AI Legalese Decoder: A Savior for Crypto Prices as Spot Bitcoin ETF Hype Subsides and Correction Looms

- October 26, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

## Cryptocurrency Prices Enter Correction Territory as Traders Plan Next Move

|

|

Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day’s top stories directly to your inbox. Sign up here! |

(Kitco News) – Cryptocurrency prices entered into correction territory on Thursday as the momentum generated by the possibility of a spot Bitcoin (BTC) exchange-traded fund (ETF) has quieted down, prompting some traders to take profits and begin plotting their next entry point ahead of a potential bull run.

Equities also trended lower, with tech stocks weighing down the major indices after a series of disappointing earnings reports. The downturn intensified after the Bureau of Economic Analysis announced that third-quarter U.S. gross domestic product (GDP) grew at an annualized pace of 4.9%, faster than consensus forecasts of 4.5%, and the fastest pace in nearly two years.

Investors are now focused on the FedÔÇÖs next interest rate decision on Nov. 1. At the close of markets, the S&P, Dow, and Nasdaq all finished in the red, down 0.88%, 0.48%, and 1.47%, respectively.

Data provided by TradingView shows that Bitcoin bulls failed to defend support at $34,800, resulting in the top crypto sliding to a daily low of $33,750 in the afternoon. At the time of writing, BTC trades at $34,200, a decrease of 1.5% on the 24-hour chart.

BTC/USD Chart by TradingView

ÔÇ£October Bitcoin futures prices [were] a bit weaker in early U.S. trading Thursday,ÔÇØ according to Kitco senior technical analyst Jim Wyckoff, who noted that ÔÇ£Prices hit a contract high Tuesday.ÔÇØ

Bitcoin futures 1-day chart. Source: Kitco

ÔÇ£This weekÔÇÖs price action has formed a bullish pennant pattern on the daily bar chart,ÔÇØ Wyckoff said. ÔÇ£The BTC bulls have the solid near-term technical advantage and still have momentum on their side, amid a price uptrend in place on the daily bar chart.ÔÇØ

Following the bullish price movement over the past week, veteran trader and analyst Peter Brandt declared that ÔÇ£the BTC bottom is inÔÇØ in a post on X (formerly Twitter), and predicted that its price will chop higher from here.

Anyone who declares they know the future path of any market is a fool. Markets will ALWAYS surprise.

Yet, with this disclaimer, I believe:

1. The $BTC bottom is in

2. New ATHs not coming until Q3 2024

3. Chop fest in the meanwhile

I’ve used this blueprint for approx 2 years pic.twitter.com/hVt0zbTOsmÔÇö Peter Brandt (@PeterLBrandt) October 25, 2023

As noted in the tweet above, Brandt doesnÔÇÖt see Bitcoin hitting a new all-time high until the third quarter of 2024, at the earliest.

Blockchain analyst Jamie Coutts agreed with BrandtÔÇÖs assessment that the bottom is in for Bitcoin and compared the recent price action to what was seen in July 2020.

BTC/USD 1-day chart. Source: Twitter

ÔÇ£What Bitcoin price action has done this week from a technical standpoint is the equivalent of the breakout above $10,500 resistance in July 2020,ÔÇØ Coutts said. ÔÇ£Price has cleared a massive supply overhang ÔÇô the largest in its history. Whilst there will be pullbacks, as we saw in Q3 2020, price is confirming the bull market regime, which I called in Dec-2022 based on my liquidity and market structure analysis.ÔÇØ

In a separate post, Coutts pointed to the entry of institutional players and the tokenization of real-world assets (RWA) as a driving force for the crypto industry moving forward.

ÔÇ£Watch Tradfi companies who bottom ticked one of the biggest financial market transformations of the past century, reverse course in 2024,ÔÇØ he said. ÔÇ£As Bitcoin eyes the throne as the next global reserve asset, pensions and fund managers clutching their ÔÇÿrisk-freeÔÇÖ US Treasuries are having to relearn the foundational tenets of risk management, diversification, [and] position size while being introduced to the inescapable realities of fiat finance.ÔÇØ

ÔÇ£Tokenization of real-world assets, account abstraction, and the rise of stablecoins are about to take crypto from 5-10 million crypto daily users to 100 million by 2028,ÔÇØ he concluded.

Altcoins consolidate

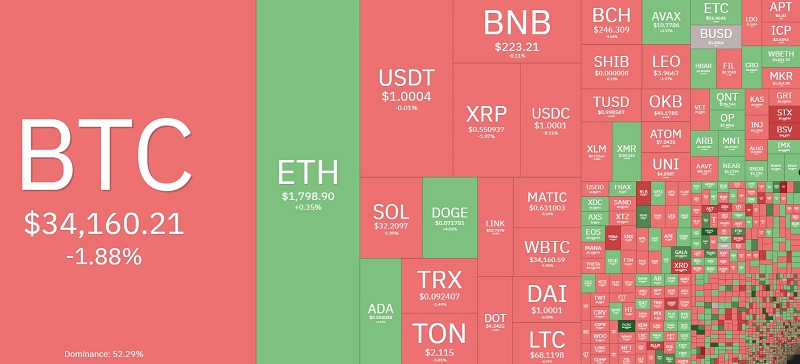

The altcoin market traded mixed, with a slight majority of tokens in the top 200 recording losses on Thursday.

Daily cryptocurrency market performance. Source: Coin360

FLOKI (FLOKI) led the gainers with an increase of 21.9%, while Polymesh (POLYX) gained 17.57%, and Gala (GALA) climbed 12.35%. Powerledger (POWR) saw the biggest drawdown with a loss of 26.1%, while Blur (BLUR) fell 10.1%, and Mina (MINA) declined by 6.4%.

The overall cryptocurrency market cap now stands at $1.26 trillion, and BitcoinÔÇÖs dominance rate is 53%.

How AI legalese decoder Can Help:

The AI legalese decoder can assist in analyzing legal disclaimers and disclosures related to financial publications such as this article. By scanning the content, the AI legalese decoder can identify any potential risks or disclaimers that may affect the reader’s understanding of the information presented. It can highlight important

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a