AI Legalese Decoder: Navigating Crypto Market Challenges Amidst US Stock Market Volatility

- January 29, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin’s Decline and Market Reactions

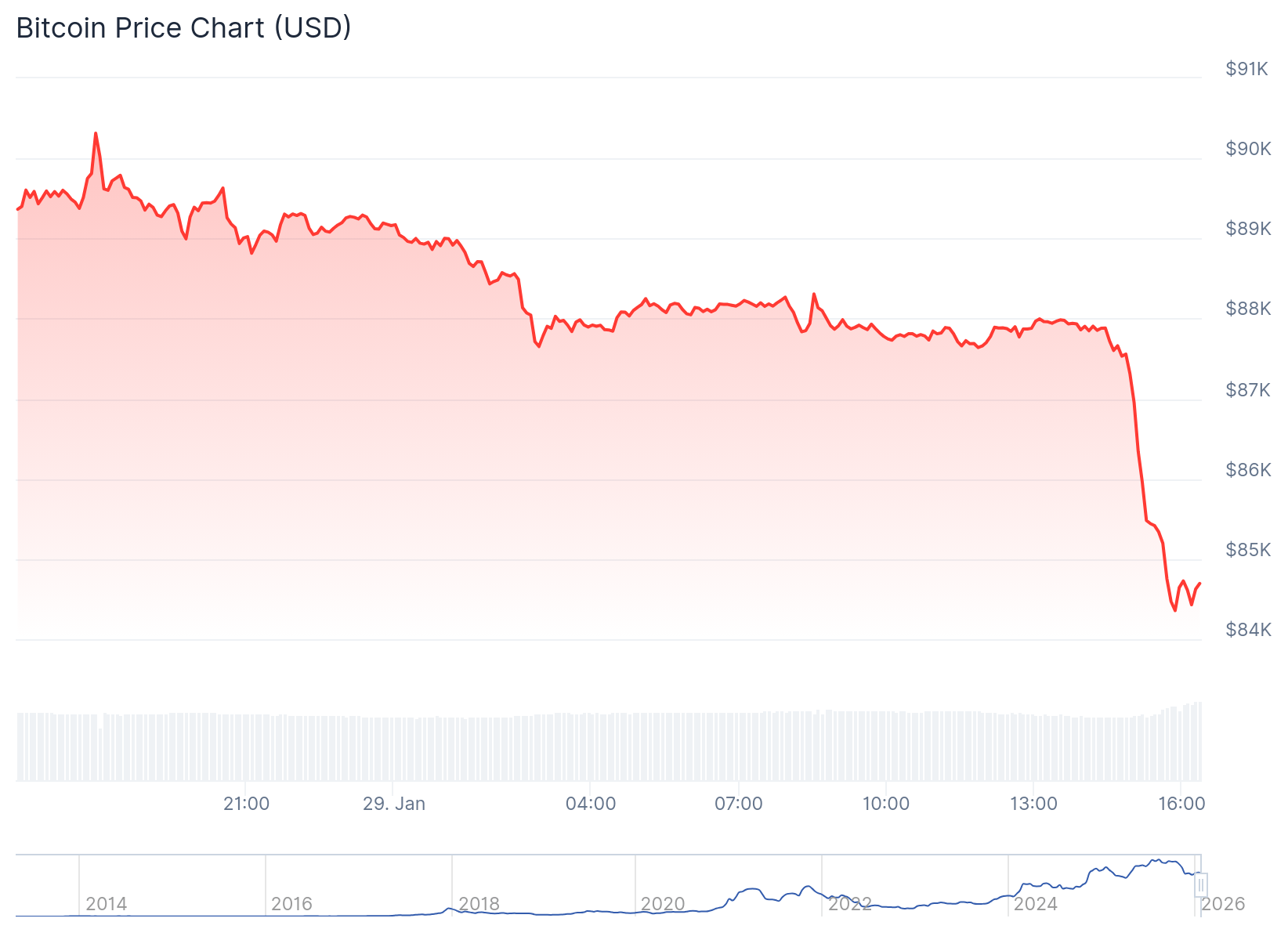

Bitcoin (BTC) experienced a notable slide, dropping below the $85,000 mark this morning. This was primarily influenced by a downturn in the stock market, which was reportedly spurred by concerns surrounding spending in artificial intelligence (AI) following Microsoft’s latest earnings report.

Market Overview: A Sharp Downturn

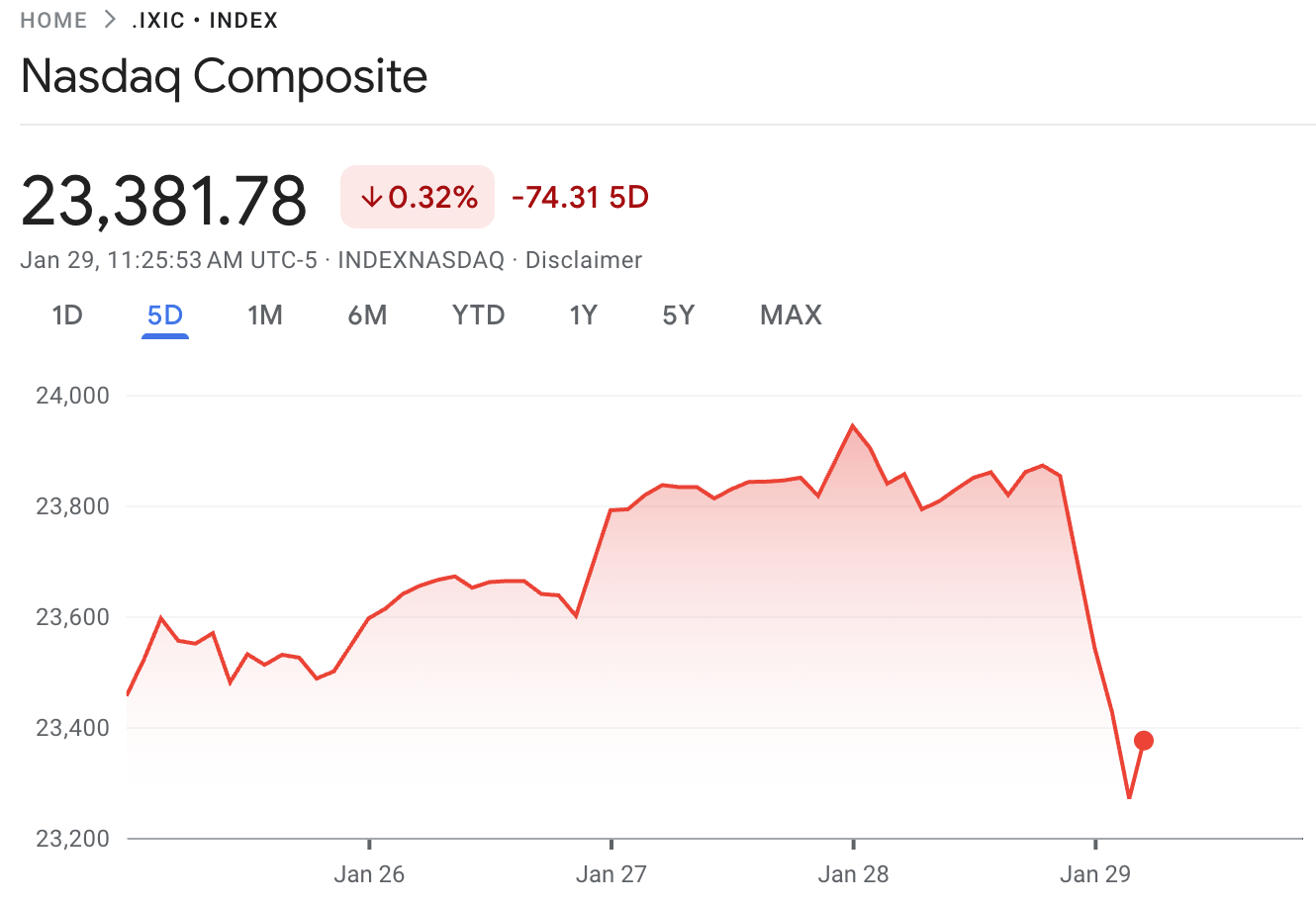

Global markets faced a significant downturn on Thursday morning, January 29. Just after the U.S. stock market opened, Bitcoin quickly fell over 5%, slipping beneath the crucial $85,000 threshold. Concurrently, the Nasdaq Composite experienced a decline of approximately 2.3%, while the S&P 500 slid about 1.5%.

BTC 24-hour price chart. Source: CoinGecko

Market declines were attributed in part to Microsoft’s increased spending on AI, which came to light after the tech giant revealed that its cloud division’s growth had slowed, a fact disclosed in its latest earnings report issued after the close of U.S. markets yesterday.

Despite Microsoft’s Q4 revenue reflecting a 17% increase, fears regarding its AI expenditures resulted in a 12% drop in its stock price this morning, causing wider repercussions across the tech sector.

Nasdaq Composite 5-day price chart. Source: Google Finance

As a result, the total crypto market capitalization also saw a significant fall, dropping around 5% to $2.96 trillion. Ethereum (ETH) was not spared, tumbling 6.4% to around $2,800. Most of the other top-10 cryptocurrencies by market cap sustained losses ranging from 4% to 6%. The exception was TRON (TRX), which remained stable over the past 24 hours.

Weak Holder Conditions Persist

The overall market sentiment remains hesitant, especially following the recent price drop. Analysts at Glassnode highlighted in their report dated January 28 that Bitcoin seems to be caught in a balancing act where buying and selling pressures are roughly equal.

“Short-Term Holder conditions still appear weak, making the market vulnerable to additional distribution if support levels fail to be upheld,” the analysts noted. They stressed that ongoing demand for hedging against further downturns keeps the market at risk for additional consolidation or deeper downward trends.

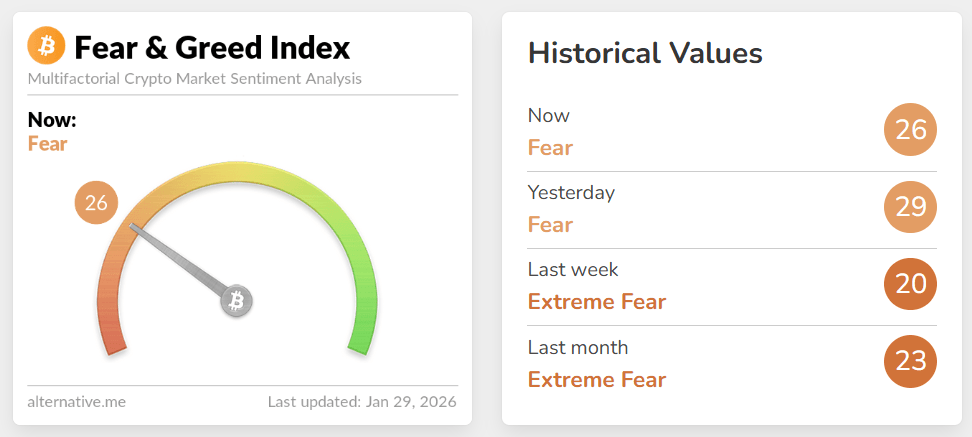

Investor sentiment, as captured by the Crypto Fear & Greed Index, remains within the “fear” zone, reflecting a cautious approach among traders since Wednesday.

Fear & Greed Index. Source: Alternativeme

Major Movers and Liquidations

Among the top 100 cryptocurrencies by market cap, Worldcoin (WLD) stood out as the top gainer over the past 24 hours, rising over 5%. This uptick followed reports indicating that OpenAI may be considering a partnership with the crypto project, which was co-founded by Sam Altman, who also co-founded OpenAI.

Conversely, Avalanche (AVAX) led the day’s losses with an 8% decline, closely followed by Mantle (MNT). According to data from CoinGlass, over 200,000 traders were liquidated in the past 24 hours, amounting to total liquidations exceeding $813 million. Long positions were particularly hard hit, accounting for nearly $700 million worth of liquidations, a result of the slipping prices.

Bitcoin was notably hit the hardest, with over $327 million wiped out in liquidations, trails closely by Ethereum with $134 million.

ETFs and Macro Conditions

On January 28, spot exchange-traded funds (ETFs) showed mixed inflows. Spot Ethereum ETFs experienced net inflows of $28.1 million, boosting total net assets to $18.22 billion. In contrast, spot Bitcoin ETFs posted $19.6 million in net outflows, bringing total net assets down to $115.35 billion.

In broader macroeconomic news, the Federal Reserve chose to pause its streak of rate cuts, keeping the benchmark interest rate within the range of 3.5% to 3.75%, as widely anticipated. This decision halted three sequential 25-basis-point reductions, which portrays a cautious stance in monetary policy. Federal Reserve Chair Jerome Powell acknowledged that current indicators suggest solid economic activity and noted that consumer spending has remained resilient.

While cryptocurrencies and the U.S. stock market stumbled this morning, oil prices surged, while gold and silver slightly receded after reaching new highs just yesterday.

The Role of AI legalese decoder

In an ever-evolving landscape, navigating the complexities of the cryptocurrency market can be overwhelming, especially during turbulent times. This is where the AI legalese decoder can offer invaluable assistance. This powerful tool can help users understand legal jargon, compliance requirements, and regulations that may affect their trading decisions and investments in cryptocurrencies.

By translating intricate legal language into plain English, the AI legalese decoder empowers traders and investors to make informed choices amid uncertainty. Staying informed about legal implications allows users to navigate potential pitfalls and seize opportunities more effectively, ensuring they are better equipped to face the challenges that lie ahead.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a