- September 17, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

**Stock-Market Strategists Finally Realize Mistake and Adjust Year-End Targets for S&P 500 Index**

Stock-market strategists who failed to accurately predict this year’s market rally are starting to acknowledge their mistake. As a result, they have raised their year-end targets for the S&P 500 Index. For instance, Societe Generale’s Manish Kabra recently adjusted his target for the index to 4,750, which is 25% higher than his original call of 3,800 at the beginning of 2023. Similarly, Michael Kantrowitz from Piper Sandler & Co. and Greg Boutle from BNP Paribas SA, who had the lowest targets of 3,225 and 3,400 respectively, also had to revise their 2023 outlooks to keep up with the 15.9% rally seen this year.

Morgan Stanley’s Mike Wilson, a well-known bear, admitted in July that he had been overly pessimistic for too long. However, he still believes that US stocks will decline over 10% before the end of the year. According to Adam Sarhan, the founder of 50 Park Investments, groupthink and psychology play a significant role in the behavior of strategists. Many strategists have been consistently wrong throughout the year, which has compelled them to adjust their targets in an attempt to catch up with the stock market.

Although strategists have adjusted their forecasts for 2023, they are not yet ready to adopt a bullish stance. For example, Kabra predicts that the S&P 500 will fall to 3,800 by the middle of next year due to a consumer-spending crunch, despite closing at 4,450 on Friday. Strategists in general anticipate a market downturn in 2024, despite signs suggesting that the US economy may avoid a recession. These signs include cooling inflation rates, robust retail sales, and the expected decision of the Federal Reserve to maintain steady interest rates this week.

Amidst the gloom on Wall Street, investors face a dilemma. The Federal Reserve’s attempts to control inflation continue to pose a threat to the economy. However, with the improving profit outlook for Corporate America and the apparent absence of any recession signs according to the Fed, some market watchers believe that the bears are once again mistaken. This situation highlights the different pressures faced by market strategists and money managers. Money managers not only have to be correct in their predictions but also outperform the market to retain their clients.

Numerous Wall Street strategists have been forced to revise their forecasts as stocks continue to climb this year. Savita Subramanian from Bank of America Corp., David Kostin from Goldman Sachs Group Inc., and Scott Chronert from Citigroup Inc. are among those who have adjusted their 2023 outlooks in recent months to keep pace with the market’s performance. Oliver Pursche, senior vice president and adviser at Wealthspire Advisors, suggests that those who modify their estimates are not necessarily wrong, but rather early in their predictions. Listening to different viewpoints is more valuable than seeking confirmation bias from those who share the same market outlook.

Despite the risks associated with the Federal Reserve’s potential future interest rate hikes and the duration of this expansion cycle, there are signs of investor sentiment turning positive. The bond market, which has historically provided recession signals, has never prolonged these alarms as it has recently. The duration of the Fed’s high-interest-rate policy remains uncertain, and economists surveyed by Bloomberg expect rates to remain in the range of 5.25% to 5.5% at the September meeting, with the first cut predicted to come in May, two months later than initially anticipated in July.

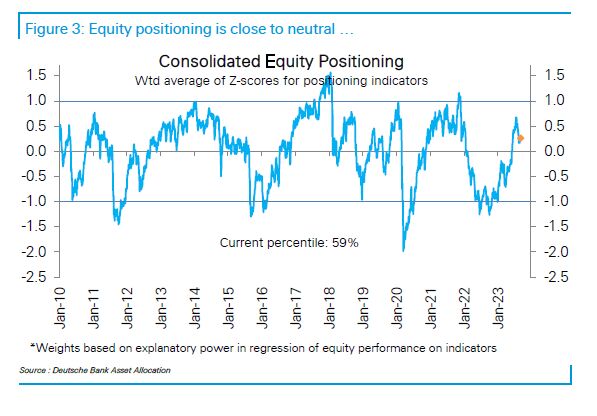

Timing the end of the Fed’s rate hiking cycle has historically yielded significant returns for equity investors. However, the trajectory becomes less clear when the central bank skips hikes before resuming them. Data from Deutsche Bank AG indicates that investors have money available to invest in stocks. Although investor exposure appeared stretched in July after the strong first-half equity gains, it is now closer to neutral. Additionally, equity funds have recorded their largest weekly inflow in 18 months, reflecting growing confidence in a soft landing for the economy, according to Bank of America.

Stephanie Lang, chief investment officer at Homrich Berg, who has held an underweight position in equities throughout the year, commented on the rally’s unexpected extent. She believes that the market’s response to whether most strategists change their outlooks will be an important indicator, especially considering the concerns of some regarding potential economic weakness.

In this situation, the AI legalese decoder can provide valuable assistance. It can help investors and legal professionals accurately decipher and comprehend the complex language used in legal documents, contracts, and other law-related content. By using advanced natural language processing algorithms, the AI legalese decoder can analyze and interpret legal terminology, making it easier for users to understand the implications, risks, and opportunities associated with legal matters. This tool can save time and effort for investors who need to navigate the legal landscape while making informed decisions.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a