Decoding the Future: How AI Legalese Decoder Can Clarify Peter Brandt’s Predictions on Bitcoin’s Next Bull Run Peak

- December 23, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Current Trends in Bitcoin Market Participation

Overview of the Bitcoin Market Situation

Despite significant accumulation by Bitcoin Exchange-Traded Funds (ETFs) and Digital Asset Trusts (DATs) this year, the interest among retail traders has not soared to the levels seen in previous market cycles. This trend raises an intriguing question about the future of Bitcoin as a widely accepted investment.

Experienced market analysts, including Ki Young Ju, CEO of CryptoQuant, and veteran trader Peter Brandt, have provided their insights regarding Bitcoin’s future. Their assessments delve into the short, medium, and long-term outlook for Bitcoin, offering investors a comprehensive view of the cryptocurrency’s potential trajectory.

How AI legalese decoder Can Help: In an evolving market like Bitcoin, the complexity of regulatory frameworks and legal documents can be overwhelming. Using the AI legalese decoder can simplify this information, allowing investors to better understand the implications of legal regulations before making investment decisions.

Short-Term Market Outlook

In the immediate term, Bitcoin appears to be grappling with challenges that may hinder its recovery. The evident weakness in Bitcoin’s performance is reflected in declining stablecoin reserves.

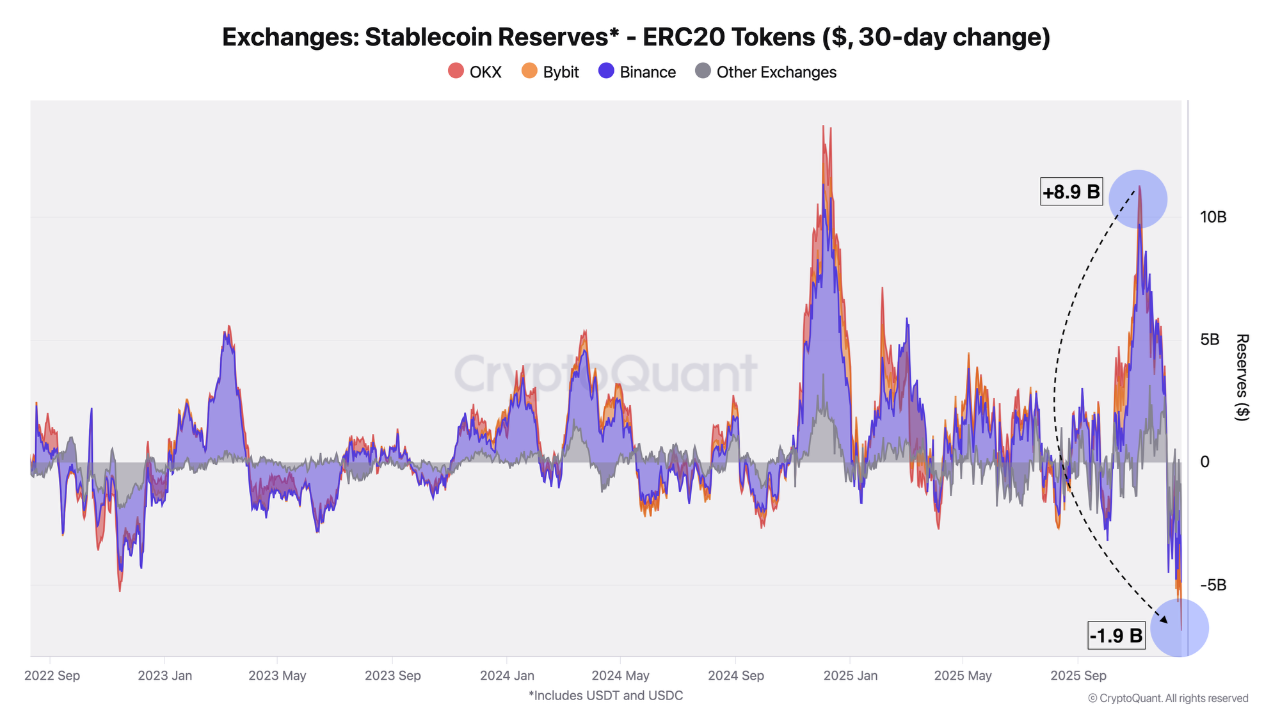

Recent data from CryptoQuant indicates a sharp decline in stablecoin reserves across major exchanges, with capital outflows nearing $1.9 billion within just a month. This data points to a critical shift in investor behavior. The prevailing trend demonstrates that individual investors are moving away from the market, which can be interpreted as a lack of confidence in Bitcoin’s short-term recovery prospects.

Stablecoin Reserves on Exchanges. Source: CryptoQuant.

Binance, one of the leading exchanges in terms of liquidity, typically reflects investor readiness to capitalize on market conditions through stablecoin balances. However, recent data suggests that the reserves of ERC-20 stablecoins on Binance and other centralized platforms have seen a significant reduction. This trend hints at a general withdrawal of retail investors from the market.

"This movement suggests a clear lack of investor interest in immediate market exposure. Rather than keeping their stablecoins on exchanges while waiting for opportunities, some investors have chosen to withdraw them," analyst Darkfost remarked.

Given these developments, Bitcoin faces an uphill battle in building sufficient buying pressure, further curtailing its upward potential in the short term.

Medium-Term Market Outlook

Transitioning to the medium-term perspective, Ki Young Ju from CryptoQuant notes a gradual decline in on-chain capital inflows into Bitcoin. After a prolonged period of growth spanning approximately 2.5 years, the realized market cap has stagnated over the last month. This metric illustrates the total value of Bitcoin based on its last purchase price, and its stagnation raises questions about continued market interest.

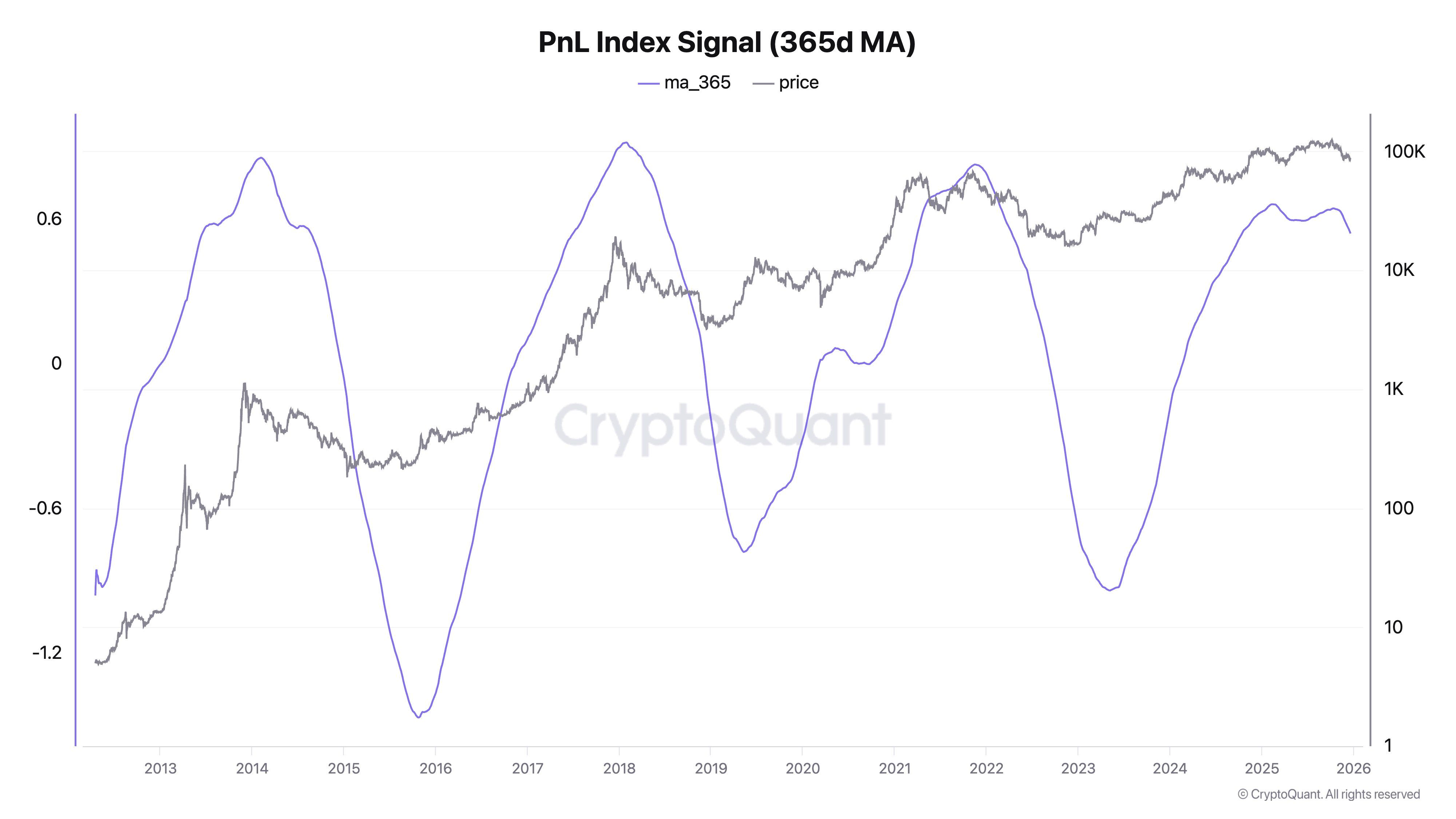

PnL Index Signal. Source: CryptoQuant.

Moreover, the PnL Index Signal, which monitors profit and loss relative to the cost basis of all Bitcoin wallets, has remained relatively flat since early 2025. Recently, it has begun trending downward as we approach the year’s end, suggesting that increasing losses may be on the horizon for many investors.

"Sentiment recovery might take a few months," Ki Young Ju predicted, indicating prolonged challenges ahead.

Long-Term Market Outlook

For the long-term outlook, however, most analysts remain cautiously optimistic. Veteran trader Peter Brandt, whose experience dates back to 1975, maintains a bullish perspective on Bitcoin. He acknowledges that Bitcoin has undergone five logarithmic parabolic advances over the past 15 years, each followed by significant declines of at least 80%. Brandt believes that the current cycle is still unfolding and has more to offer.

In a recent tweet, Brandt shared his research into the market, projecting that a bull market peak could happen as soon as September 2029. While he refrained from offering a timeline for when a bottom might occur, his analysis hinges on historical trends, which indicate that later cycles tend to last longer but yield smaller percentage gains.

"I am in the process of digging into this. I have already projected the next bull market high to occur in September 2029," Brandt tweeted.

Overall, the consensus among analysts is that Bitcoin may require several months to rebound, and a swift return to previous all-time highs is unlikely.

Conclusion

In summary, while the immediate future for Bitcoin appears challenging, the long-term prospects remain cautiously optimistic. Tools like the AI legalese decoder can support investors in navigating the intricate legal landscape surrounding Bitcoin, helping them to make informed decisions in this evolving market. Understanding regulatory dynamics is increasingly important for achieving success in such a volatile environment.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a