Decoding Legal Jargon: How AI Legalese Decoder Unravels Blame on Jane Street for Bitcoin’s Decline

- December 9, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin Experiences Continued Volatility: A Closer Look

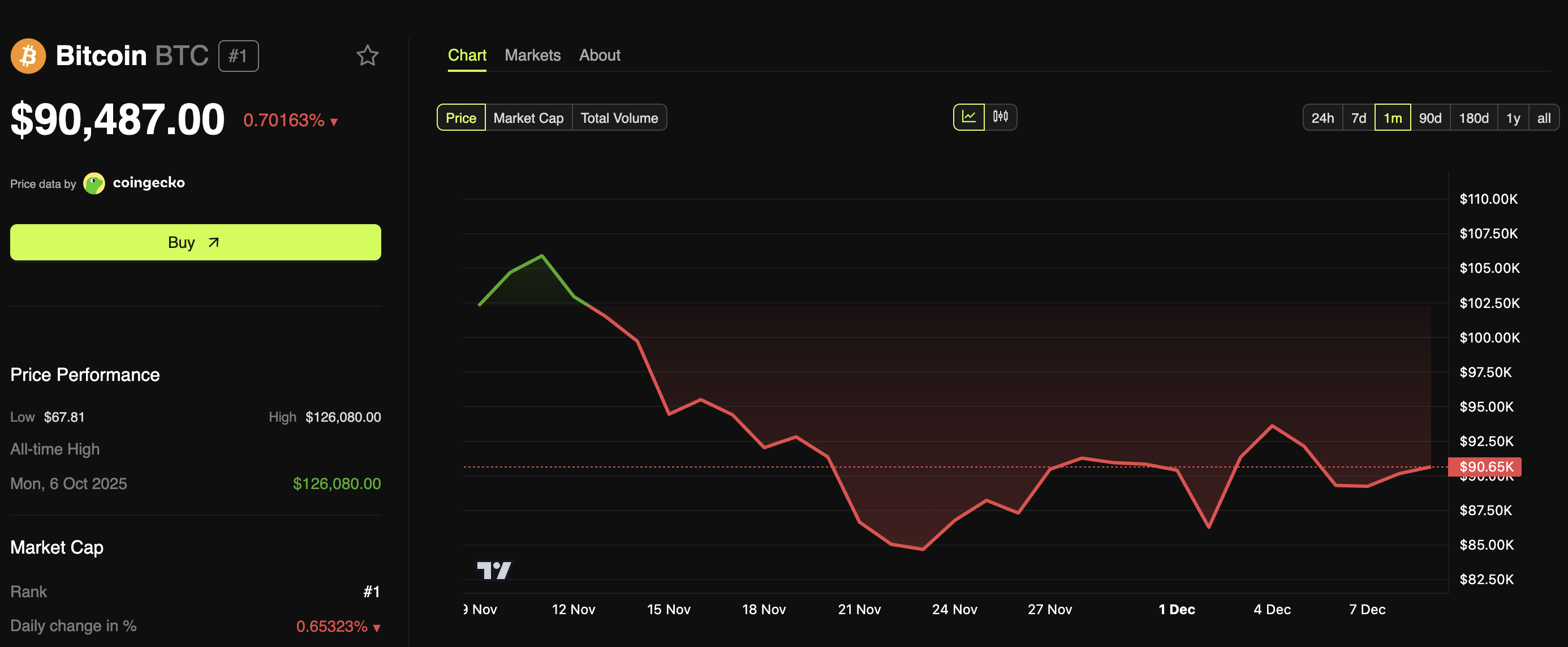

Bitcoin (BTC) has maintained its turbulent trajectory, experiencing a decline of 0.70% over the past 24 hours, which has raised alarm bells among traders who closely monitor this asset’s performance. Many are left questioning the underlying reasons for these fluctuations as the marketplace remains shaky.

Some analysts suggest that Bitcoin’s current performance may be indicative of price manipulation, pointing to a persistent pattern where significant declines frequently coincide with the opening of the U.S. markets. This phenomenon has been observed repeatedly, raising concerns about institutional involvement in swaying the asset’s price due to their significant trading power.

Internal Manipulation vs. Market Dynamics: Decoding Bitcoin’s Decline

Bitcoin has historically thrived during the Q4 period, which generally aligns with bullish market sentiment. However, contrary to expectations, it has failed to capitalize on this trend. The recent downturn initiated by the October 10 market crash has left many observers pondering the tenacity of Bitcoin’s weakness.

Traders are becoming increasingly disheartened by Bitcoin’s seeming indifference to important market developments. Notably, on the previous day, Strategy (formerly known as MicroStrategy) made headlines by acquiring 10,624 BTC for an astounding $962.7 million. Remarkably, this positive news has not bolstered Bitcoin’s price; instead, it continues to drop, currently trading at $90,487.

Bitcoin Price Performance. Source: BeInCrypto Markets

Interestingly, negative news has triggered a similar sell-off. Analyst Ash Crypto pointed out that the market appears irrational, showing no response to positive developments, which has traditionally been its nature.

)

In his analysis, Ash noted that the crash from $126,000 to $80,000 is not a mere normal market correction. He explored several alarming indicators:

- U.S. equities have risen by 8%, with many stocks reaching all-time highs.

- Bitcoin lingers 29% below its pre-crash levels, with any short-term rallies quickly quashed by heavy selling.

- Continuous liquidations of approximately $500 million occur almost every other day, indicating a pattern of forced selling.

"If it was just leverage, we would have seen a quick bounce; however, the continued decline points toward manipulation by major institutions who are liquidating both long and short positions due to significant losses," he added.

Additionally, another analyst has pointed to weekend price actions as further evidence of manipulation. Reports reveal that Bitcoin’s price swiftly dropped from $89,700 to $87,700, resulting in roughly $171 million in long liquidations. Shortly afterward, it surged back to around $91,200, leading to another $75 million in short position liquidations.

"This is another example of manipulation during low-liquidity weekends, targeting both leveraged longs and shorts," noted Bull Theory in their analysis.

Is Jane Street Behind Bitcoin’s Morning Dumps?

Interestingly, a discernible trend has emerged: Bitcoin often faces sharp declines around 10 a.m. when U.S. markets open. This has been part of a glaring pattern since early November, echoing similar behavior recorded earlier in the year.

This repetitive occurrence suggests a coordinated strategy at play, rather than chaotic market response. Analysts have pointed fingers at Jane Street, a notable high-frequency trading firm, as a potential orchestrator of this pattern. Jane Street is reported to hold $2.5 billion in BlackRock’s IBIT ETF, making it its fifth-largest position.

Chart Showing Bitcoin’s Price Drops at the US Market Open. Source: X/Bull Theory

The suspected strategy utilized by high-frequency traders involves dumping BTC at market openings, subsequently pushing the price into liquidity pockets, and then repurchasing at reduced levels. This cyclical behavior allows them to capitalize on predictable volatility, accumulating billions in Bitcoin over time.

"Yes, that’s called wash trading, which has been illegal on the stock market since 1933. Unfortunately, no regulations currently restrain this in the crypto space. Until they implement the Market Structure Bill, such trading can occur freely," noted Marty Party.

Despite the apparent manipulations, experts are optimistic about Bitcoin’s future. They believe that once major players finish their accumulation strategies, Bitcoin is likely to find support from strong fundamentals and resume its upward trajectory.

How AI legalese decoder Can Help

For traders and investors grappling with the complexities of the current market manipulation surrounding Bitcoin, an innovative solution exists. The AI legalese decoder can assist by simplifying the often convoluted legal and financial jargon that surrounds cryptocurrency regulations and trading practices. This tool can provide clarity, helping individuals understand their rights, obligations, and the significance of major trading activities.

By demystifying the legal aspects and providing accessible interpretations of relevant documents and news, the AI legalese decoder empowers users to make informed decisions in a turbulent market, potentially enhancing their trading strategies and protecting their investments against illicit activities that may arise.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a