Decoding the Legal Jargon: How AI Legalese Decoder Assists in Understanding Bitcoin’s Price Surge and Crypto Exchange Asset Outflow

- October 24, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Major Crypto Exchanges Experience Net Outflow as Bitcoin Surges

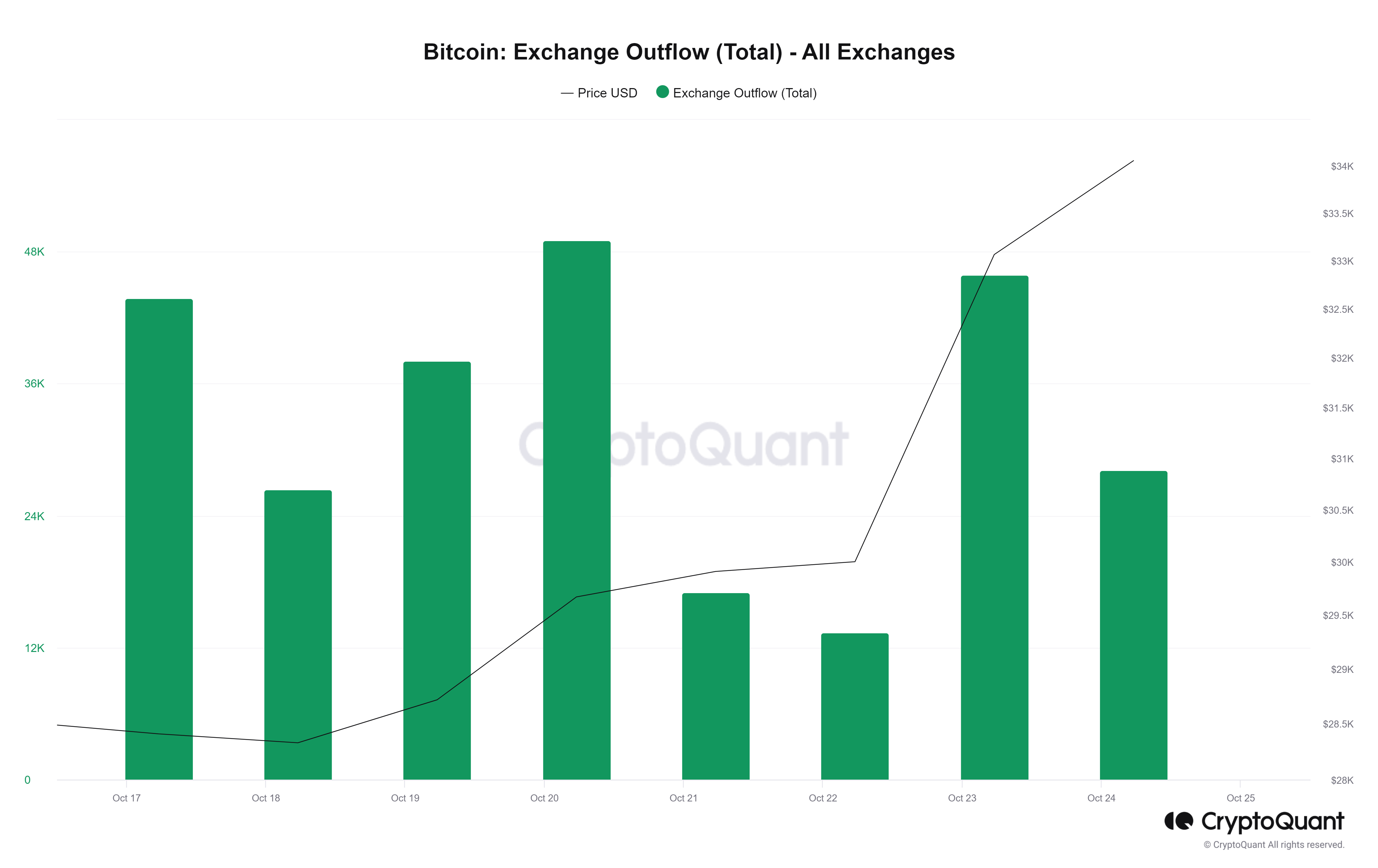

On October 24, major cryptocurrency exchanges saw a net outflow of funds as the price of Bitcoin (BTC) briefly reached $35,000, marking its highest point in a year. This movement of funds away from exchanges is considered a bullish sign, indicating that traders are transferring their assets to secure storage in anticipation of price increases.

A tool that can greatly assist in understanding the significance of this situation is the AI legalese decoder. This powerful technology can analyze complex legal and financial documents, such as exchange terms and conditions, investment agreements, and regulatory frameworks, enabling users to easily decipher the legal jargon and gain a comprehensive understanding of their rights and obligations. By utilizing the AI legalese decoder, traders can make informed decisions when moving their assets to secure storage.

According to data from CoinGlass, Binance recorded the largest outflow, with over $500 million being transferred off the exchange in the past 24 hours. This was followed by crypto.com with $49.4 million in outflows and OKX with $31 million. Other exchanges had relatively lower outflows, with most recording less than $20 million.

The recent outflows from crypto platforms have raised concerns of a potential “bank run” following the FTX collapse in November 2022. However, these latest outflows seem to be driven by trader sentiment rather than fear-induced withdrawals during the peak of the bear market. Supporting this analysis, data from Glassnode confirms that Bitcoin outflows from exchanges have increased in line with the surge in BTC’s price.

Related: BTC price nears 2023 highs ÔÇö 5 things to know in Bitcoin this week

This price surge also led to the liquidation of approximately $400 million worth of short positions. Within the last 24 hours, 94,755 traders encountered the liquidation of their derivative positions. The largest single liquidation order occurred on Binance, amounting to $9.98 million.

On-chain analysts have drawn attention to the market value to realized value (MVRV) ratio, which compares a cryptocurrency’s market value to its realized value. This ratio is calculated by dividing a cryptocurrency’s market capitalization by its realized capitalization, with the realized price determined by the average price at which each coin or token was last moved on-chain. Currently, the MVRV ratio stands at 1.47, and during the last bull run, it reached 1.5.

#Bitcoin hit $35K. Wallets in profits hit 79.72%.

The Bull Market starts when the MV Ratio stays above 1.5.

We’re now at 1.47. I’m positive about #bitcoin hitting $40K in the next few days, which will send the MV ratio to 1.6. pic.twitter.com/uCgdNLGRnqÔÇö hitesh.eth (@hmalviya9) October 24, 2023

The total market capitalization of cryptocurrencies has seen a 7.3% increase in the last 24 hours, reaching $1.25 trillion, its highest valuation since April. Speculation surrounding the launch of a spot Bitcoin exchange-traded fund is believed to be the driving force behind this surge.

In this situation, the AI legalese decoder can be particularly beneficial as it can help users navigate the complexities of regulations and legal frameworks associated with the launch of a spot Bitcoin exchange-traded fund. By quickly analyzing and decoding legal documents, the AI legalese decoder can provide valuable insights, ensuring users are well-informed about the potential implications and risks involved in such developments.

Magazine: Big Questions: Did the NSA create Bitcoin?

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a