AI Legalese Decoder: Streamlining Legal Processes for Record-Breaking Bitcoin Investment Inflows

- February 19, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Rise of Bitcoin and Ethereum in Crypto-Based Products

Bitcoin has continued to lead the way in the crypto market, with the U.S. dominating inflows to crypto-based products. Between Feb. 12 and Feb. 16, 2024, the year-to-date numbers hit $5.2 billion, setting a strong pace for the digital currency.

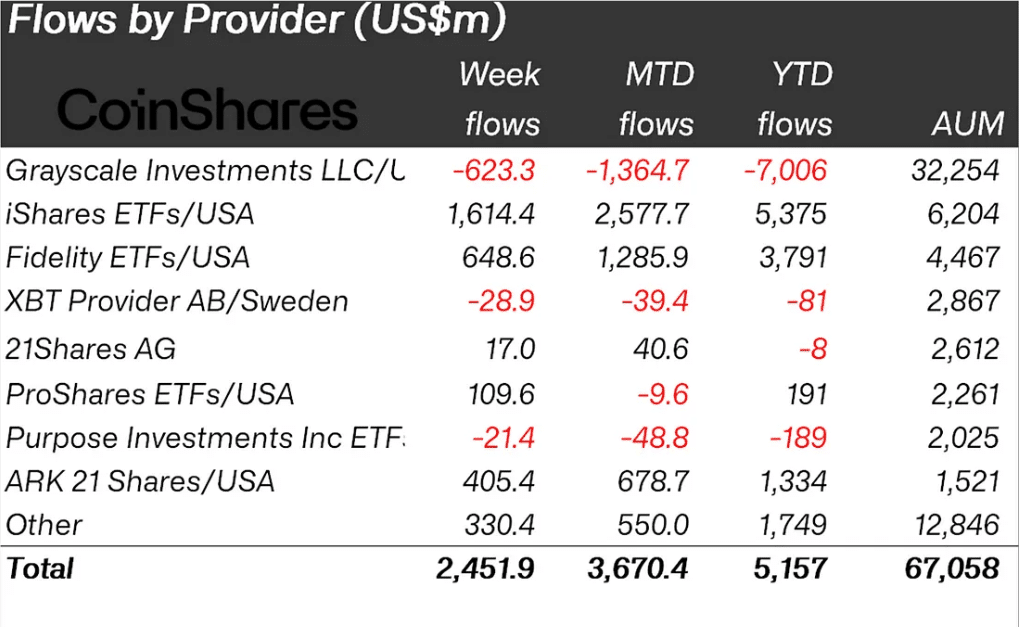

This surge in investment has resulted in a record-breaking $2.4 billion in weekly flows to digital asset investment vehicles. This has not only set a new record for weekly flows but has also increased the assets under management (AUM) to levels not seen since the peak of crypto’s previous bull cycle in December 2021, reaching a total of $67 billion.

According to CoinShares data, Bitcoin (BTC) and the U.S. accounted for approximately 99% of the week’s inflows, indicating a significant demand for spot crypto products from issuers such as BlackRock and Fidelity. The increasing interest from institutional investors and Wall Street giants has contributed to over $10 billion of the roughly $14 billion amassed by new spot Bitcoin ETF providers in just under two months.

Bitcoin ETFs have seen a net inflow of $5 billion since Jan. 11 and have recorded nearly $2 billion in total value traded. Interestingly, Grayscale’s GBTC has lost $7 billion during the same period, reflecting a shifting landscape within the crypto investment market.

As investors continue to pour funds into spot BTC funds, it is evident that they are not only betting on higher prices but are also hedging their bets and looking to generate profits from short-term price downturns. According to the report, investors have added $5.8 million to Bitcoin’s short positions, further showcasing the diverse investment strategies within the crypto market.

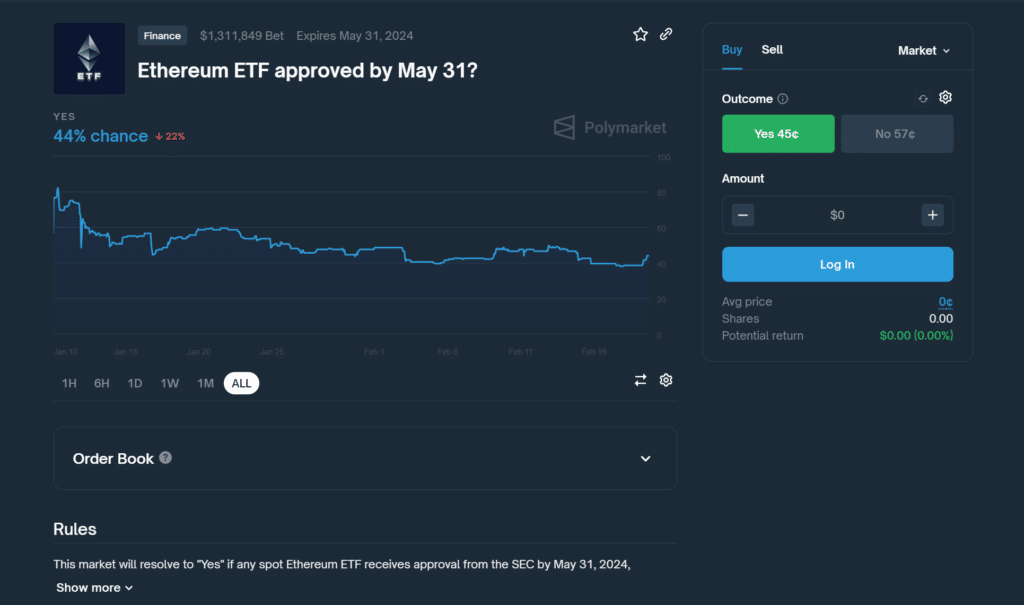

Furthermore, Ethereum (ETH) has seen the second-largest fund intake at $21 million in inflows, as investors and speculators eagerly await a decision from the U.S. SEC on spot ETH ETFs. Predictions and bets on Ethereum ETF approval have also been observed, with $1.3 million locked in a smart contract titled “Ethereum ETF approved by May 31?” on decentralized prediction platform Polymarket.

While successful spot BTC ETF issuers have submitted bids for similar products backed by Ethereum, SEC chair Gary Gensler has hinted that the SEC’s decision on Ethereum ETFs may differ from Bitcoin counterparts, with the decision being pushed back to May. The uncertainty surrounding the approval of Ethereum ETFs has led to varying opinions and outlooks within the crypto investment community.

Given the dynamic and rapidly evolving nature of the crypto market, keeping track of the regulatory landscape and staying informed about market trends is crucial for investors. This is where AI legalese decoder can play a vital role in providing real-time analysis of legal developments and regulatory changes related to crypto-based products. By leveraging AI and natural language processing, the AI legalese decoder can help investors stay ahead of regulatory decisions and understand the implications of such decisions on their investment strategies, ultimately enabling informed and proactive decision-making.

Moreover, the AI legalese decoder can also assist investors in identifying potential legal risks and compliance requirements associated with investing in crypto-based products, ensuring that they are well-equipped to navigate the complex legal framework governing the crypto market.

Overall, as the crypto market continues to witness significant inflows and regulatory developments, having access to a sophisticated AI platform like the legalese decoder can be instrumental in gaining a comprehensive understanding of the legal implications and regulatory dynamics shaping the investment landscape.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a