Decoding Legal Strategies: How AI Legalese Decoder Can Navigate Impacts of Bitcoin Dropping Below $8,000

- February 15, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Overview of MicroStrategy’s Debt Strategy Amid Bitcoin Volatility

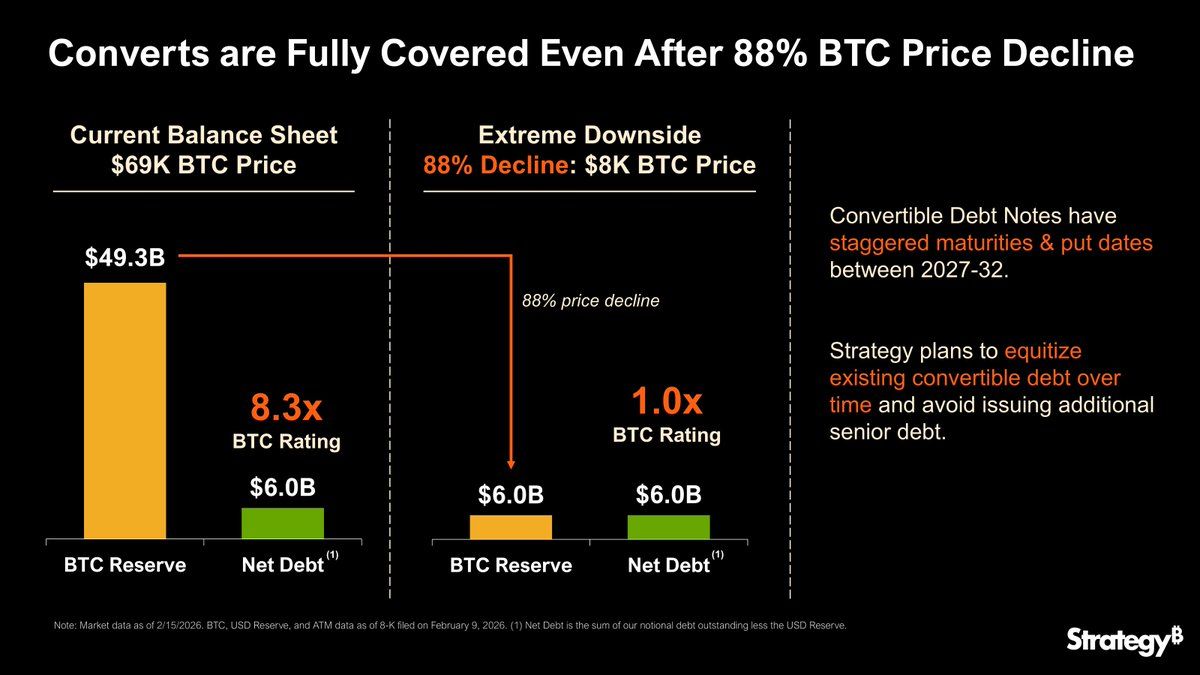

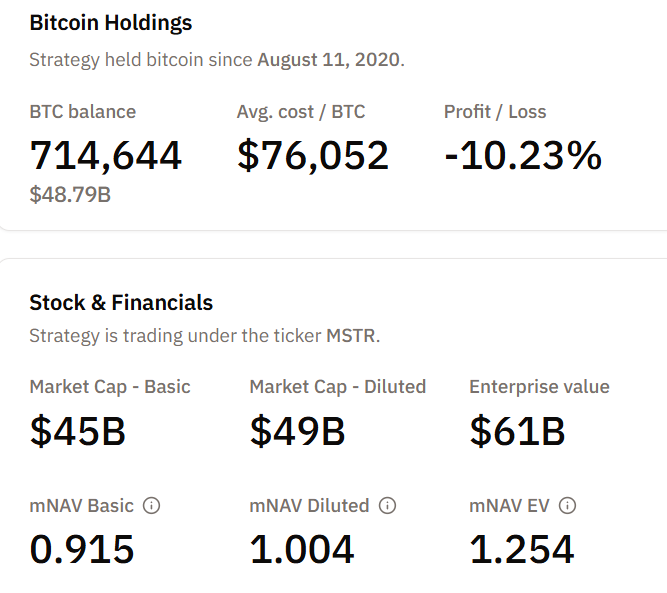

MicroStrategy has recently made a bold statement asserting its capability to entirely mitigate its $6 billion debt even in the face of a dramatic Bitcoin (BTC) plunge, potentially down to $8,000, marking an 88% drop from current values. However, this claim raises an important question: What would occur if Bitcoin falls even further below this critical threshold?

The company has robustly showcased its $49.3 billion Bitcoin reserves (valued at $69,000/BTC) complemented by staggered convertible note maturities extending until 2032, specifically structured to minimize the risk of immediate liquidation.

Understanding MicroStrategy’s Position on Bitcoin Price Drops

Reiteration of Financial Resilience at $8,000 Bitcoin Price Point

Just shortly after its earnings call, MicroStrategy has reiterated its stance on the implications of an $8,000 price point for Bitcoin—the second such announcement within a brief span of time.

“MicroStrategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt,” stated the company.

At face value, this announcement conveys a strong sense of resilience amidst extreme market volatility. Yet, further analysis reveals that $8,000 may function more as a theoretical stress point rather than an actual safeguard against financial turmoil.

At the $8,000 mark, the company’s assets equate to its liabilities, rendering its equity technically zero. Despite this, the firm possesses the capability to meet its debt obligations without needing to liquidate any Bitcoin holdings.

“Why $8,000?: This is the price point where the total value of their Bitcoin holdings would roughly equal their net debt. If BTC stays at $8,000 long-term, its reserves would no longer cover its financial obligations through liquidation,” investor Giannis Andreou has explained.

Convertible notes remain manageable, and the staggered maturities afford management greater maneuverability. CEO Phong Le recently emphasized that even a 90% decline in Bitcoin would likely unfold over several years, giving the company ample time for restructuring, issuing new equity, or refinancing debts.

"In the extreme downside, if we were to have a 90% decline in Bitcoin price to $8,000, which is pretty hard to imagine, that is the point at which our Bitcoin reserves equal our net debt. If that happens, we’ll look into restructuring, issuing additional equity, or possibly new debt," stated Le.

However, beneath this seemingly daunting figure lies a complex web of financial pressures that may escalate rapidly if Bitcoin experiences further declines.

Covenant and Margin Stress Below $8,000

The Onset of Financial Pressure at $7,000

The beginning signs of financial distress appear around the $7,000 mark, where secured loans backed by BTC collateral breach Loan-to-Value (LTV) covenants. This triggers demands for additional collateral or partial repayments.

"In a severe market downturn, cash reserves would deplete swiftly without access to new capital. The loan-to-value ratio could exceed 140%, causing total liabilities to surpass asset values. MicroStrategy’s software division generates around $500 million yearly, which may prove inadequate for servicing significant debt obligations on its own," explained Capitalist Exploits.

Should the market become illiquid, MicroStrategy might be compelled to liquidate Bitcoin to meet lenders’ demands, setting off a reflexive cycle that would further depress Bitcoin prices. While the firm may still technically remain solvent, forced sales magnify market risks and could lead to a leverage unwind scenario.

The Risk of Insolvency at $6,000

A decline to $6,000 shifts the dynamics considerably. Total assets would fall substantially below total debt, leading unsecured bondholders to face real losses, while holders of equity would experience severe depreciation, resembling a deep out-of-the-money call option on potential Bitcoin recovery.

MicroStrategy would likely need to consider restructuring, even as it continues operations. Management may explore strategies such as:

- Debt-for-equity swaps

- Maturity extensions

- Partial haircuts to stabilize the balance sheet

Implications Below $5,000: Approaching the Liquidation Threshold

If Bitcoin plunges below $5,000, the situation escalates to a point where secured lenders may enforce collateral liquidation. Coupled with low market liquidity, this scenario could lead to cascading Bitcoin sell-offs and widespread systemic repercussions.

In this dire situation:

- The company’s equity would likely be wiped out.

- Unsecured debt would face significant impairments.

- Restructuring or outright bankruptcy emerges as a genuine possibility.

"Nothing is impossible… Forced liquidation would only become a risk if the company could no longer service its debt, not merely from volatility," remarked Lark Davis.

Analyzing Speed, Leverage, and Liquidity as Risks

The critical takeaway is that $8,000 isn’t a definitive death sentence; rather, the firm’s survival hinges on several factors:

- Speed of BTC Decline: Rapid drops elevate margin pressure and lead to reflexive selling.

- Debt Structure: Heavily secured or short-term debt heightens risk beneath $8,000.

- Liquidity Access: Market closures or frozen credit exacerbate strain, possibly triggering liquidation spirals even above the nominal floor.

Potential Market Impact of MicroStrategy’s Position

MicroStrategy stands as a significant holder of Bitcoin. Any forced liquidations or sales driven by margin calls could catalyze ripples throughout the broader cryptocurrency market, affecting ETFs, miners, and leveraged traders alike.

Even if the company manages to survive in the short term, equity holders would still confront significant volatility, leading to potentially sharp shifts in market sentiment in anticipation of stress-related events.

The Role of AI legalese decoder in Navigating Financial Uncertainty

In these uncertain financial waters, AI legalese decoder can assist stakeholders by breaking down complex contracts and legal documents that govern financial dealings and obligations. This tool provides essential clarity, ensuring that MicroStrategy and its investors understand the nuances of their debt structure, covenants, and available options for restructuring.

As the interplay of leverage, covenants, and liquidity increasingly influences survival beyond simple price metrics, having a clear understanding of all contractual obligations could prove invaluable in strategizing the firm’s next moves within the volatile cryptocurrency landscape.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a