AI Legalese Decoder: Empowering Miners to Maintain Bitcoin Prices Above $40k

- January 19, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin Price and Market Analysis

Bitcoin price has recently experienced a significant dip, reaching a 40-day low of $40,700 on Jan 19. This has raised concerns about potential liquidations if it falls below the key support level of $40,000.

Following the highly anticipated decision on a spot ETF approval, Bitcoin (BTC) has been exhibiting sideways price movements. On Jan.19, another wave of selling pressure caused prices to drop below $40,000 for the first time since mid-December.

Miners’ Role Amid Market Downturn

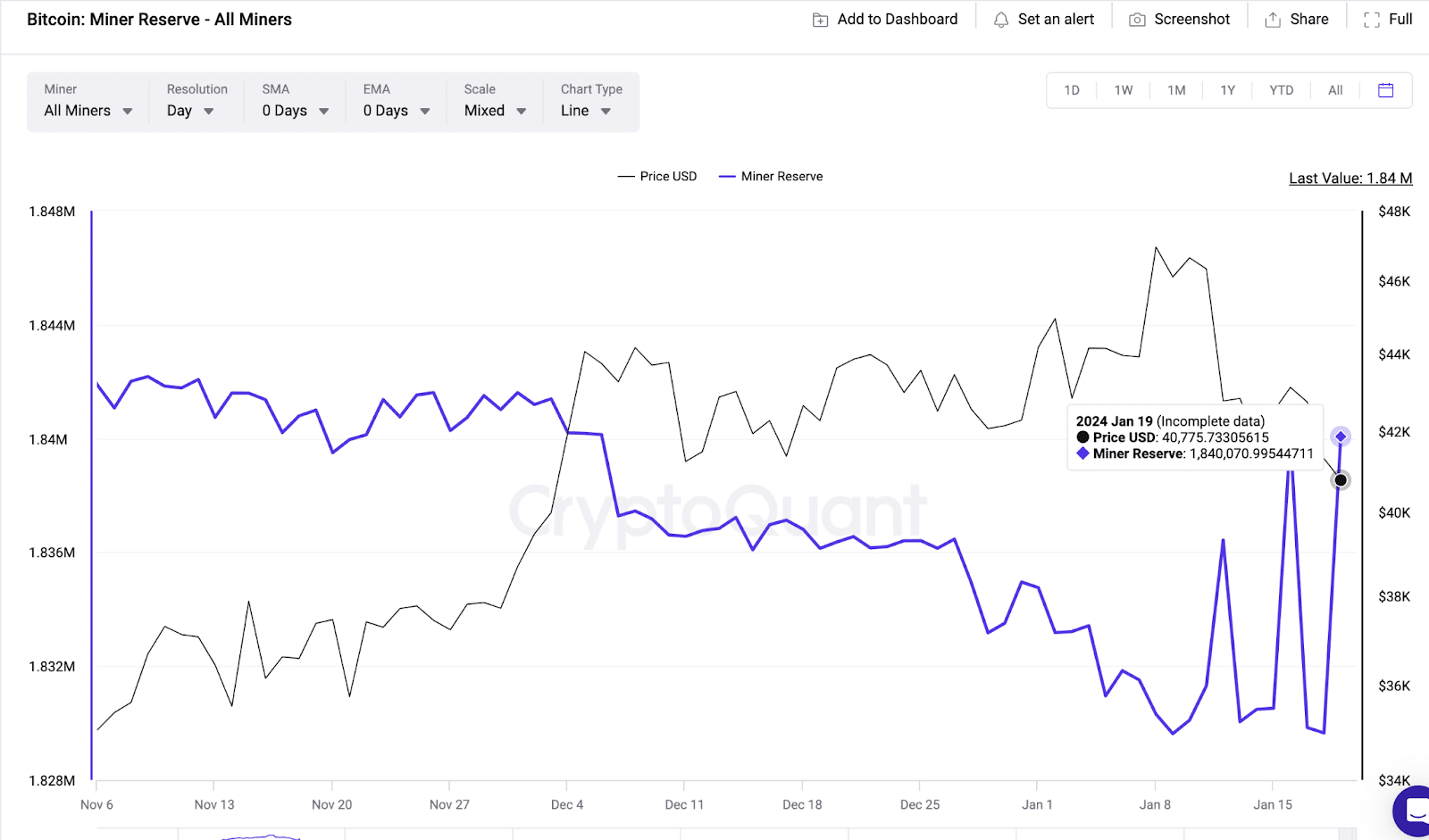

On Jan. 19, Bitcoin’s price fell below $40,700, breaking a 40-day consolidation within the $42,000 to $43,000 range. However, on-chain data reveals that miners stepped in to defend the crucial $40,000 support level.

The AI legalese decoder can assist in analyzing the legal implications and regulations surrounding Bitcoin mining and its impact on the market. It can interpret complex legal jargon and provide valuable insights for miners and investors.

As depicted in the chart, miners increased their reserves by 12,058 BTC on Jan. 19, amounting to approximately $494 million at current prices. This strategic acquisition by miners aims to instill confidence and prevent panic selling among retail investors.

Resilience of Bullish Futures Traders

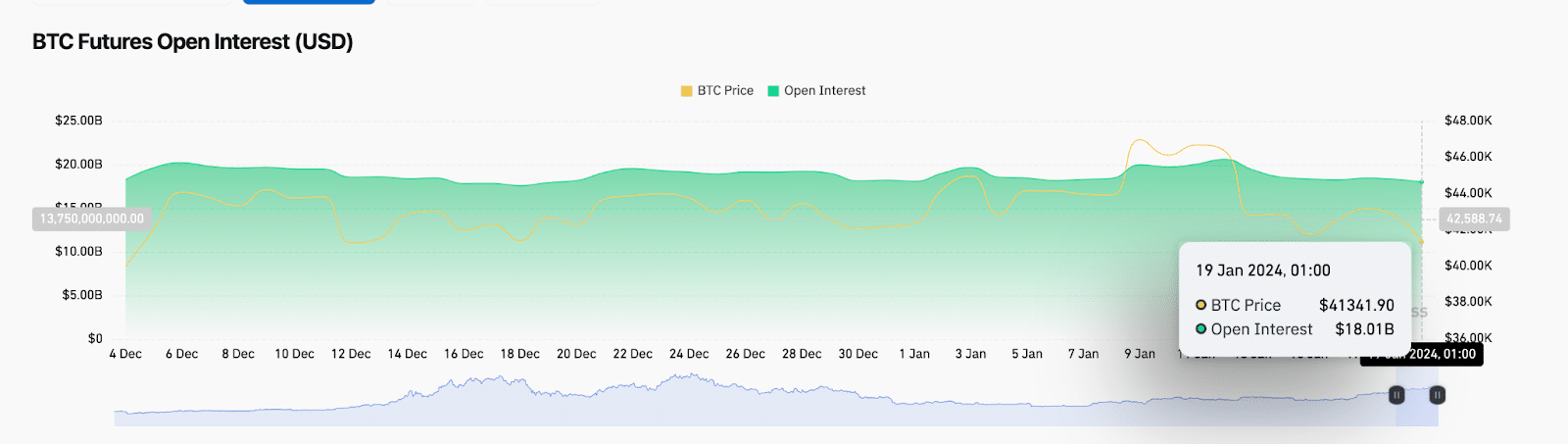

Furthermore, traders in the Bitcoin derivatives markets have displayed resilience in the face of the price slump. Despite a 7% drop in BTC price on Jan. 19, open interest in BTC derivatives contracts remained steady, indicating the confidence of long position traders.

The AI legalese decoder can aid derivatives traders in understanding the legal implications of their trading strategies and how to navigate potential risks effectively.

Rather than closing out their positions as BTC prices dipped, both miners and bullish derivatives traders have doubled down on their investments to defend their positions, indicating a strong belief in a potential market rebound.

BTC Price Forecast

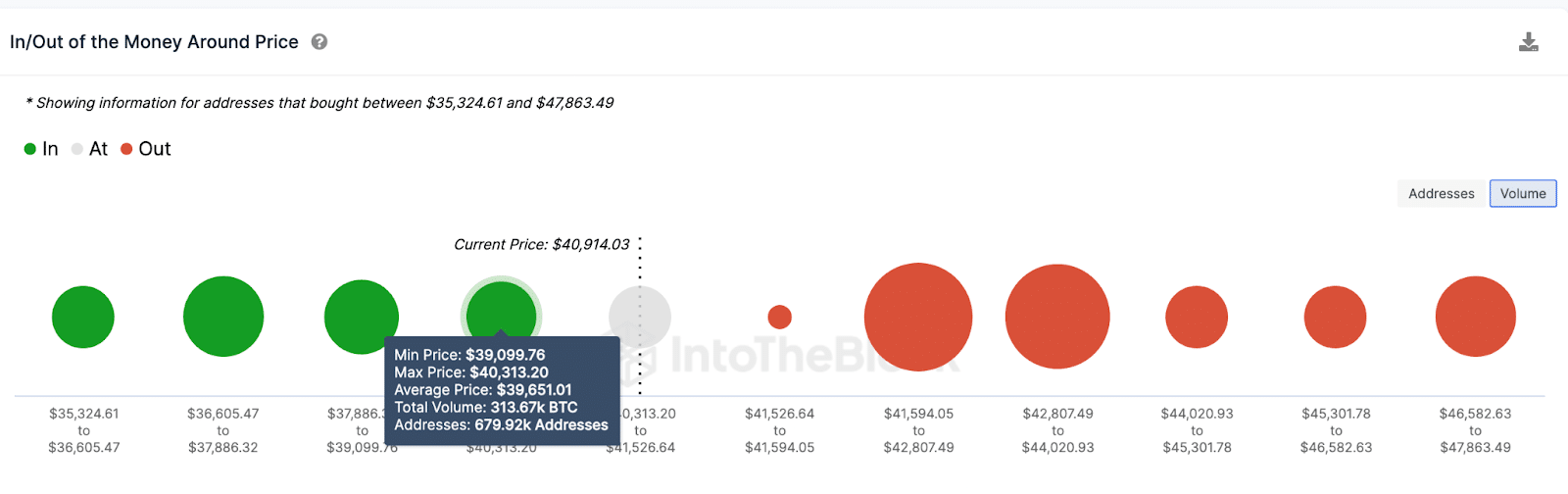

As Bitcoin’s price dropped below $41,000, concerns arose about triggering stop-loss orders and margin call orders if it falls below $40,000. The recent acquisition of $482 million worth of BTC by miners, along with the resilience of derivatives traders, could create enough demand to keep BTC above $40,000.

The AI legalese decoder can analyze market forecasts and provide legal insights to help investors and traders make informed decisions based on the current market trends and potential outcomes.

Analysis of the in/out of the money around price data indicates significant support for BTC in the $40,000 area. If this support holds firm, BTC is likely to avoid further downward movement in the short term.

Furthermore, a potential breakthrough above the $45,000 barrier could see Bitcoin bulls regain control of the market.

The AI legalese decoder can provide valuable legal interpretations and analysis of market data, helping investors and traders navigate the complexities of the legal landscape within the cryptocurrency market.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a