How AI Legalese Decoder Can Clarify Bitcoin Price Reversals Amidst Retail Trading Surge in Trump-Related Tokens

- January 15, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

## Bitcoin Stalling Amid Market Shifts and Declining Demand

– **Bitcoin’s price experienced a plateau at $100,600 on Wednesday, capping its daily gains at 3%.**

– **Market analytics indicate dwindling demand for Bitcoin as traders favor Trump-associated assets and various lending protocols.**

– **Bitcoin’s on-chain transactions have dropped a staggering 37% over the last three days, suggesting that the current market rally is primarily driven by a shrinking pool of active buyers.**

On Wednesday, Bitcoin’s price peaked at $100,686, yielding a 3.3% gain within that 24-hour period. Analysis of market conditions reveals that many traders are leaning towards altcoin investments, a shift potentially prompted by VanEck’s recent filing for an ETF.

## Impact of VanEck’s ETF Filing on Altcoin Markets

Bitcoin saw its price reach $100,686 on Wednesday, resulting in a daily gain of 3.6%. This price increase coincides with VanEck’s submission for an Onchain Economy ETF to the U.S. Securities and Exchange Commission (SEC) on January 15, 2025. The ETF aims to allocate at least 80% of its assets to companies involved in digital transformation and digital assets, covering areas such as software development, mining operations, and cryptocurrency exchanges.

Despite Bitcoin’s modest uptick, altcoins have outstripped its performance significantly. The total market capitalization for altcoins surged over 8.6% on Wednesday. This trend indicates that investors are increasingly gravitating towards altcoins, potentially in anticipation of regulatory approvals for ETFs focused on these alternative cryptocurrencies.

In essence, VanEck’s recent ETF filing seems to have injected vitality into the altcoin market, causing a notable shift in investor sentiment away from Bitcoin. While Bitcoin experienced slight gains, it appears that rising interest in altcoins may have redirected capital away from BTC, putting pressure on its capacity to sustain upward growth.

## Decline in Bitcoin Transactions Signals Market Challenges

Bitcoin’s recent 3.6% price gain, which lags behind wider market trends, raises questions about the durability of its upward momentum. Compounding these concerns is the observable decline in recent on-chain transaction activity, pointing to potential risks that could hinder Bitcoin’s positive trend.

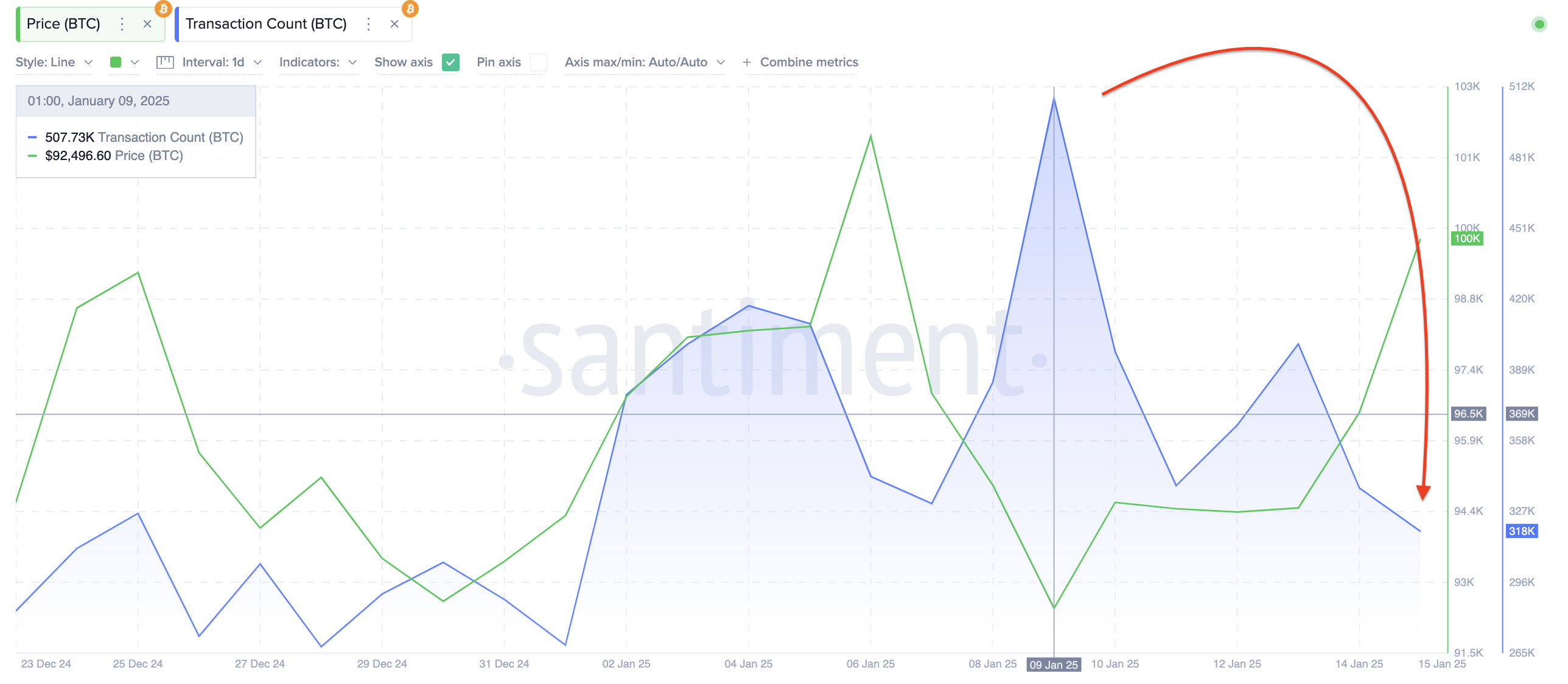

Although the broader cryptocurrency market has experienced a bullish flip, the activity within Bitcoin’s primary blockchain shows a troubling decrease. The chart from Santiment below illustrates this declining trend in daily transaction counts on the Bitcoin blockchain.

At the market’s recent peak on January 9, investors conducted a staggering 507,730 transactions on the Bitcoin network. However, as of Wednesday, this number plunged by 37%, dropping to approximately 318,000 transactions. Such a dramatic reduction in transaction volume, especially during a price increase, raises several bearish flags.

One major implication of these figures is that retail traders seem largely absent from the current market surge, which could be contributing to the significant drop in transaction counts witnessed over the past three days. Moreover, this data reveals that Bitcoin’s latest price movements are increasingly dependent upon a less diverse pool of traders.

The diminishing transaction volume heightens worries that Bitcoin will find it difficult to sustain upward trends. With fewer active traders, Bitcoin becomes more susceptible to sudden price fluctuations, particularly if institutional investors exploit thin liquidity to manipulate favorable price movements.

## How AI legalese decoder Can Support Traders Amid Market Uncertainty

In light of these challenging market conditions, the AI legalese decoder can play a crucial role for traders and investors. The decoder simplifies complex legal jargon and regulatory texts associated with cryptocurrencies and investments, making it easier for stakeholders to understand the implications of new filings like those from VanEck and other significant market developments.

By breaking down legal language, the AI legalese decoder equips traders with the knowledge necessary to navigate the evolving regulatory landscape. This ensures that they can make informed decisions about their investments, whether they choose to pursue Bitcoin or explore altcoin opportunities. Understanding the legal structures behind asset movements and ETF approvals can significantly impact trading strategies in times of uncertainty.

As traders navigate these market challenges, utilizing tools like the AI legalese decoder not only enhances comprehension but also instills confidence in decision-making processes. Investing in cryptocurrencies involves a myriad of legal considerations, and being informed can spell the difference between success and setbacks.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a