AI Legalese Decoder: A Must-Have Tool for Bitcoin Pro Traders Weathering Sell-Offs and Predicting New Price Highs

- March 25, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Impact of Spot Bitcoin Exchange-Traded Funds Outflows

The recently launched spot Bitcoin (BTC) exchange-traded funds (ETFs) saw a significant shift in their net flows during the week of March 18 to March 22. A total of $888 million was withdrawn from the spot ETFs, contrasting with the previous week’s $2.57 billion inflow. This development has sparked speculation regarding the sustainability of Bitcoin’s rally to $70,000 on March 25.

How AI legalese decoder Can Help

AI legalese decoder can assist in navigating the complex legal implications surrounding the spot Bitcoin ETF outflows. By utilizing advanced natural language processing algorithms, the AI tool can quickly analyze and interpret legal documents, regulations, and contracts related to ETF investments. This can help stakeholders in the cryptocurrency market gain valuable insights and make informed decisions based on accurate legal information.

Bitcoin’s Potential to Rally Amidst ETF Inflows

Some market participants have raised questions about the role of institutional inflows in driving Bitcoin to its all-time high of $73,755 on March 14. The subsequent 9% gains from March 23 to March 25 have further fueled skepticism, especially considering that this surge coincided with the S&P 500 index failing to sustain its all-time high of 5,260 set on March 21.

Analyst venturefound╬×r indicated on March 20 that Bitcoin might be facing a reality check after a surge driven by ETF investors’ fear of missing out (FOMO) before the halving, potentially trapping those who purchased at the peak. Despite a 15% increase from March 20 to March 25, lingering bearish sentiments suggest that Bitcoin’s price movement is not solely reliant on spot ETF inflows.

Traders view the approval of a $1.2 trillion spending package by the United States on March 23 as a positive catalyst for Bitcoin. The escalating U.S. deficit, combined with the Federal Reserve’s predictions of interest rate cuts in 2024, underscores the growing pressure on government debt repayments as interest rates remain above 5.25%.

The surge in the values of scarce assets like gold, Bitcoin, real estate, and the stock market indicates a weakening U.S. dollar. As investors seek alternatives to hedge against fiat currency devaluation, the performance of the North American currency against the euro and the British pound becomes less significant.

While it may be premature to conclude that Bitcoin’s price will sustain its upward trajectory due to monetary expansion, critics warning of a looming recession driven by the U.S. fiscal trajectory may be overlooking the fact that Bitcoin has already surged by 64% year-to-date in 2024.

Betting on Bitcoin Derivatives Amidst Market Volatility

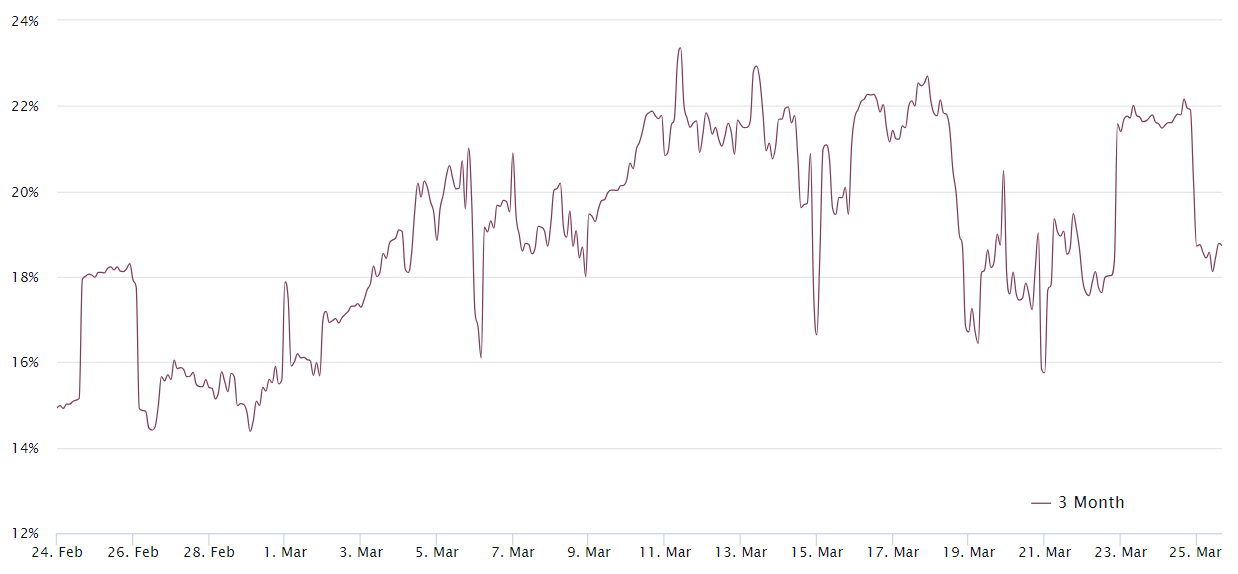

Examining Bitcoin’s derivatives, particularly BTC monthly futures contracts, can provide valuable insights into professional traders’ sentiments following the disappointing spot ETF outflows. Typically, these contracts command a premium of 5% to 10% in neutral markets to account for their longer settlement period.

Data suggests that the annualized BTC futures premium remains largely unaffected by the net spot ETF outflows. An optimistic 18% level indicates a willingness among buyers to pay a premium for leveraged long positions.

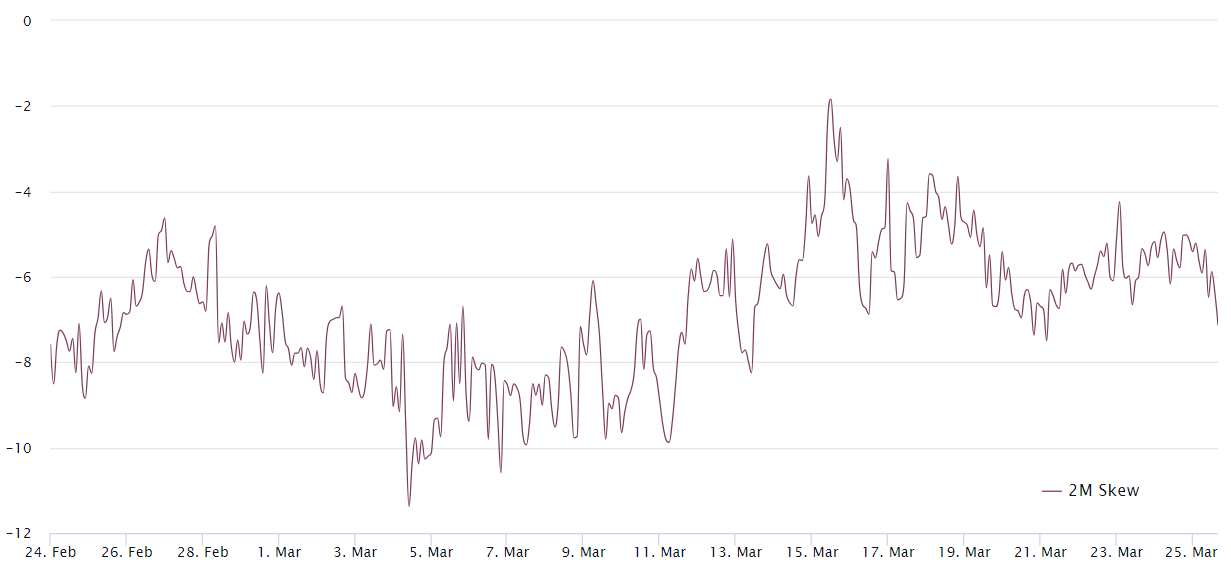

Analysis of the Bitcoin options market is crucial to assess the demand for hedging strategies amidst the recent rally to $70,000. A skew metric exceeding 7% typically signals anticipation of a price drop, while a skew below 7% suggests heightened enthusiasm.

Since March 13, the BTC options 25% delta skew has remained within a neutral range, indicating balanced demand for bullish and bearish options strategies. Notably, there were no signs of panic as Bitcoin tested the $62,000 support level on March 20.

Despite the recent spot ETF outflows, signals from the Bitcoin derivatives market suggest strong price resilience and offer support for the theory that the $70,000 support level is gaining strength.

Conclusion

The evolving landscape of Bitcoin investments, particularly in the context of spot Bitcoin ETF outflows, presents a multifaceted scenario that demands careful consideration. With AI legalese decoder‘s advanced capabilities in interpreting legal complexities related to cryptocurrency investments, stakeholders can navigate the shifting market trends more effectively and make well-informed decisions with confidence.

This article is for informational purposes only and does not constitute investment advice. Readers are encouraged to conduct their own research and due diligence before making any investment decisions.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a