How AI Legalese Decoder Can Clarify the Impact of Accelerating AI Data Storage Demand on Seagate Technology’s Investment Case

- October 25, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

### Seagate Technology: A Rising Star in AI-Driven Data Storage

#### Analysts Highlight Seagate’s Strategic Advantage

Earlier this week, **Seagate Technology** came under the spotlight as analysts identified it as a key beneficiary of the rapidly increasing demand for AI-driven data storage solutions. The company’s ongoing transition toward mass-capacity solutions specifically for data centers has garnered significant attention. This strategic shift not only enhances the company’s market position but also addresses the crucial needs of modern enterprises that rely on vast amounts of data processing and storage.

#### Momentum Growth Investors Show Interest

An intriguing development is Seagate’s growing appeal among momentum growth investors. The company’s financial health has improved remarkably, as evidenced by rising gross margins and enhanced free cash flow. Additionally, the management’s decision to resume share repurchases reflects confidence in the company’s future, attracting those investors looking for robust growth opportunities. The combination of these factors positions Seagate favorably for long-term growth.

#### Seagate’s Expanding Role in Large-Scale AI Data Storage

In our exploration of how Seagate’s expanding role in large-scale AI data storage strengthens its long-term investment outlook, it’s essential to emphasize the technology’s transformative potential. Analysts expect the company to continue harnessing this demand, focusing on product innovation that aligns with the evolving needs of large data centers and cloud services providers. By doing so, Seagate enhances its viability in an industry marked by rapid technological advancement.

These companies have proven resilient post-COVID and are well-prepared to navigate trade challenges, allowing forward-thinking investors to fortify their portfolios before external pressures escalate.

### Key Investment Narrative for Seagate Technology Holdings

Owning stock in **Seagate Technology** hinges on the belief in the ongoing surge in data storage demand. The rise of AI and cloud computing has propelled data center growth on a global scale. While Seagate’s share price has recently surged due to positive analyst sentiment, this increase does not alter the fundamental short-term catalysts. The primary factor remains the accelerated adoption of mass-capacity drives and the inherent risk posed by competitive technology shifts, such as SSDs encroaching on HDD market share.

The latest reports underscore ongoing trends without fundamentally changing the short-term outlook. Seagate’s announcement in July about the shipping of over one million **Mozaic hard drives** and the introduction of new 30TB HAMR-based models signals a strong commitment to product innovation, crucial for capturing opportunities in the high-capacity storage market. These innovations target the burgeoning requirements of data centers and cloud customers, which is central to the current excitement surrounding Seagate’s stock.

However, investors must remain vigilant regarding the imminent risk posed by rapid technological innovation in storage hardware. The market landscape could change swiftly as new technologies emerge, affecting current business models and growth trajectories.

For a comprehensive view of Seagate Technology Holdings, click here to read the full narrative (it’s free!).

### Future Projections: Revenue and Earnings Growth

Seagate Technology Holdings is projected to attain an impressive $12.0 billion in revenue and $2.5 billion in earnings by the year 2028. These projections are founded on a sound assumption of annual revenue growth at 9.5%, alongside a $1.0 billion increase in earnings from its current position of $1.5 billion.

By analyzing these forecasts, it is determined that Seagate’s fair value could stand at $204.35, indicating a 13% downside relative to its current market price.

### Exploring Varied Perspectives on Seagate

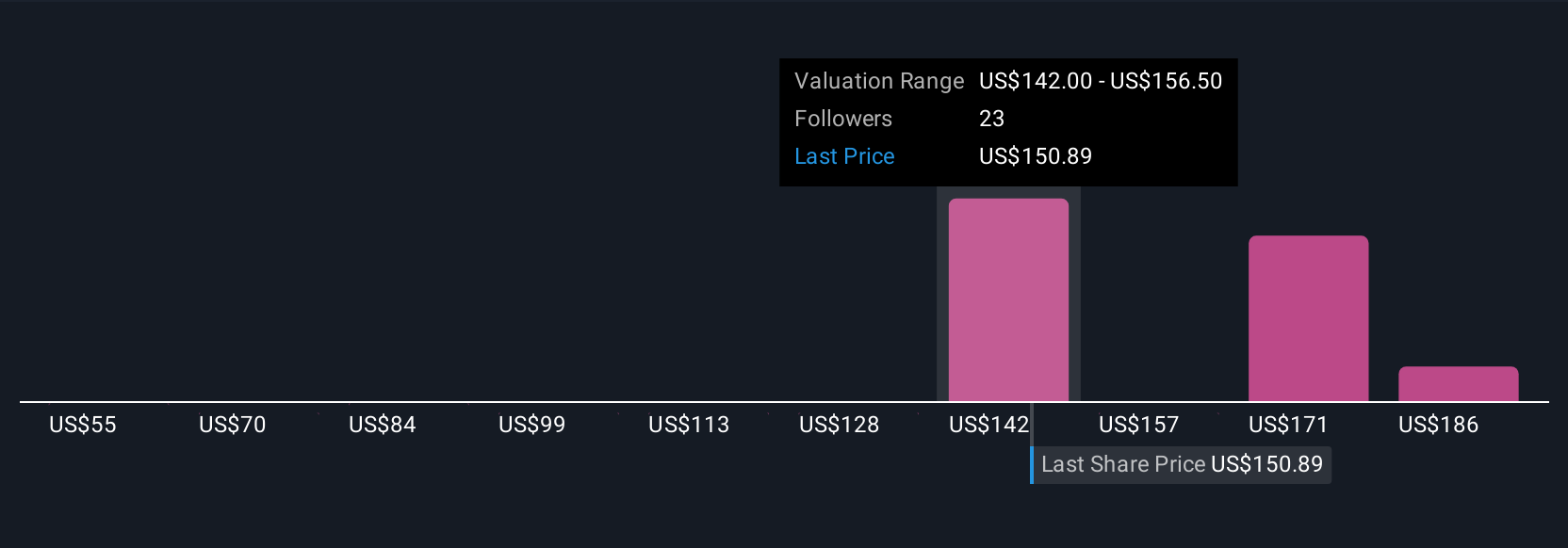

The Simply Wall St community’s fair value estimates for Seagate Technologies range from approximately US$97 to US$230 based on four different analyses. This disparity illustrates how opinions can vary significantly among analysts. While increasing demand for mass-capacity storage could catalyze growth, the competitive landscape remains a critical factor in evaluating the company’s future outlook.

Explore four other fair value estimates related to Seagate Technology Holdings and discover the potential for the stock’s value to reach as high as $230.17!

### Crafting Your Unique Seagate Technology Holdings Narrative

Do you have a different perspective? Why not create your own investment narrative in under three minutes? Remember, extraordinary investment returns often stem from independent thinking rather than following the crowd.

### Ready to Explore Diverse Investment Strategies?

A selection of stocks is generating buzz today, according to our analysis—act swiftly before the market price catches up!

### Important Advisory Note

This article by Simply Wall St is intended for informational purposes only. **Our commentary is based on historical data and analyst forecasts, utilizing an unbiased methodology. It does not serve as financial advice or a recommendation to buy or sell any stock and does not consider individual objectives or financial situations.** Our goal is to provide long-term focused analysis driven by substantive data. Please note, our analysis may not encapsulate the latest price-sensitive company announcements or qualitative factors. Simply Wall St holds no positions in any mentioned stocks.

### Enhance Your Investment Journey with AI legalese decoder

When navigating the intricate world of stock investments, including those surrounding Seagate Technology, it’s essential to understand the legal documents and reports associated with your trades. **AI legalese decoder** can assist by simplifying complex legal jargon and presenting it in a user-friendly format. This tool ensures you comprehend the essential facets of legal agreements, helping you make informed decisions that align with your investment goals.

### Manage All Your Stock Portfolios Seamlessly

We’ve developed the **ultimate portfolio companion** designed for stock investors, and it’s available for free!

– Connect an unlimited number of portfolios and view your total in one currency.

– Receive alerts about risks or new warning signs via email or mobile notifications.

– Keep track of your stocks’ fair values.

Try a demo portfolio at no cost!

#### Feedback and Concerns

**Have thoughts about this article? We’d love to hear from you.** Feel free to contact us directly or email us at [email protected].

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a