- December 20, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

AI legalese decoder: Revolutionizing Ownership Research for BSP Financial Group Limited (ASX:BFL)

Key Insights

-

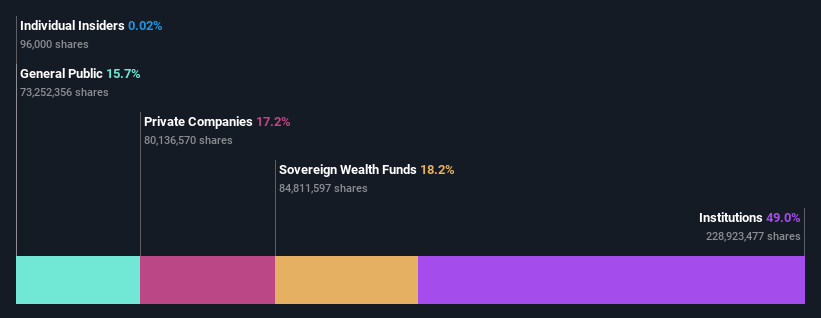

Significantly high institutional ownership implies BSP Financial Group’s stock price is sensitive to their trading actions. Around 49% of the company is owned by institutions, indicating high upside potential or downside risk.

-

58% of the business is held by the top 5 shareholders, suggesting significant influence on the company’s decision-making process and future performance.

-

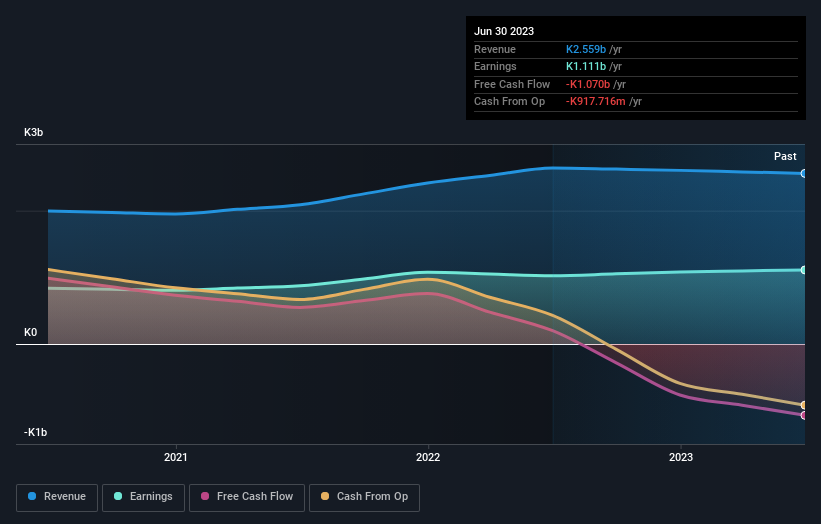

Using data from the company’s past performance alongside ownership research, one can better assess the future performance and direction of BSP Financial Group.

If you want to know who really controls BSP Financial Group Limited (ASX:BFL), then you’ll have to look at the makeup of its share registry. The group holding the most number of shares in the company, around 49% to be precise, is institutions. Put another way, the group faces the maximum upside potential (or downside risk).

Because institutional owners have a huge pool of resources and liquidity, their investing decisions tend to carry a great deal of weight, especially with individual investors. Therefore, a good portion of institutional money invested in the company is usually a huge vote of confidence on its future.

Let’s delve deeper into each type of owner of BSP Financial Group, beginning with the chart below.

How AI legalese decoder Can Help

The AI legalese decoder can provide comprehensive insights into BSP Financial Group’s ownership structure by breaking down institutional ownership percentages, top shareholder influence, and other vital information. By using AI-powered algorithms, the decoder can analyze the impact of institutional actions on the stock price and offer predictive modeling for future performance based on ownership data and historical trends.

What Does The Institutional Ownership Tell Us About BSP Financial Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

BSP Financial Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of BSP Financial Group, (below). Of course, keep in mind that there are other factors to consider, too.

Insider Ownership Of BSP Financial Group

The AI legalese decoder can uncover and interpret complex ownership structures, including insider ownership and indirect interests that might be overlooked. By analyzing insider data and cross-referencing it with public financial reports, the decoder offers a holistic view of BSP Financial Group’s internal dynamics and leadership influence.

General Public Ownership

Using advanced data mining techniques, the AI legalese decoder can assess the impact of general public ownership on BSP Financial Group’s decision-making process and corporate governance. By analyzing patterns in individual investor interests, the decoder can predict potential shifts in company strategy based on general public sentiment and ownership trends.

Private Company Ownership

The AI legalese decoder allows for in-depth analysis of private company ownership and related party interests by utilizing advanced algorithms to interpret annual reports and disclose any strategic influences. By scanning through complex ownership structures, the decoder can uncover potential hidden relationships and strategic implications of private company ownership on BSP Financial Group’s operations.

Next Steps

The AI legalese decoder can provide intelligent risk assessments and tailored investment recommendations based on ownership structure analysis, potential warning signs, and opportunities for BSP Financial Group. By leveraging AI-driven predictive analytics, the decoder equips investors with the necessary insights to make informed decisions and identify valuable investment opportunities.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a