AI Legalese Decoder: Navigating Market Uncertainties as XRP Faces Potential 40% Drop Amid Trump Tariffs

- March 28, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Warning Signs Emerge in the XRP Market Amidst Economic Pressures

The current market for XRP (XRP) is displaying critical warning signs as a bearish technical pattern begins to unfold on its weekly chart. This alarming development coincides with macroeconomic pressures stemming from anticipated tariffs set to be implemented in the United States, specifically slated for April.

XRP’s Descending Triangle Pattern Indicates Potential 40% Decline

Since rallying in late 2024, XRP’s price chart has been progressively forming a discernible triangle pattern on its weekly chart. This pattern is highlighted by a flat support level, combined with a downward-sloping resistance line, signaling caution for investors and traders alike.

The descending triangle pattern is particularly significant as it forms following a robust uptrend, suggesting a potential bearish reversal. Traditionally, this setup concludes with the price breaking below the established flat support level, leading to a decline that could match the triangle’s maximum height, indicating a serious risk for holders of XRP.

XRP/USD weekly price chart. Source: TradingView

As observed on March 28, XRP was approaching the triangle’s crucial support level, indicating a potential breakdown could be imminent. Should this occur, analysts estimate the price could plummet to a target area of around $1.32 by April, reflecting a worrying 40% decrease from the current price levels. Such a scenario underscores the urgency for traders to remain vigilant.

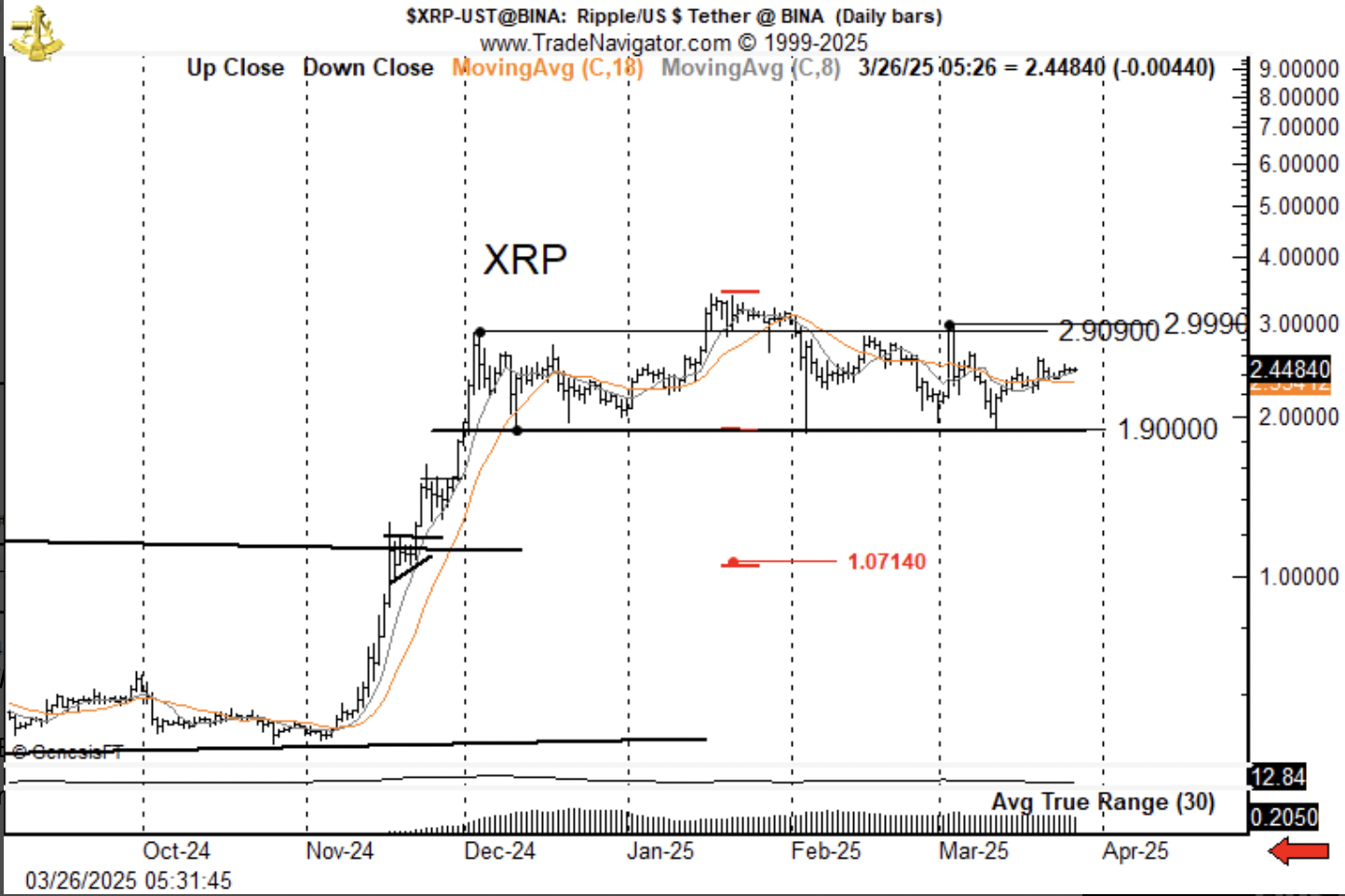

This downward trajectory aligns with the predictions from seasoned trader Peter Brandt, who has cautioned that XRP could tumble to as low as $1.07, attributing this forecast to a “textbook” head-and-shoulders pattern that is taking shape on the daily price chart.

XRP/USD daily price chart. Source: Peter Brandt

On a more optimistic note, if XRP manages to rebound off the triangle’s support level, there is potential for the price to reach its upper trendline, estimated to be around $2.55. A convincing breakout above this resistance level might even invalidate current bearish structures altogether, propelling the price toward the previous high of $3.35.

Impact of Proposed Tariffs on the XRP Market

In the broader economic landscape, market sentiment has grown increasingly cautious in response to President Donald Trump’s impending 25% tariffs on auto imports, scheduled to take effect on April 3. The introduction of these tariffs is expected to significantly raise prices for US manufacturers and consumers alike, complicating the economic outlook further.

Supporting this view, the February 2025 US Consumer Price Index (CPI) report demonstrated a month-over-month increase of 0.2%. These developments are likely to amplify concerns among investors, particularly in the cryptocurrency sector.

Related: Is altseason dead? Bitcoin ETFs rewrite crypto investment playbook

St. Louis Federal Reserve President Alberto Musalem has estimated that the newly proposed tariffs may add roughly 1.2 percentage points to inflation. He elaborated that about 0.5 percentage points could arise from direct impacts, while the remaining 0.7 percentage points may result from indirect ramifications throughout the economy.

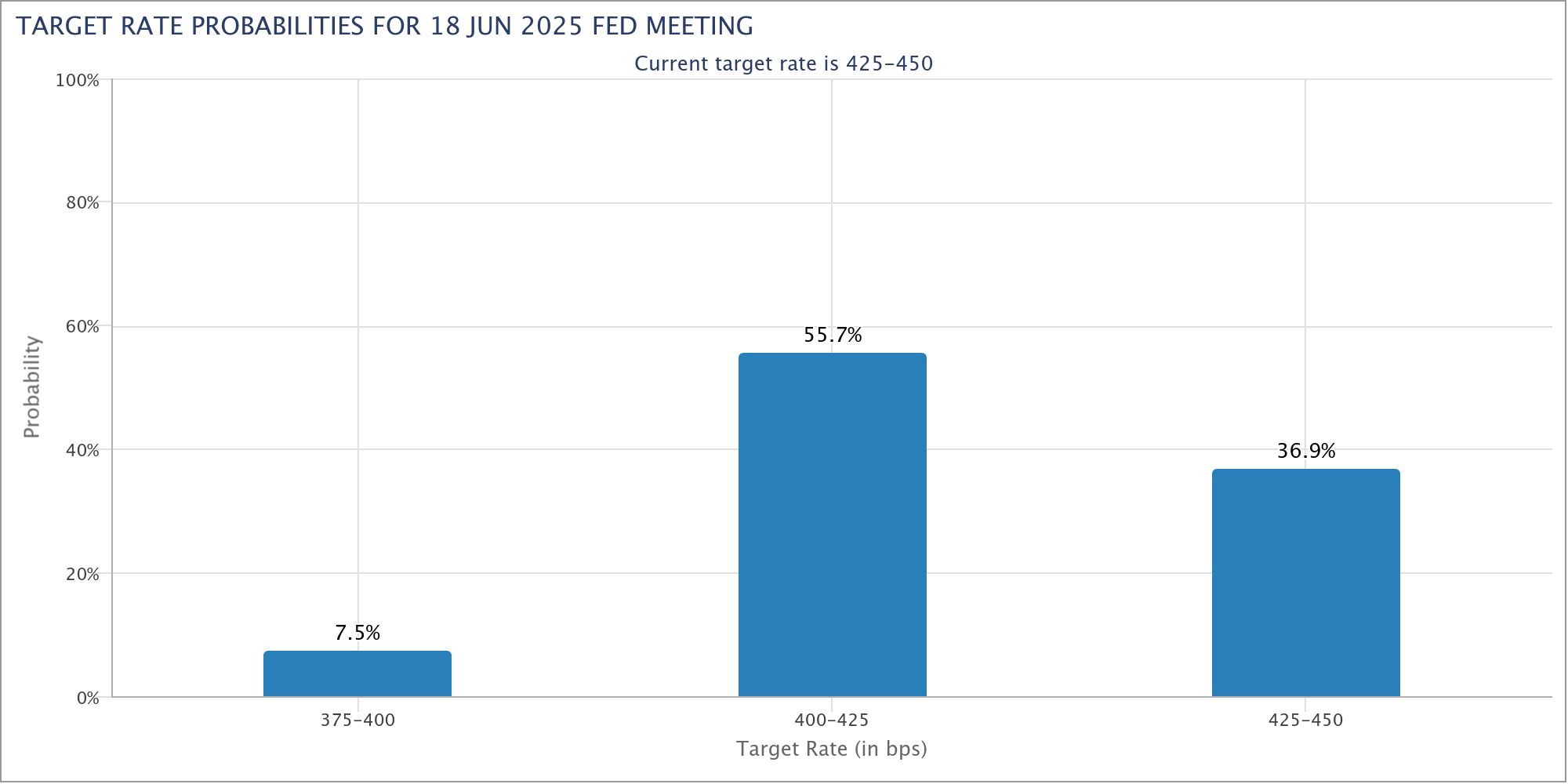

Furthermore, market forecasts indicate a reduced likelihood of the Federal Reserve cutting interest rates to a target range of 400–425 basis points as of March 28, with the probability now standing at 55.7%. This marked a decline from 67.3% a mere week prior, and 58.4% just a day earlier.

Target rate probabilities for the June Fed meeting. Source: CME

This delayed approach to rate cuts could significantly reduce the flow of capital into speculative markets, which would inevitably stall the momentum for XRP and other digital assets that typically perform well in a favorable low-rate, risk-on environment.

How AI legalese decoder Can Help Navigate Market Risks

In these turbulent times, navigating the complexities of cryptocurrency markets and their implications requires more than just market analysis. Here, the AI legalese decoder emerges as an invaluable tool for traders and investors alike. It can aid users in unpacking legal documents, tweets from industry leaders, or analytical reports that often contain dense jargon.

Whether examining terms associated with new tariffs or interpreting Federal Reserve announcements, the AI legalese decoder can simplify intricate language, allowing users to focus on actionable insights rather than getting lost in legalese. By enhancing understanding, traders can make better-informed decisions, especially when uncertainties loom large in the market.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Enter your email address to Win 1 Yr Home Plan

****** just grabbed a

****** just grabbed a