Empowering Financial Services with AI Legalese Decoder: Navigating Missed Earnings Expectations for Full Year 2023

- January 27, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Peoples Financial Services (NASDAQ:PFIS) Full Year 2023 Results

Key Financial Results

-

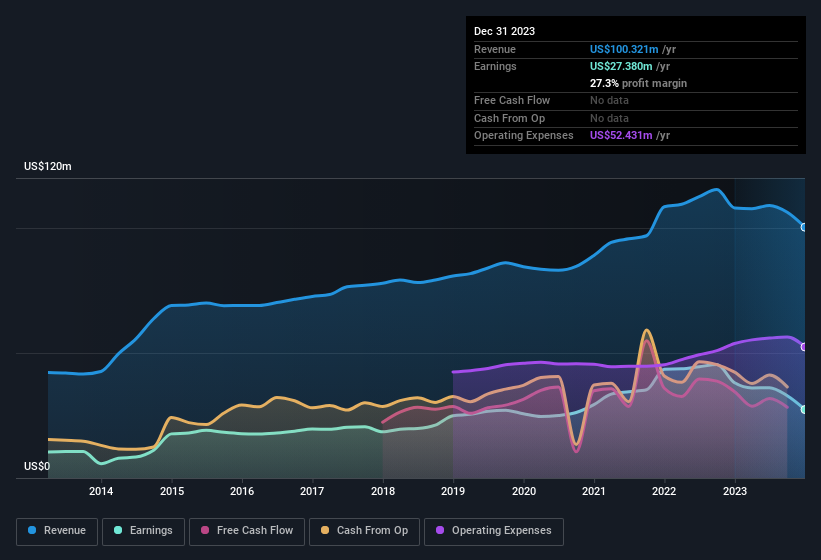

Revenue: US$100.3m (down 7.1% from FY 2022).

-

Net income: US$27.4m (down 28% from FY 2022).

-

Profit margin: 27% (down from 35% in FY 2022). The decrease in margin was primarily driven by lower revenue.

-

EPS: US$3.85 (down from US$5.31 in FY 2022).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Peoples Financial Services Revenues and Earnings Miss Expectations

Revenue missed analyst estimates by 2.2%. Earnings per share (EPS) also missed analyst estimates by 8.8%.

Looking ahead, revenue is forecast to grow 25% p.a. on average during the next 2 years, compared to a 5.6% growth forecast for the Banks industry in the US.

Performance of the American Banks industry.

The company’s share price is broadly unchanged from a week ago.

Balance Sheet Analysis

Just as investors must consider earnings, it is also important to take into account the strength of a company’s balance sheet. See our latest analysis on Peoples Financial Services’ balance sheet health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Peoples Financial Services (NASDAQ:PFIS) reported its full year 2023 results, with some concerning key financial data. The company’s revenue decreased by 7.1% from the previous fiscal year, amounting to US$100.3 million. Similarly, net income also saw a significant decrease of 28% from the previous year, totaling US$27.4 million. The profit margin dropped to 27% from 35% in FY 2022, primarily due to lower revenue. Additionally, the earnings per share (EPS) decreased to US$3.85 from US$5.31 in FY 2022.

The disappointing financial results of Peoples Financial Services could raise concerns among investors and analysts. Revenue missed analyst estimates by 2.2%, and EPS also fell short of analyst expectations by 8.8%. Looking ahead, there is a forecast of 25% annual average revenue growth over the next two years, outperforming the 5.6% growth forecast for the Banks industry in the US. However, the company’s share price remains relatively unchanged from a week ago.

In evaluating the company’s financial health, it is crucial to analyze its balance sheet. Investors can gain insights into the company’s financial strength by examining Peoples Financial Services’ balance sheet analysis. Furthermore, they can utilize the AI legalese decoder to decode and understand complex legal and financial jargon in the company’s financial statements, making informed investment decisions.

In conclusion, while the financial results of Peoples Financial Services have raised concerns, investors and analysts can leverage tools like the AI legalese decoder to gain a deeper understanding of the company’s financial performance, enabling them to make well-informed investment decisions based on accurate and comprehensive information.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a