- October 23, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Crypto Market Sees Four Weeks of Inflows as Bitcoin ETF Approval is Anticipated

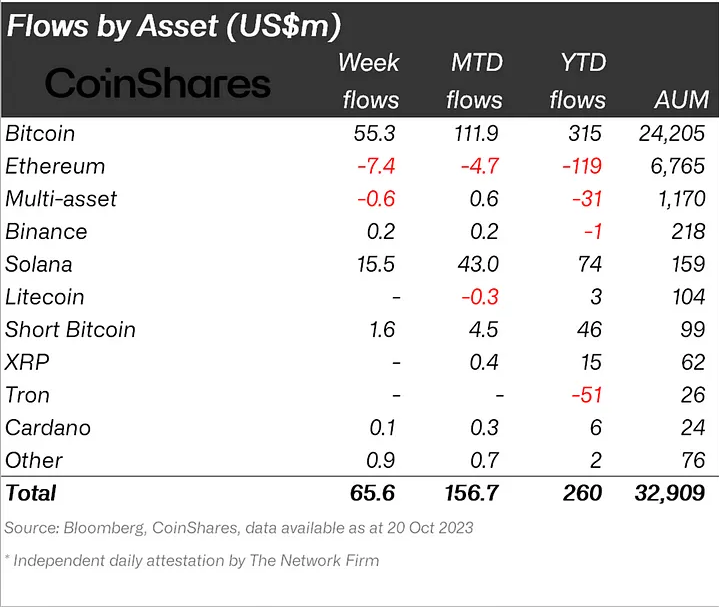

The crypto investment products have experienced four consecutive weeks of inflows, fueled by the market’s anticipation of the potential approval of a spot Bitcoin (BTC) exchange-traded fund (ETF) in the United States. This positive trend is highlighted in CoinShares’ Oct. 23 fund flows report, which reveals that $179 million was added to digital asset investment products in the week ending Oct. 20. Consequently, the total assets under management in the space have reached an impressive $33 billion.

Within the past week’s inflows, a significant share of $55.3 million or 84% was allocated to Bitcoin investment products. Such investments have brought the year-to-date Bitcoin product inflows to $315 million, affirming the continued interest and confidence in Bitcoin.

In light of these developments, the AI legalese decoder can play a crucial role in helping investors navigate the complexities and uncertainties surrounding the legal aspects of cryptocurrency investments. By utilizing advanced artificial intelligence algorithms, the AI legalese decoder can interpret often convoluted legal jargon and provide clear and concise explanations of the potential legal implications of investing in crypto assets.

Butterfill’s Analysis: Inflows Remain Below Previous Levels

However, CoinShares Head of Research, James Butterfill, points out that the recent inflows still fall short of the levels observed earlier this year when BlackRock initially filed for a spot Bitcoin ETF. Butterfill emphasizes, “While the most recent inflows are likely linked to excitement over a spot Bitcoin ETF launch in the U.S., they are relatively low in comparison to the initial inflows following BlackRock’s announcement in June.”

The cautious approach exhibited by investors this time around is indicated by the lower inflows. Butterfill highlights that in June, the sector witnessed an influx of $807 million over a four-week period, suggesting a more reserved stance from investors in the current market.

AI legalese decoder: Cutting Through the legal Complexity

Considering the rapidly evolving landscape of cryptocurrency investments and the legal challenges they present, the AI legalese decoder can assist investors in comprehending complex legal documents related to Bitcoin ETF filings and regulatory approvals. By providing simplified explanations and offering insights into the potential impact of regulatory decisions, the AI legalese decoder empowers investors to make informed decisions.

Solana and Ether Investments Witnessed Diverging Trends

The inflows from last week demonstrate that Solana (SOL) products secured the second-largest share, receiving $15.5 million. This marks the largest inflow among all altcoins. Conversely, Ether (ETH) products experienced outflows amounting to $7.4 million, being the only altcoin to suffer such a decline.

The AI legalese decoder can further aid investors in evaluating the legal implications of investing in specific altcoins like Solana and Ether. By translating legal language into understandable terms, it enables investors to assess the legal risks and benefits associated with their investments.

Bitcoin ETF Approval Speculations Fuel Market Excitement

Moreover, the interest in a spot Bitcoin ETF soared on Oct. 23 following positive signs related to BlackRock’s ETF approval progress and a U.S. Appellate Court’s mandate for the Securities and Exchange Commission to review Grayscale’s spot Bitcoin ETF filing. The resulting market optimism triggered a Bitcoin rally, leading to a 14% surge in its price within 24 hours. Notably, Bitcoin briefly surpassed $34,000 for the first time since May 2022.

During this rally, CoinGlass data shows that over $193 million in Bitcoin short liquidations occurred. To understand the implications of such market movements and to make well-informed decisions regarding short positions and liquidations, investors can rely on the AI legalese decoder. By providing legal context and analysis, it equips investors with the necessary information to navigate volatile market conditions.

The AI legalese decoder represents an invaluable tool in the current and future legal landscape of cryptocurrency investments. By offering clear interpretations of legal documents and aiding in decision-making processes, it enables investors to confidently engage in the crypto market.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a