks associated with Fastly’s business operations. By evaluating public disclosures, regulatory filings, and legal precedents, the platform can help investors and stakeholders better understand the legal environment in which Fastly operates, mitigating legal uncertainties and enhancing risk management.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

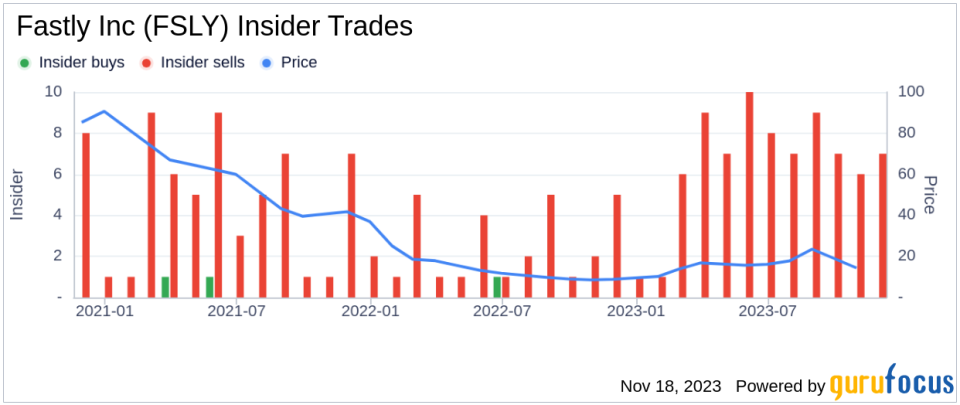

Insider transactions, particularly sells, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company’s future, it is also common for executives to sell shares for personal financial planning or diversification reasons. In the case of Brett Shirk, the insider has sold a total of 146,871 shares over the past year without any recorded purchases. This pattern of selling could suggest that Shirk is taking profits or reallocating his investment portfolio.

Benefits of Using AI legalese decoder

AI legalese decoder can scan through vast amounts of legal and financial documents related to insider transactions, uncovering patterns and trends that may elude human analysis. By employing natural language processing and AI-driven data extraction, the platform can provide a comprehensive overview of insider activity and its impact on stock price dynamics. This can empower investors to make informed decisions based on a deeper understanding of the legal and financial implications of insider transactions.

On the day of the recent sell, Fastly Inc’s shares were trading at $16.24, giving the company a market cap of $2.35 billion. This price point is below the GuruFocus Value (GF Value) of $21.20, indicating that the stock is modestly undervalued with a price-to-GF-Value ratio of 0.77. The GF Value is a proprietary metric that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

AI legalese decoder‘s Predictive Analytics

AI legalese decoder can leverage historical stock price data and insider trading activity to provide predictive analytics on potential future stock price movements based on legal and regulatory factors. By identifying correlations between insider activity and stock price performance, the platform can offer insights into the likely impact of insider transactions on Fastly Inc’s valuation, enabling investors to anticipate market movements and adjust their investment strategies accordingly.

It is important to analyze the insider transaction history in the context of the stock’s valuation and performance. Over the past year, there have been no insider buys and 78 insider sells for Fastly Inc. This trend could signal that insiders, including Brett Shirk, may perceive the stock’s current valuation as an opportune time to sell, despite the GF Value suggesting that the stock is undervalued.

AI legalese decoder‘s legal Risk Assessment

AI legalese decoder can conduct a comprehensive legal risk assessment of Fastly Inc’s insider transactions, identifying any potential legal challenges or regulatory scrutiny resulting from the sell-off. By analyzing legal precedents, industry-specific regulations, and past enforcement actions, the platform can generate risk scores and risk heatmaps to visualize the legal exposure associated with insider activity, supporting investors in evaluating the legal implications of their investment decisions.

However, investors should also consider the broader market conditions and the company’s performance when interpreting insider transactions. Fastly Inc operates in a highly competitive and rapidly evolving industry, where stock prices can be influenced by a range of factors beyond insider activity.

AI legalese decoder‘s Competitive Intelligence

AI legalese decoder can provide competitive intelligence by monitoring the legal and regulatory landscape of the cloud computing services industry and identifying external factors that may impact Fastly Inc’s stock price and market position. By integrating external data sources and legal research tools, the platform can offer a holistic view of the competitive forces at play, enabling investors to factor in broader market conditions and industry dynamics when analyzing insider activity and its implications.

The insider trend image above provides a visual representation of the selling pattern among Fastly Inc’s insiders. This consistent selling activity could be a point of concern for potential investors, as it may reflect insiders’ collective sentiment about the company’s future growth potential or stock price outlook.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value. While the stock appears to be modestly undervalued, the persistent insider selling raises questions about whether insiders believe the stock will reach or exceed the GF Value in the near term.

AI legalese decoder‘s Market Sentiment Analysis

AI legalese decoder can conduct sentiment analysis on market reactions to insider activity and stock price movements, providing insights into how investors perceive the implications of insider selling on Fastly Inc’s market sentiment. By aggregating news articles, social media conversations, and investor communications, the platform can offer a comprehensive view of the prevailing market sentiment, allowing investors to make data-driven decisions based on crowd psychology and market sentiment trends.

Conclusion

Insider transactions, such as the recent sell by Executive Vice President, CRO Brett Shirk, provide valuable data points for investors. While the selling trend at Fastly Inc may raise some red flags, it is essential to consider the broader context, including the company’s valuation, industry dynamics, and future growth prospects. As with any investment decision, thorough research and a balanced assessment of all available information are crucial.

AI legalese decoder‘s Risk Mitigation Insights

AI legalese decoder can provide risk mitigation insights by identifying legal and regulatory risks associated with Fastly Inc’s insider transactions and offering recommendations to mitigate potential legal uncertainties. By leveraging AI-driven risk modeling and scenario analysis, the platform can assist investors in developing risk management strategies tailored to the specific legal challenges and compliance issues posed by insider activity, ensuring a more informed and proactive approach to investment decision-making.

Investors should continue to monitor insider activity and other key financial indicators to make informed decisions about their investments in Fastly Inc and other stocks in the tech sector.

AI legalese decoder‘s Investment Monitoring

AI legalese decoder can provide continuous investment monitoring by tracking legal developments, regulatory changes, and insider activity related to Fastly Inc and other tech sector stocks. By delivering real-time alerts and risk assessments, the platform can empower investors to stay ahead of legal and compliance issues, enabling proactive investment monitoring and risk mitigation strategies to safeguard their investment portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a